Do you know how to print or download your pension salary slip on login to SBI Internet banking, Just check the details and download pensioner payslip online and advantages of Pension slip…

we all know about the salary slips for a working employee, like that a pensioner will also gets pension slip which containing the details of Basic pension and dearness allowance along with other emoluments if any.

Here we can tell you the process of printing or downloading the Pension Slip or Pensioner Salary slip online through State Bank Internet Banking and this applicable for those pensioners who draw their retirement salary through State Bank of India only.

After Login SBI Net Banking, you can download the pension salary slip for the old/current month on the requirement, but the old month’s slip will generate on or after October 2006 only, and there is no limit to download or print the pension slip through SBI net banking login.

Let’s check the step by step process about how to download the Pension Slip from SBI Net Banking

SBI Pension Slip Download

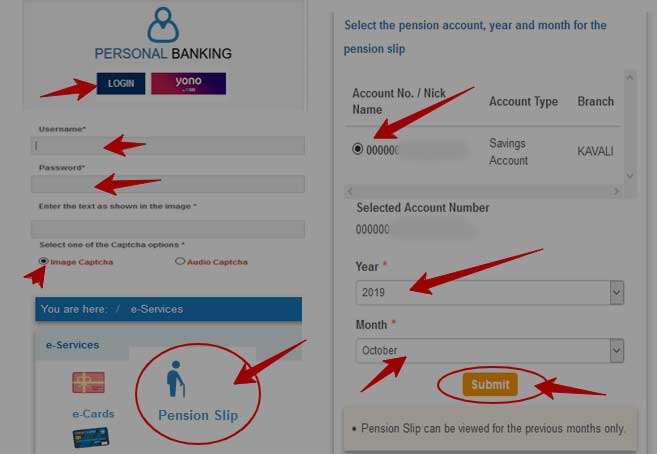

- Visit official website of SBI onlinesbi.com

- Fill your registered username and password to login to SBI netbanking

- Visit the e-services

- Click Pension Slip, Your Account Numbers will be shown and choose Pension Account

- Select Year from drop down menu and Choose Month

- Click Submit, Your Pension Slip will be a downloaded instantaneously and ready to Print

The downloaded pension slip from SBI contains, Name, PPO (Pension Payment Order) number, Year, Month, Basic Pay, DA, Medical and other payment allowance details (Arrears, allowances) and income tax if any deducted will be shown indicating each clearly which was paid for that calendar month.

So, from anywhere on the web, a pensioner those who are getting the pension through any disbursing branch of State Bank of India can download and check the pension details through a login to SBI Internet banking.

The other way to get the pensioner pay slip is, approaching concerned State Bank of India pension servicing branch and request the dealing assistant for the required month pension slip.

Advantages of SBI Pension Slip

- The only source to know the Pensioner Salary with all item of incomes.

- Can avail the pension loan from any bank or from any registered non banking financial companies (NBFC).

- Have a idea and identify any discrepancies in the regular pension amount.

- A pension slip gives confidence to the pensioner after superannuation about, “that he will not retire from the life and want to continue any type best service”

- Will Plan the future months accordingly as per the incomes shown in the Pension Slip.

- Can provide a surety to their dear once through their incomes shown in pension pay slip.

- Even if lost Pension book, the pension slip shows all the details about Pension Payment Order (PPO) Number, so that, pension can easily track the details and approach concerned Pension Authority for other PPO as per the procedure PPO if possible

Downloading the pension slip in SBI branch or Internet banking or from post office (at any pension servicing source/branch) to know all the details of incomes, deductions and tax if any, so pension slip download is one of the major thing to feel like a working employee.

Mam pension pasword kese pta chalega.

Pension password kaisepata challenge.

I am a family pension holder of WB state govt, May I get a pension slip through SBI quick app, by email ( without net banking)?

Pension password kaisepata challenge

My pension slip not generated.

I am the pensioner defence ppono157198400091 p Venkataraman dob 01011947 Pension @28029 pm

How much pension loan eligibility. I reqd 10,0000. please advise me I am drawing pension from SBI.

Sir pl send me salary slip July 2021

EVERY MONTH I WANT TO KNOW HOW MUCH PENSION IS CREDITTED IN MY PENSION ACCOUNT NO. OF SBI

For down loading pension slip is it safe?

Please let me know.

मुझे अक्टूबर की पेंशन स्लिप भेजें

Muje Dec 2021 ki pension slip beje please

I want pension slip for the month of November 2021.

Let me provide my pension slip for the month of Jan 2022

Sir please send me pension statement of March 22, i shell be thankful to you dear sir

My father’s pension payment is not found me plz check the

I am unable to get my Pension slip. Kindly arrange to download pension slip.

WO Rajendra singh (Retiered), 673938, Please send my pay slip for the month of April 22. I am unable to get my pension slip from Sparsh.