Now employers registered under EPFO can make their employee EPF online payment by raising the electronic challan with the ECR portal, just check the defined process guide to upload the salary deduction to the employee EPF account…

Employee Provident Fund is a service that has been brought by Indian Government for every private and public sector employee, it is a never-ending scheme for the purpose of retirement has been bought with the equal share of employee and employer.

There are certain rules and regulations on which the Employee Provident Fund account for an employee is created and gets multiple with an interest rate fixed by the government, and the employer who is registered with the Employee Provident Fund office can only contribute to this scheme and get their employees to get their EPF account created.

Since 2015 it has been mandatory to make employers registered with EPFO if they exceed a minimum of 20 employees in their organizations, and EPF has been taken to bring maximum returns to the amount invested by the employer, which is a share deducted from the employee account every month.

EPF Online Payment

As through the provisions with ‘Provident Funds and Miscellaneous Provisions Act, 1952’ which is called as PF act, both employee and employer must contribute with an equal share that is being saved for employee retirement.

Payment of PF contribution by the employer must be done before the due date of every month and thus any delay in this contribution will be levied with an EPF Interest Rate on the total amount which multiples in days till the final PF amount has been deposited.

The Employer needs to get themselves registered with the Employee Provident Fund with their details and can make their payment online or through the auto-debit process as per registrations done. The payment of the EPF amount can be made through EPF’s official website or from the official bank website, as there are numerous banks that provide EPF direct payment gateway.

Here are the basic steps that can be followed to make the EPF payment online and have a successful contribution to the Employee PF service as directed.

EPF Online Payment Process

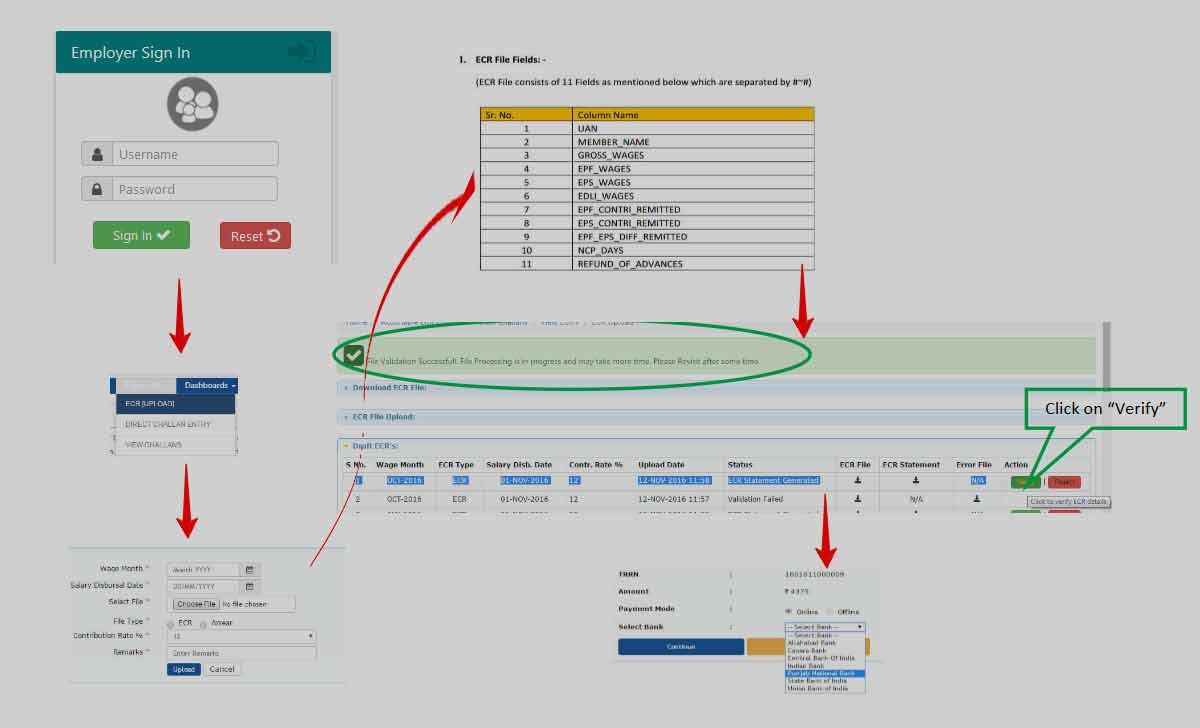

- Visit Employee Provident Fund ECR web portal unifiedportal-emp.epfindia.gov.in/epfo/

- Ener employer username, password and Click Sign In

- Verify that you have establishment ID, name, Address and other are correct

- Move to the Payment option from the dropdown list provided

- Select ECR Upload and select the Wage Month, Salary Disbursal Date, and others

- Upload the ECR text file by selecting wage month and rate of contribution and then wait for the file to get validated

- The File Validation Successful message will appear and click on TRRN option

- Verify the TRRN and then generate an ECR summary sheet

- Click on Prepare challan and enter your Admin / Inspection Charges and Generate Challan

- Once verify the amount, click on Finalize and click on Pay against TRRN

- Select Online and use the payment method page as an Internet login page and move on

- Select Bank, Click Continue to make a payment transfer and then get the transaction ID for reference

- The transaction status can be seen from your Employee Provident Fund Office page of the employer with your EPF credentials in the truncation columns, and the confirmation made against the TRRN number will be shown thus provided by the EPFO.

Do we have a late payment penalty for EPF Account?

Yes, as per the Section TQ an interest of 12% per annum will be appreciable for every single day on the employer if they did not deposit the PF amount of employee and their share in the EPF account, and the interest rate will vary, and the applicable amount will be shown during your payment process.

Can Employee Make Employee Provident Fund Payment Online?

No, as per the guidelines the employer will deduct the amount form the employee e salary month and the same will be deposited under EPF contribution with adding their agreed share, and the amount will vary every month which will be calculated by the employer and deposited before the deadline and there is no involvement of employees in making EPF payment online.

Does EPF Payment Online have Auto Debit Option?

The employee provident fund office does not have any auto-debit option, as this is a recruitment firm for the employer to fill the proper checklist of the employer and submit their amount, and every time a new employee joins, employers must enter their name under their UAN number and initiate their contribution under PF through their direct online banking or EPFO official website payment link.