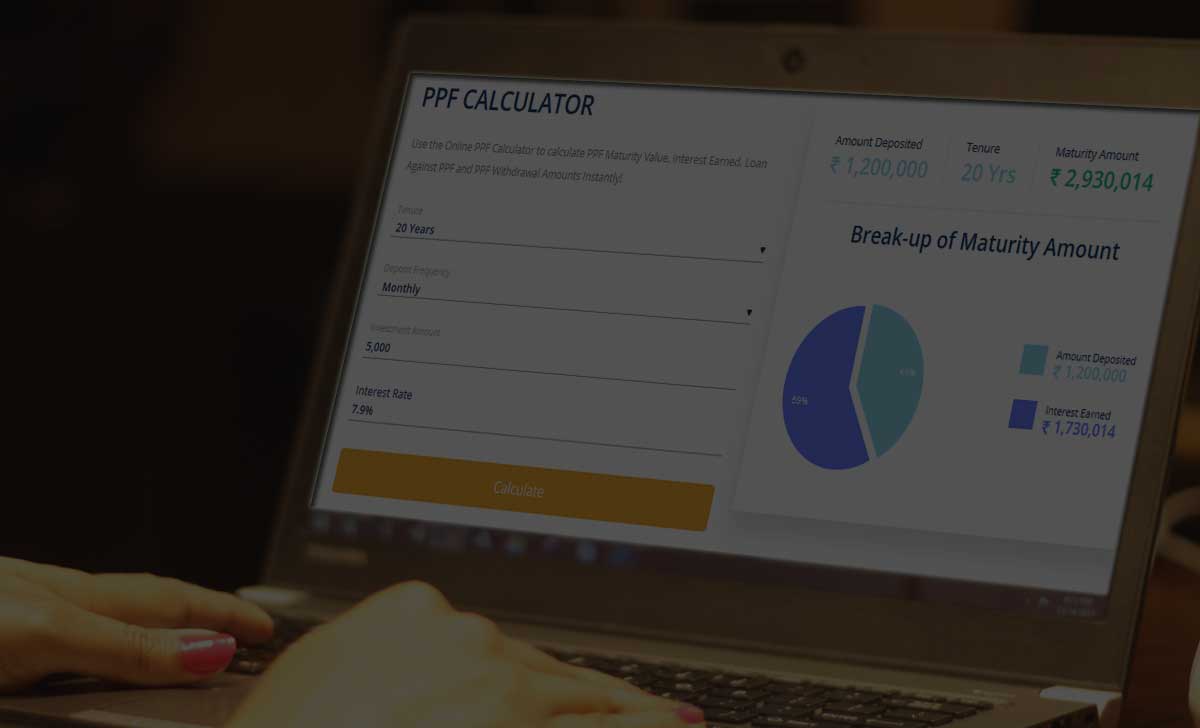

Here is the new PPF calculator to calculate your hard earnings on PPF deposit as per new interest rates of 2019 for your PPF account in SBI / Post Office / HDFC bank etc without any finotax software, Also check what is the formula to calculate PPF and how interest is calculated…

PPF Calculator

Now it will be up to you on the amount to be deposited and depending on the deposit, the returns will be calculated on new PPF calculator, and you might be wondering that when we have the provident fund act then is it necessary to invest in another scheme, So check the main reason why we suggest to use Public provident fund scheme is because it is the safest scheme and it will be tax free as well.

Public Provident Fund was introduced in India in 1986 with a motive to allow small scale investors to invest for the future, and the PPF interest applied annually and monthly on the amount deposited by investor will be added to once account on every March 31 of year after calculation with new PPF calculator.

So with many reasons, PPF is a secure way of investment for future with returns added with applicable interest rates of simultaneously year.

PPF Formula

We do have many PPF calculator available online, which do calculate your total earning by just filling some minimal information required, so if you’re ready to calculate the amount manually, follow the below given steps.

PPF account amount will be calculated with Compound interest formula

- Formula: F = P [({(1+i) ^n}-1)/I]

- F= Maturity Proceeds of PPF

- P= Annual Instalments

- n= Number of Years

- I= Rate of Interest/100

Just get your annual payments information from the account and calculate the number of years completed since you have applied for PPF, and this basic information will be enough to calculate your PPF and let you plan for your future, and Most Employees are seen taking Loan on PPF account once their minimal term of 7 Years is completed.

PPF Interest Rate

You may check the interest rate from the date of introduction of Public Provident Fund (PPF) with effect from 1st April 1986 to till date

Check the source to PPF Interest Rates

Which Bank is best for PPF deposit?

Many banks(ICICI Bank, SBI, HDFC Bank, AXIS Bank) and Post Offices offers PPF account as per the rules of RBI and Government of India, out of which SBI has many branches and having flexibility with Internet Banking, so SBI may be one of the best possibility for opening a PPF deposit account.