Property tax online payment Chennai now renewed and easy to pay or process Chennai property tax online payment through official portal using your credit, debit card or internet banking…

The Greater corporation does maintenance, manages, and collects Chennai corporation property tax from residents owners of city, and the properties which is a building, land, or commercial residence comes under a slab, and thus they get levied.

There are 15 zones in Chennai based on which the property tax varies from every residence, and the slab of property tax does vary based on zone and their current monthly reasonable letting value.

Thus the annual rental value calculates based on property location and plinth area to get property tax, and the amount collects from citizens and utilized in many developing works of the city and its surroundings in all aspects.

There are online and offline modes to pay chennai corporation property tax, thus you can use any of the following approaches to make your due cleared.

Property Tax Online Payment Chennai

If you have got your debit card or internet banking active service, then use this option to make an online property tax payment

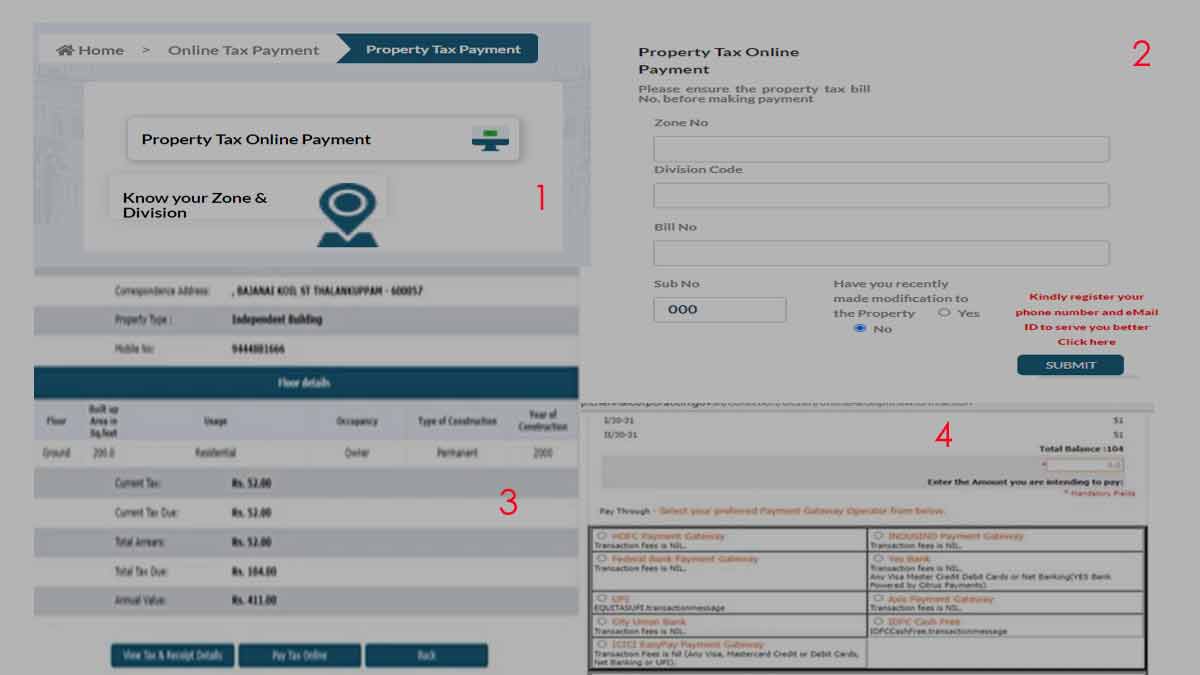

- Visit chennaicorporation.gov.in/gcc/ (Official source to pay property tax online)

- Click Online Services (then online payments) or Online Payments directly

- Tap on Property Tax Online Payment

- Enter your property details to fetch your tax due amount (Provide Zone No, Ward No, Bill No, Sub Number)

- Click Submit to fetch the property tax details

- Check property details of Taxpayer with detailed taxes

- Find the Payable amount and to select the payment mode

- Choose the payment mode (Credit Card, Debit Card, UPI or Net banking) after entering tax amount to pay

- Once Confirmed, the property tax submitted, and a confirmation receipt available to download for your reference

Chennai Corporation Property Tax Status

- Open https://chennaicorporation.gov.in

- Click on Online Services

- Tap Property Tax

- Click Property Tax Status

- Enter Existing Bill Number or Revised New Bill Number

- Provide Zone No / Division / Bill No

- Select Yes / No for recently made property tax

- Click Submit

Before or after payment, you may check Chennai corporation property tax status through online mode to know the live status of the property tax.

Chennai Property Tax Offline Payment

In this process we will be using Check or Demand Draft or cash to make the corporation property tax payment by visiting any of the below given places.

- Tax Collector Office in Municipality Office

- Authorized Banks such as Indian Overseas Bank, City Union Bank, IDBI Bank, Kotak Mahindra Bank, and more.

- E-Seva centers by Tamil Nadu State Government

- Tamil Nadu Arasu Cable television Corporation in all Taluk offices

Chennai Corporation Property Tax Calculation

The tax values do depend on land plinth area, the rate per square feet, monthly Reasonable Leave Value, and here is the formula as below

- Plinth Area *Basic Rate per Square Feet = Rs 1000 per month ( assume 1000 sq. ft and 1 re)

- Annual Rental Value = Plinth Area * Basic Rate Per Sq. ft *12 – 10% of land

- Yearly Rental Value = Rs 1000 * 12 – 10 % *1000

- Annual Rental Value = Rs 10,800

- Depreciation value = Less 10% Depreciation for Building = Rs 10,800 – 1,080 = Rs 9,720

- Add 10% building value to above = 1000 * 200 = 1,200

- Annual value for Land and Building = Rs 9,720 + Rs 1,200 = Rs 10,920

- Thus Rs 10,920 is the property tax being levied if your land is 1000 sq. ft with a basic rate of 1 re.

Property Tax Chennai Due Date and Rewards

Paying property tax timely is a good sign of helping the government in importing public infrastructure, and thus everyone should make their property tax due within the due date to avoid any penalty.

- The Due date of property tax is Sep 31st and March 31st

- A penalty of 1% added in total amount if missed due date

- A reward of discount price given if tax paid timely

- 20% rebate for monthly RLV if building is semi-permanent

- 25 % rebate on Monthly RLV in case owner occupied property and

- 10% rebate in case owner occupied commercial property

- 1% depreciation given for building older than 4 years

Do we have extra charges to pay Property Tax Chennai?

The amount shown in property tax receipt may the end amount that needs to pay by the property owner before the due date, and in case you’re using a credit card, it might avail service charges for using the credit card for tax payment.

How to resolve errors while paying Property Tax?

If you tried to make payment of property tax Chennai online and got stuck online, then you can call 044 – 25619258 for an inquiry about any payment relate complaints.

Can I make payment of Property Tax offline?

Yes, there are government offices and banks which authorized to accept Chennai property tax payment, and thus property owners with their details can visit any of these offices and make the due amount cleared.