If you are a resident or business owner of Ghaziabad, then pay your property tax dues online at Nagar Nigam Ghaziabad online payment portal to clear your outstanding dues against your property…

Ghaziabad is a municipal corporation of Uttar Pradesh State which is the adjacent City of Delhi, and Ghaziabad Property Tax is levied on every property owner which is under the boundaries of the Municipal corporation.

The Greater Municipal does collect the tax amount to develop the surroundings and ensure that the money collected is spent on correct development works.

The Property Tax is decided by the state government of Uttar Pradesh based on the Annual Rate of Ghaziabad, and based on the zone and the area of development the rate of interest is different in the city.

There is a Receipt of Ghaziabad Property Tax supplied to every owner of residential and commercial property individually by the local municipality at their doorsteps.

Ghaziabad Property Tax

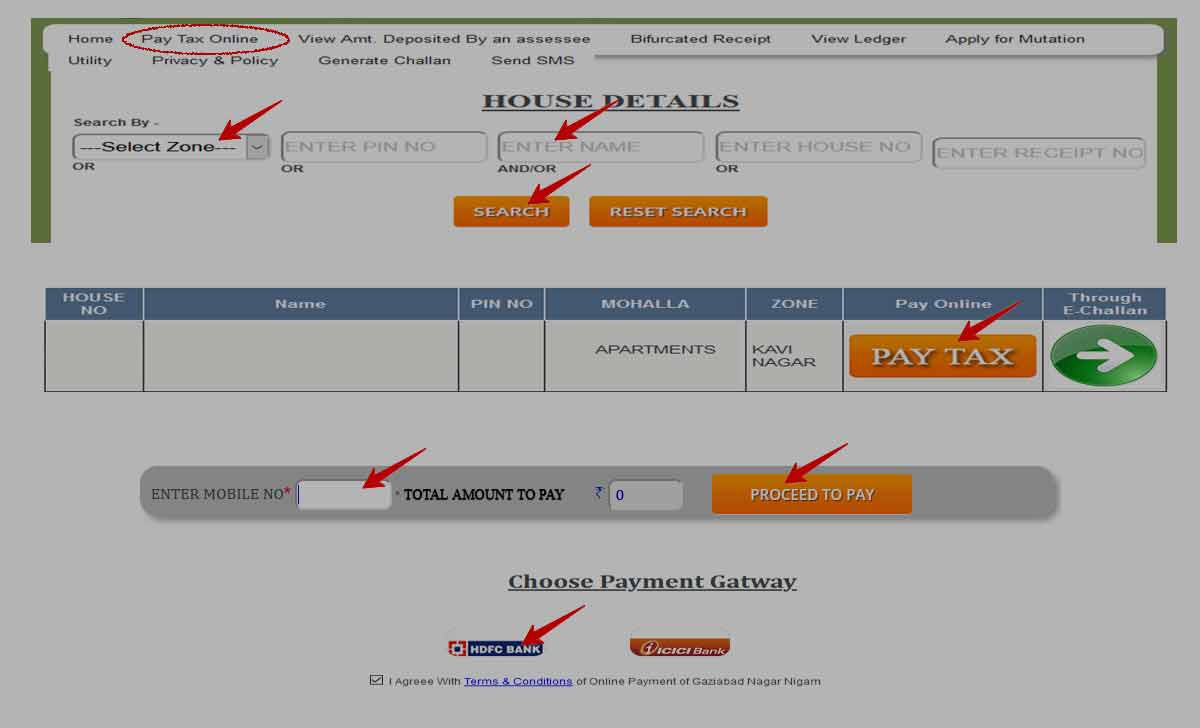

Here is the process that will guide you to get the Ghaziabad Property Tax Paid online using your property details. So follow these steps correctly and make the payment online.

- Visit the Ghaziabad Official Web portal at onlinegnn.com

- Click on Pay Tax Online option next to the Home button

- Select the Zone in which your property does reside

- Enter the PIN number or Enter Name or House number or else enter the receipt number

- Click on the search button

- The details of the property with the amount will be displayed as mentioned (House Number, Name, Address)

- Click on the Pay button and go to the payment page for confirmation

- Check your Property or House details and house tax amount includes with arrears, house tax, water tax, discounts if any

- Enter Mobile Number if required to change > Total Amount to Pay > Click Proceed to Pay

- Choose Payment Gateway (HDFC Bank or ICICI Bank) by click on I Agree with Terms and Conditions

- Complete your payment > Once the payment is done, Ghaziabad Property Tax Receipt will be generated for your confirmation of payment.

How can I get my PIN number for Ghaziabad Property Tax?

The PIN number can be searched from the same pay online page of the Ghaziabad Property Tax payment page, and else you can use the old receipt of tax payment to confirm your PIN number and use your house number to search for details.

Does Ghaziabad Property Tax is verified by the Government?

Yes, the property tax rate of Ghaziabad Property Tax is decided by the state government, and thus the property tax is collected for the development of municipality location and its rate of interest for commercial and residential property is differently decided by the government as per the updated calculation on the property tax calculator.

Can I make the Ghaziabad Property Tax Offline?

The Ghaziabad Property Tax can also be paid offline from any of the government offices, and the local municipal office and Banks do accept the payment for property tax.

Is Ghaziabad Property Tax Receipt Mandatory?

Yes, the Receipt of Ghaziabad Property Tax is an important source of communication for the payment of Tax amount, and this Receipt stands as proof for your ownership of property and for confirmation of tax paid.