Check the new salary payslip format in online or offline for every month salary details appear in pay slip towards incomes, deductions and take home pay or net pay for April 2024.

Every employee must know the importance of payslip and pay slip download process online to check all the monthly pay details containing bank account and PF accounts along with PAN number.

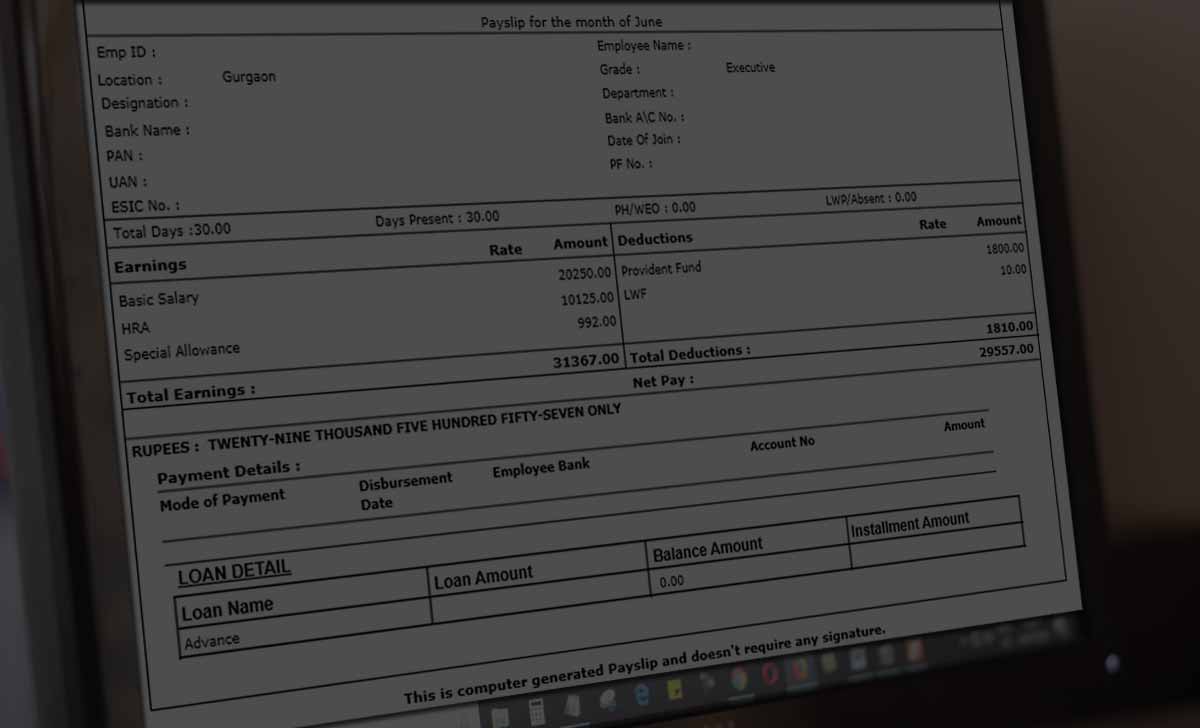

Salary Payslip

A payslip is also called as the Salary slip or Salary Payslip which is documentation provided to an employee from an employer or an organization which has the breakdown of the monthly salary deposited to an employee.

There are different elements and particulars that can be found on the salary slip which will explain how much money is to be given to a certain employee.

The reason Pay Slip is used is to make sure that every employee is received with the basic payment which is called as Basic pay every month, and on top of that, the extra benefit that an employee receives are also registered and labelled on the same salary slip for clear explanation.

You might wonder that the pay slip is only important to an employee which is correct but at the same time it is important to the employer as well.

The Pay slip or the Salary slip works as the authentic proof that the employee has worked for the period of the time mentioned in the slip and the employer has provided them with the salary up to date as well.

PaySlip

In simple terms a Pay slip or the Salary slip to an employee is the amount or money deposited by the employer to you for the period mentioned in the slip. It has all the particulars and elements listed out explaining how salary has revised and sent to you.

The most important thing that an employee should know is that when they apply for a new job at another company or organization, then they have to give the past 3 months or 6 months salary slip to the new organization for verification purpose that you have worked for your past company.

Every Organization or Employer will use an online payroll management system calls as Employee Management System (EMS), someone using SAP Management ERP and someone with other software, where in the system, you may allotted a particular Employee ID for a certain company you work for and password so as to log into your Management system to download the salary slips every month.

Salary Payslip used for different reasons

- Income Tax Filing: Every year all salaried employees and income source individuals have to file Income tax returns and while filling the form you have attach salary slips as proof along with other necessary documents.

- Loans for Home, Car and more: If you want to apply for loans on different reasons like Home, Car or construction then you will have to provide proof of current employment which can only be done via giving salary slips.

- Proof of Employment : As I already told you, no one will believe you that you have worked for particular organization or company without salary slips from them. This may advised that salary slips downloaded every month for future reference. Nowadays the only proof of employment is payslip only, where the major IT employees have submitted the payslip as proof of employment for their previous company when shifted and got a job in another.

What are the Elements and Particulars mentioned in the Pay Slip?

Pay Slip is basically a clear documentation of your monthly payment from your employer which clearly divided into different sections that explain how the salary calculated.

PaySlip Income Part Contain

- Basic Salary: The basic salary is minimum wage offered without any benefits for the month or year. This may noted that this will only comprise the 40% to 50% of the total salary.

- HRA: Home Rent Allowance is one of the biggest benefits most of the IT and government sector employees receive, In the Pay slip you will find a line with HRA and the amount that has been allot as the HRA benefit to you for the particular month.

- LTA : LTA amount deposited to your salary account mentioned on the payslip under LTA.

- Bonus : Government of India has made amendments clearly that the employer has to give their employee bonuses. The given bonuses is a part of the legal paperwork, So, all the bonuses you receive during festival time or the year end added to the salary slip.

Salary Slip Deductions

Deductions are very important and crucial part of the salary slip. This contain the amount deducted from your total salary for reasons such as PF, Professional Tax and TDS as well.

- Provident Fund : Employees Provident Fund deducts 12% of your basic salary every month towards the Provident fund act. This amount saved in your own account, which may withdrawn after retirement or during work at different cases.

- Professional Tax: Every company or Organization will deduct a certain amount of tax towards tax payment to India.

- Tax Deductible at Source (TDS) : TDS is a form of tax that is deducts from the employee by employer towards the PF act.

Salary Pay Slip Online, How does it work actually work?

As the world is moving towards online revolution, all the companies, brands and organizations that manage a lot of employees moved towards online Payroll management systems.

In these systems every employee will have an employee ID and password through which they able to access the Pay slips from online directly.

Such a process of accessing pay slips from online called as e Payslip or Electronic Pay slip management system, and even the government sector organization has started using the facility of e-Pay Slips now.

Normally, the Payslip you receive physically will have stamp and signature but the e-Pay slip will not have any of the signatures or stamp as well, but at the end of the Salary slip there will be a note stating that this will work as original salary slip.

Pay Slip Download

We present different companies as below and about the process of pay slip download in online of that company to avoid confusion in getting the salary particulars instantly.

| HRMS Odisha Payslip | BCCL Payslip |

| Bihar Employee Payslip | JK Pay slip |

| Haryana Payslip | Karnataka Police Payslip |

| ITBP Pay Slip | NDMC Payslip |

| DSC Pay Slip login | ICAR Pay Slip |

What is Pay Slip to an Employer?

There are various reasons why Pay Slips are important to an organization or the employer you are working for

- Employee Assessment: Every year organizations and company asses their employee and they also provide them with revised salary which calls as increment. In order to decide the increment, they look at the previous salary slips and basing on them new increment decided and mentioned in the latest salary payslip.

- Convenient Employee Management: Some organizations have 100 employees while some have 1000 or more employees and the process of managing the salaries becomes difficult without online Payroll management systems and payslips.

Monthly pay slip of 2019 and 2020 required for personal pay maintanence.

PFMS not found

Pay slip generate.

Bank account no XXX0100005149 is an update

Pay slip generate.

Payslip period of April 2021

pl. january,febraury,march and april-2021 required for personal pay maintanence.

Payslip of April 2021 generate

Please send income tax inspector salary payslip format once

OTP Nahi prapt hua

March pay slip 2021.

Payroll send me

3 month pay slip Manipur police Diperment.

Give me 3 months pay clip salary slip

I’m not able to get salary slip from my ifhrms

Particulars of salary from March 2021 to Dec 2021

I have not received my salary since December my employment month

how can i receive my payslip via sms