If you’re an employee of an organization, then it is necessary that you will be part of their employee Group Care Health Insurance Policy, and this policy does allow entire employees of a firm to get insured within the group coverage products defined.

This is different from an insurance, which you buy individually and referred to as a health insurance policy, and the treatments and the medications under Group Care Insurance Policy might not cover costly diagnosis but will surely help you from minimal accidents, and the policy does have Maternity, Accident cover, Sudden diseases or such can be covered under.

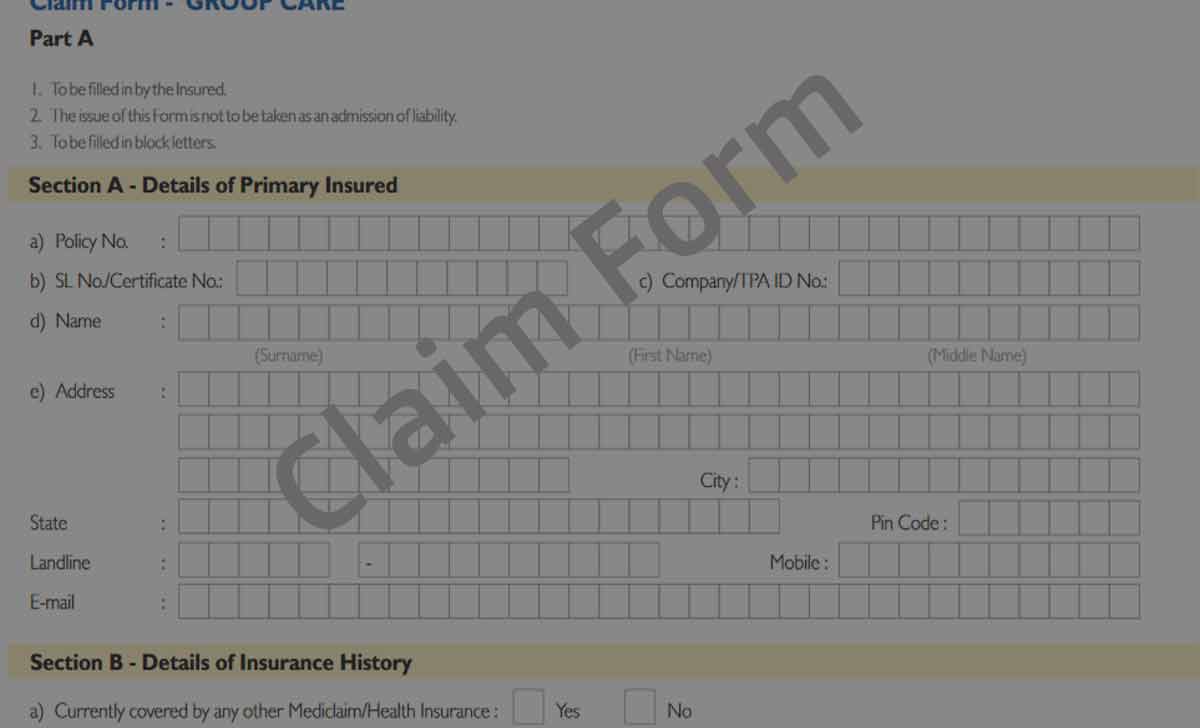

Group Care Health Insurance Policy Claim Form

An employee if has been admitted to the hospital and took the treatment, then they can cover the medication amount from the Group Care Insurance Claim form, and it is advised to employees to check the Group Care Policy details and contact the insurance provider to inform them about your diagnosis.

The employee must ensure that the diagnosis he has undergone is marked in the Group Care Policy and can be reimbursed.

How to Fill the Group Care Health Insurance Policy Claim Form

The Claim form for Group Care Health Policy does come with the tag of Claim Form – Group Care, which is to be used to reimbursed under this policy details, and below are some must-to-be-filed details to submit your claim form to the provider.

- The employee group carefully numbers along with the reference number as an intimation number to be provided.

- Details of Primary contact along with communication address and relation with patient

- Details of hospitalization along with the date of joining with the details of the treatment underwent in hospital

- Details of Insured person and the history of any claim history within the same group policy or any for reference.

- Full details of individual bills that have been paid to the hospital along with their receipt number having total as the claim reimbursement amount.

- Claim Form by Hospital to be filled with their communication address and other details as asked for registering the case in insurance tool.

- Entire list of medication followed by the insured person and the details of the treatment underwent for recovery.

- At the end of the Group Care Insurance Policy Claim Form, in Part A the insured person must declare the details with a signature and the Part B should be declared by the Hospital with a signature.

Can we claim for Heart Attack under Group Care Health Insurance Policy?

The Group Care Insurance Policy does cover any sudden disease or treatment that the employee has undergone when they are on duty. Thus, the insured person can check the policy details by contacting their HR executive to make sure that your diagnosis is covered under policy or not.

Does Normal Maternity Covered under Group Care Health Insurance Policy?

Yes, the maternity in normal or operation condition are both covered under the Group Care Health Policy, and the amount that will be sanctioned will be based on the agreed market value, and in the same scenario, no medicine or test bills can be reimbursed. This is a one-time amount and cannot be mixed with other bills that are used under the same treatment procedure.

Does Company Approval Requirement for Claim Group Care Health Insurance Policy?

The Group Care Health Insurance Policy is from the company that you’re working under and you must engage your company insured executive with having your HR in contact. This must be known to your organisation, as during the time your absence will be recovered.