Login to eNagar portal and Pay eNagar Gujarat property tax online at enagar.gujarat.gov.in using simple payment modes and through offline service at eNagar office…

Property Tax is a onetime tax levied on every property holder of Gujarat State by the Municipal Corporation. This is the primary source of income for the municipal corporation, which may used for the development works in the surrounding area.

There are multiple municipal corporations in the Gujarat state which does levy the charges based on the property type and the area of property located. Through this guide, you can learn the process to complete your eNagar Gujarat property tax payment online.

eNagar Gujarat

Here we brought the process for payment at eNagar Gujarat property tax through their official website, and the citizens of the state can also use other ways of payments. Online payment Applications and other local service centers do accept the property tax payment.

The residents of eNagar Gujarat state can use multiple methods which are available to make their Gujarat Property tax payment and clear the tax dues for the particular financial year. Having paid the property tax dues on time, does ensure you to have continued municipal services for your property.

enagar.gujarat.gov.in Property Tax

Gujarat government has launched eNagar Gujarat portal to accept the payment of property tax and other services offered by the state by . Follow the below steps to fetch and pay your property tax dues online.

- Visit the official website of eNagar login using enagar.gujarat.gov.in

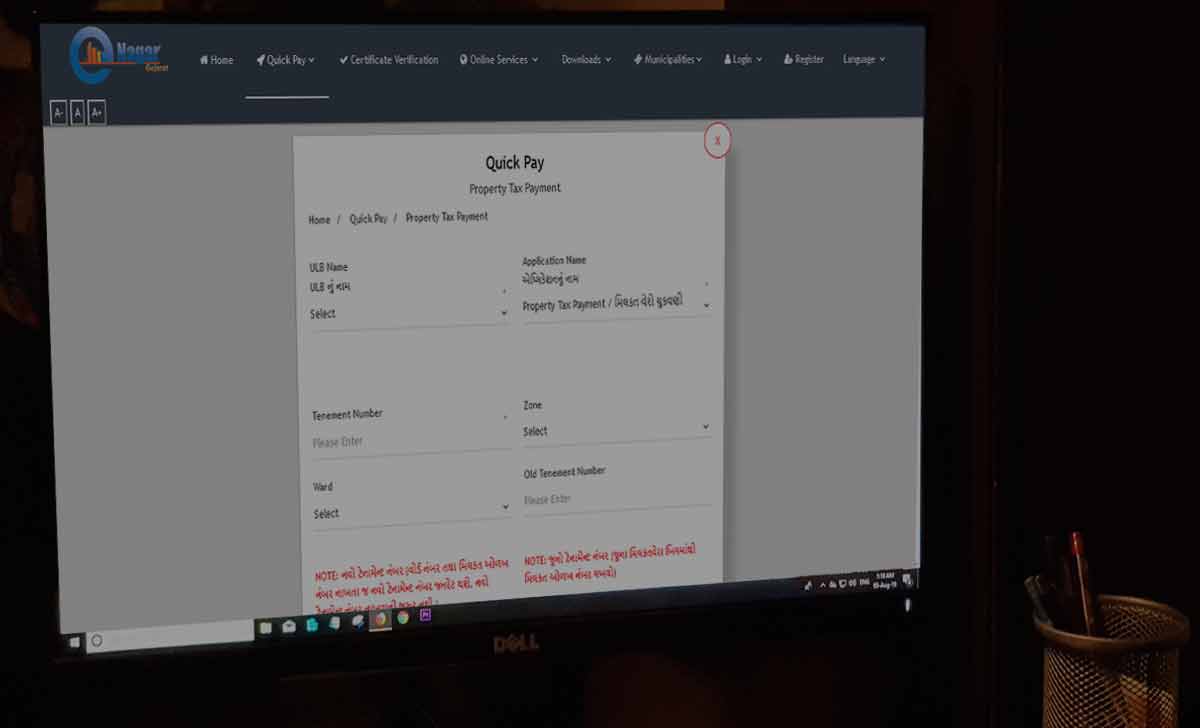

- Here click on Quick Pay form the top menu option provided

- Then tap on Property Tax payment to visit the Quick Pay page

- Now select the appropriate Municipal Corporation from drop down list

- Then select Application Name as ‘property tax payment’

- Enter the Tenement Number and then select Zone along with Ward

- Type Captcha Code and then click on Search button to fetch the dues

- Verify the due amount along with your property details clearly

- Now tap on Pay button and select any online mode to make payment

eNagar Property Tax payment offline

Citizens of Gujarat state can make their eNagar property tax payment by visiting the nearest Municipal office of their area or the government recognized service centers.

- Locate and visit the nearest municipal corporation office of your area

- Here go to the property tax counter and provide your Tax number

- Let executive fetch the details and provide your due list

- Confirm the amount and details form the property tax due

- Hand over the cash and wait for payment to process

Also check: SAS Gujarat Administrative Login and Vadodara Corporation Professional Tax Payment

Does the Gujarat State Government apply interest on eNagar Gujarat Property Tax?

The Property tax firstly calculates based on the property size and the location from the area. If any resident has delayed the payment, then the state governor applies an interest of 2 percent as a due penalty.

Can eNagar Gujarat property tax amount questioned?

The property tax amount calculated based on the area size of the property and other local factors, the same can be provided by the owner of property through the Self Assessment process. Under the self assessment process, property tax will be levied based on their provided size with proper verification.

Is it mandatory to make payment for Gujarat property tax?

As per the Property tax Act, it is mandatory for every resident owner and commercial owner of property to make the eNagar Gujarat Property tax payment. This is compulsive tax which levied on every property tax and asked to pay within a stimulated time limit.