Basic Gratuity Calculator as per the new Gratuity calculation formula updated in this page, Just select your service and get the gratuity amount instantly online…

If you are an employee working for an organization of private or public then you should be aware of Gratuity. In simple terms, any employee who worked more than 5 years and has either retired/laid off/ resigned or even in other instances the gratuity amount given by the employer to employee.

Gratuity means the amount paid by the employer to the employee for the service that they might have provided during their working tenure of 5 years while in some cases there is relaxation on the working tenure.

But it is important to be aware of how much gratuity amount you will receive after 5 years and in order to help you with it we have the gratuity calculator that is simple to use. In this article, we will learn more about how to use a calculator and gratuity calculation formula as well.

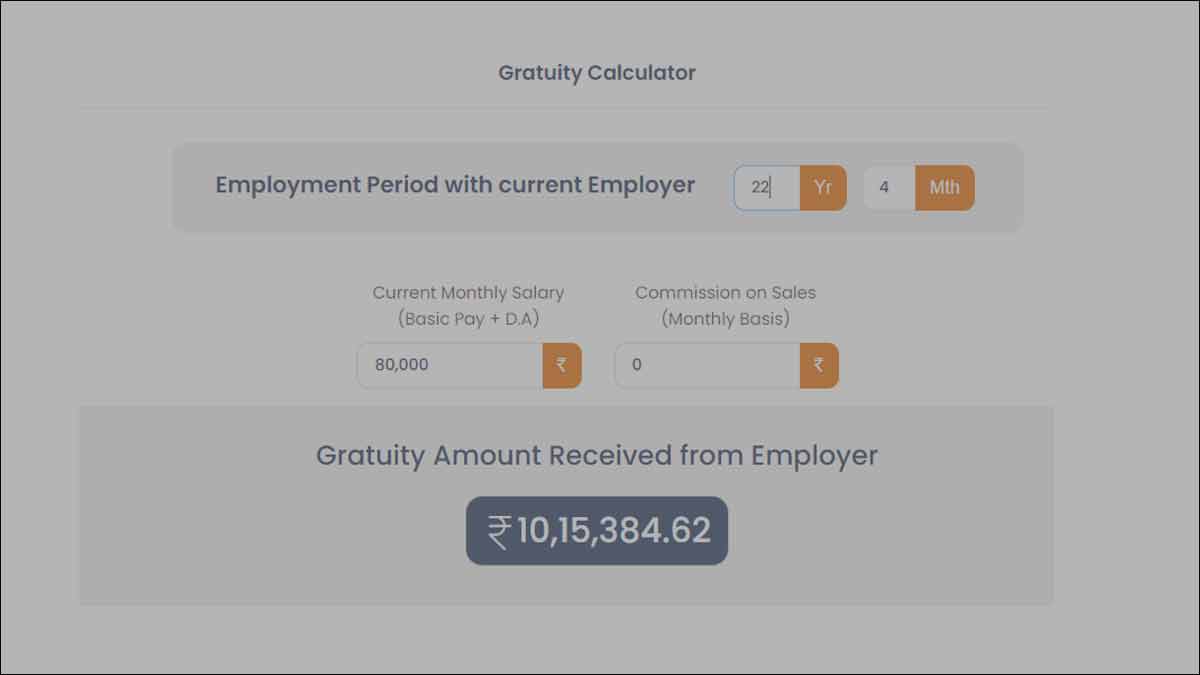

Gratuity Calculator

It is a simple calculator which uses few basic inputs from an employee such as the last drawn salary, working tenure in order to help calculate the gratuity amount.

What is a Gratuity Calculation Formula?

Now you know the gratuity calculator and the formula that it uses from above but if this is your first time then you need to understand more about the gratuity calculation formula and what are the values or metric it takes into account as well.

Gratuity = (15 × last drawn salary × working tenure)/30

Here, the last drawn salary is the total salary with all benefits while working tenure is the number of years that you have worked for the organization. 30 is simply the number of working days while 15 is the wages per day.

What is the basic formula for calculation of gratuity?

The basic formula for the calculation of gratuity is Gratuity = (15 × last drawn salary × working tenure)/30.

What is 15 in the gratuity calculation formula?

In the gratuity formula 15/26 A/B 15 stands for the wages per day.

How gratuity calculated manually?

In general, the gratuity formula depends on the wages per day multiplied by the last drawn salary and working tenure by number of working days i.e, 30.

How 2023 gratuity calculated?

Gratuity formula remains the same for every year and thus no change from Gratuity = (15 × last drawn salary × working tenure)/30 for 2023 gratuity other than the number of working days i.e, 30.