Find the GPF statement online for Haryana employee to know the subscribed amount and interest accrued balance of GPF account, Check the process to log in online anytime…

The General Provident Fund of every employee in the Haryana State is monitored by the Principal Accountant General, and there is an official website created for the same, who looks after the accounts and manages every employee GPF account. The GPF scheme by the government to benefit the employee after retirement has been made mandatory, such that they manage to run their life after employment happily.

There is an equal share based on employee share that will be accumulated by the government, to make their every investment double and which gets to a huge amount and there is a unique PIN number given to every employee, which using they can access their account online.

The total amount will be calculated with an interest rate decided by the government, which increases the lump sum amount accumulated in your GPf account. The Government of the state of Haryana has provided GPF services to its state government employees which can be easily fetched from the online portal, and here we bring you the details of how to know your Haryana GPF Balance online.

Know Haryana GPF Balance

- Visit aghr.cag.gov.in/defaulteng.aspx which is the Haryana Principal Accountant General web portal page

- Scroll down and view the on this site link in the little green color box

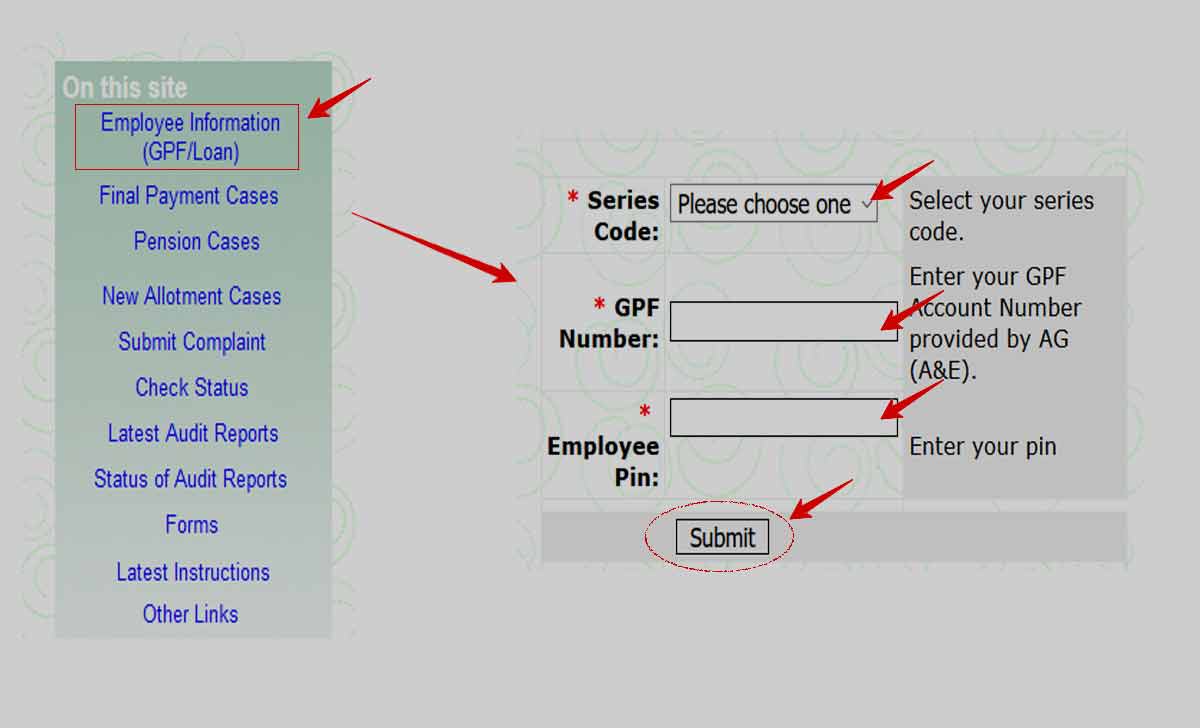

- Click on Employee Information (GPF/Loan)

- A new page will be loaded with Information for Employees at web1.hry.nic.in/aghry/Employee.aspx

- Select your Series Code from the dropdown which is your Department Code

- Enter your General Provident Fund (GPF) number

- Enter the PIN that is given to you by the DDO officer with your details

- Click Submit > You will be able to view your employee information

- Select GPF from the menu and click on to view the Balance sheet

- That’s it, the General Provident Fund details of your account will be on screen and you can wish to view the information of any month or year in the form of a balance sheet.

How to Get Haryana GPF Account Details / PIN

The Accountant General of Haryana does create the GPF account for every employee, such that they can easily view their details online, and here is the process that will be followed to activate employee information account in online.

- Visit the department office of your work location

- Locate your DDO officer, associated with your department

- Submit your details along with the mobile number which is active

- Provide your details with all details in the application form

- DDO officer will submit the same in the online AG portal

- The employee will be given a PIN that gives access to the portal

Why is it required to check the Haryana GPF Slip?

As a Government employee, an amount will be deducted from your salary every month on behalf of Haryana GPF, and thus it is necessary to check what amount is being deducted from your salary and is it getting added to your GPF account, where the total amount must be increasing with the added sum of your monthly sum.

Who does manage the Haryana GPF Interest Rate?

General Provident Fund is a scheme from the Government of India and thus the final interest rate on the amount accumulated in the employee GPF account is done by the Government only, and thus one decides the interest rate, the same will be applied to every Haryana GPF account and the amount multiplied with sum.

Can we withdraw the Haryana GPF Amount from account?

Yes, there is an energy option that is provided to every employee who can withdraw the money, and an application form needs to be submitted to the department office offline with the reason to withdraw the Haryana GPF account money. Based on the requirement and share from your total amount will be allowed to withdraw but not the total amount.

What if I withdraw 50% from my Haryana GPF Account?

As per the General Provident Fund rules and regulations, an employee is asked to withdraw the amount in case of an emergency, and by leaving a share of one third in the Haryana GPF account, employees can withdraw their other amount with proper approvals from the officials.

Can I increase my share in the Haryana GPF Account?

Yes, employees are asked to increase their pay if they want to save more for their retirement, but the share from employees should not increase 100% of their basic and should be least at 12 % of basic. As per these deadlines, an employee can change their share in the Haryana GPF, such that a good amount will be collected in their account, and the number of shares from the employer will be the same and will not increase with your change in pay.

plz correct my ph no 700xx50 of sh jai parkash aasstt. irrigation deptt.haryana plz update imidate with my GPF A/C NO HR/PWD xxx