In this article, we will confidently walk you through the process of ePaying your taxes using the Income Tax portal. Furthermore, we will also discuss how to check the e-tax payment status with ease. So, sit back and follow the guide below with confidence.

Income Tax Payment based on your PAN and TAN for any entity such as Individual, company or institution might seem hard but its quite easy with the new ePay tax payment process that allows citizens to either pay online or take eChallan to pay at the bank again your PAN card or TAN.

ePay Tax

Making e-tax payments in superfast mode is easy and straightforward once you have your PAN, TAN, or respective tax account details handy. Simply follow the steps below with confidence and complete your payment quickly and efficiently.

- Open the Incometax efiling portal from incometax.gov.in/iec/foportal/

- Click on ePay Tax from the homepage

- Tap on continue

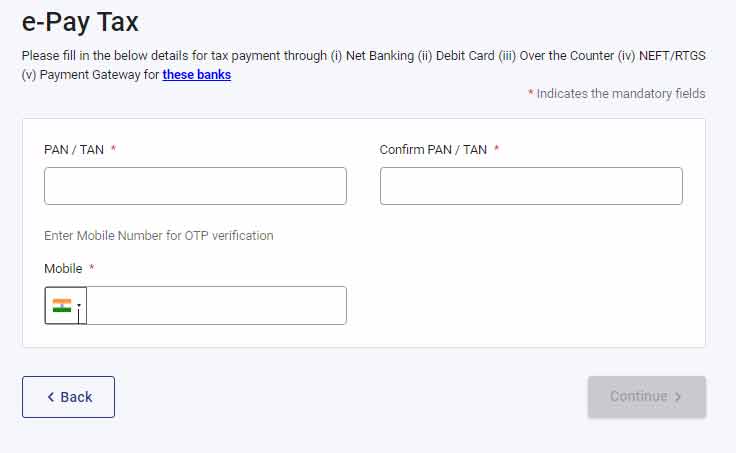

- Enter your PAN/TAN and confirm the same along with your registered Mobile number

- Provide the OTP received on your registered mobile number

- Click on continue

- On the next page, confirm PAN/TAN and name confirmation then click on Continue

- Select the payment category net

- Select the assessment year and type of year and click on continue

- Add your tax break details and the total along with the documents you have uploaded,

- click on continue and You will be redirected to payment mode

- Select a payment gateway and click on continue

- Complete the payment through your desired gateway.

Also Check: Income Tax Refund Status

Can I download my Income tax portal ePay tax receipt

Yes, you can download your receipt from the Payment receipt section under your Income Tax portal account.

Can I make e tax payment from Bank

Yes, you can fill your e-Pay tax details on the ePay Income tax portal payment page and then select your payment methods as bank challan of selected one and then download. Print the e-Challan and show it at your selected bank to complete the payment as required.

Also Read: AIS Download

e Tax Payment Status

Now that you have made your payment steps, then follow the below instructions to check your payment status.

Once any e Tax payment is made from the Income tax portal, then you will receive both e-Mail confirmation and SMS confirmation on your registered email address and registered mobile number with the e-Filing portal.

To confirm the e-tax payment status with utmost confidence, head straight to your receipt section and download the payment receipt.