Do find the new steps to pay the MP property tax payment through quick pay without login to mpenagarpalika web portal, Get the detail ledger and print the demand note for Madhya Pradesh Property Tax…

Property tax is an important source of government income to spend on surroundings and development works, and the MP Property Tax is levied on owners of property for residential and commercial, as the cities gets developed day by day, their corresponding needs to provide better infrastructure also increases.

So people are asked to make their in time so that it gives them an opportunity to help the government with their local municipal functions, and on the other side if anyone is seen not to make the payment for Property Tax in the state, their amount will be added with a penalty.

We mentioned the easy process of getting your dues cleared for MP Property Tax online using its official website at mpenagarpalika.gov.in and we provide the stepwise process for the same for your easy reference.

MPeNagarPalika Property Tax Online Payment

- Visit the MP eNagar Palika web portal at mpenagarpalika.gov.in

- Click Pay Taxes/Charges > Property Tax

- Click the Suitable link (Property Tax Citizen Login / Quick Pay / Partial Payment / By Old Property ID) – Let you Assume you are using Quick pay for Property tax payment

- Click on Property Tax Quick pay under Property Tax which a new page for the quick payment will be loaded on the screen

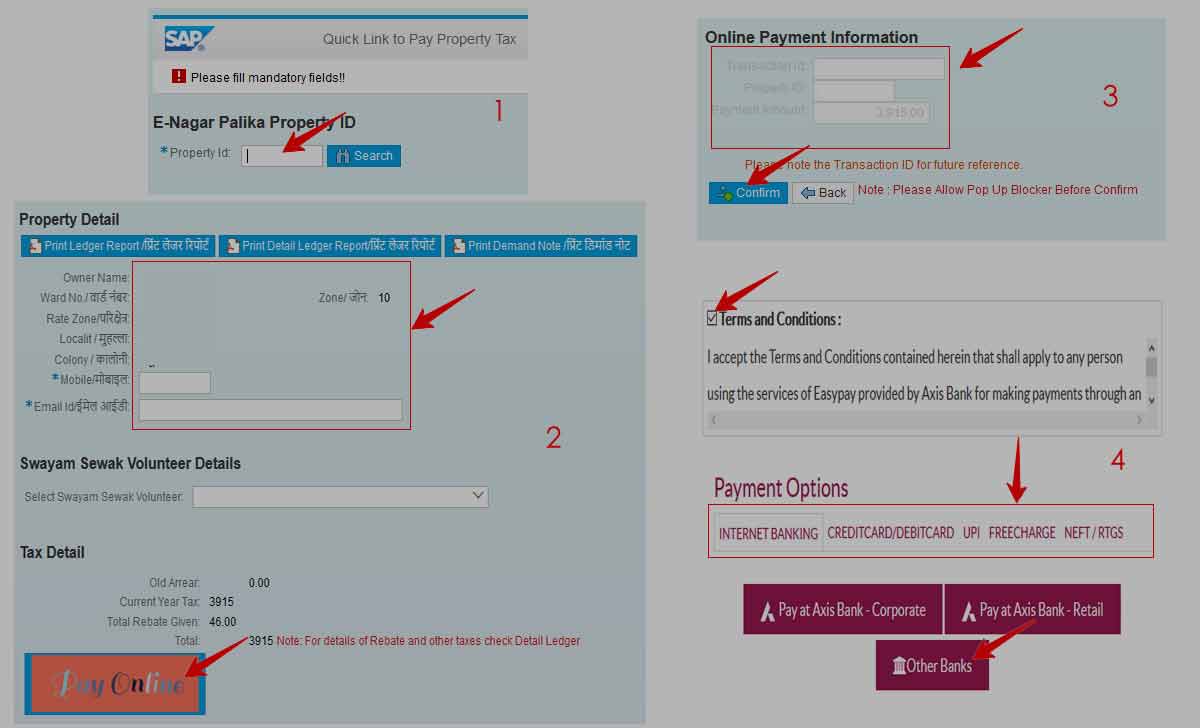

- Enter your Property ID and click on Search to display the details or Print ledger /demand

- Confirm the address and name along with the payable amount

- Enter Mobile Number and eMail address if required to change

- Click on Pay Online

- Verify the transaction ID, property ID, Tax Amount > Click Confirm

- Click the Terms & Conditions to confirm

- Select the payment gateway (Internet Banking / Credit Card/ Debit card/ UPI / FREE Charge / NEFT / RTGS)

- Complete your payment by using your credentials and Once the property tax payment is confirmed, you will receive a receipt number on your mobile / email address for the confirmation of the MP Property Tax payment for your respective residential or commercial property.

Some of the citizens choose this process rather than using the online Property Tax pay module, they want to use offline sources, as they don’t trust the way of payment done online, thus use the below process to get which we use for Indore Property Tax online payment and also to calculate the tax in property tax calculator.

Madhya Pradesh Property Tax Payment Offline

- Locate the nearest municipal Office in your surroundings

- Also, use the Bank for paying the MP state Property Tax anytime

- Provide your property ID along with Name and Address

- That’s it, Submit your amount to the respective officer and your Indore Property Tax offline will be accepted here. The receipt will be here for your confirmation of payment for Property Tax.

Can I pay MP state Property Tax using online applications?

Yes, the owner of MP Property can move to pay their MPeNagarPalika Property Tax anytime using the acceptable Online Applications, and there are numerous applications which are here to help the owner to get their tax paid instantly using their mobile.

Can I ask for half payment in Madhya Pradesh Property Tax?

Yes, the payment process is fully comfortable for the owner of residential or commercial property, and the owner needs to visit the office of municipal to make the half payment of their MP Property Tax or use the online Municipal Corporation site to make the payment.

Am I eligible for a discount in MP Property Tax Payment?

The Madhya Pradesh does give a full flexible payment option for the owners through MPeNagarPalika property tax portal, and the one who makes the payment earlier will be given a discount and whereas others will be given a penalty as well.