Telangana property tax search now available in online for entire state and Hyderabad residents with GHMC property tax search option using ghmc.gov.in…

Telangana Property Tax Search

Property Tax is an important and yet primary source of income for the municipal corporation in the Telangana state. According to the Property Act, it’s require to pay the property tax to local municipal offices in the state twice every year. The government authority does calculate the property tax on your building or land, based on the location and type of structure.

Property tax varies differently with every land and their type of structure as well it is based on the rural or urban area. Each municipal office allocates PTIN numbers unique to every property in their area, which may used to fetch the Property tax details through online or offline. So, in order to do so you need to learn Telangana property tax search through below methods.

Property Tax in Telangana may check from GHMC official website and as well though Telangana e-Municipal website. Here we bring you the procedure to search for your property tax and know the due amount details.

Telangana Property Tax Search through Municipal

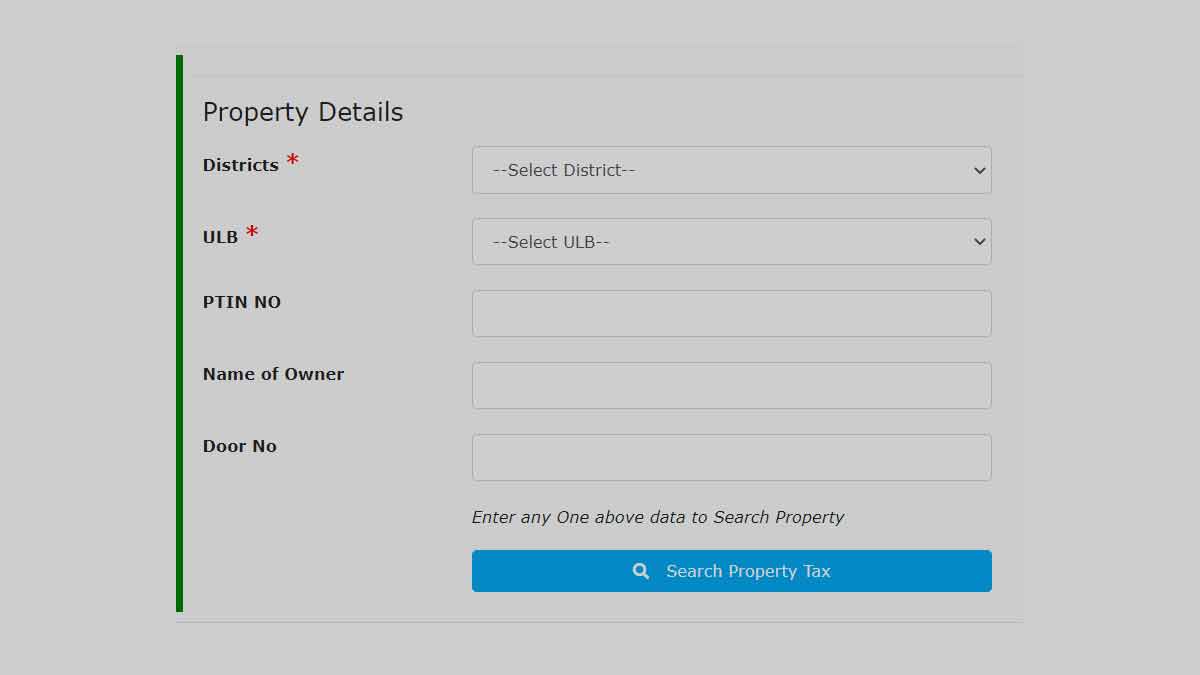

The district and other surrounding areas of Telangana state other than the greater Hyderabad area are all monitored through the Municipal website. Here is the process to check your property tax from Telangana e-Municipal website.

- Visit the official website of Telangana e-Municipal using emunicipal.telangana.gov.in

- Here click on services and then tap on ‘property tax’ form list

- Next select ‘Property tax all’ to load the tax page in new window

- Here click on ‘property tax dues’ and enter your PTIN Number

- Click on search button to show your property tax details

Also read>>> GHMC Property tax payment

Telangana property Tax search offline

Citizens of Telangana state can know their property tax information by visiting Mee-Seva Kendra and the Municipal office in their locality.

- Locate and visit the nearest State Municipal office or Mee-Seva Kendra

- Here go to the Help desk and provide them your property details

- Show the identity proof for ownership of property in Help desk

- The respective authority will fetch and verify your details

- In receipt of Property Tax will be provided based on your information

Also read>>> Telangana property tax payment

GHMC Property Tax Search

Greater Hyderabad Municipal Corporation (GHMC) has its exclusive portal which provides quick links to check and know the property tax details with below process

- Visit the official website of GHMC from your browser using the ghmc.gov.in

- Click on Online Service from Menu option

- Select property tax

- Now select GHMC and then tap to open the tax search page

- Provide PTIN Number

- The details of your Property Tax along with the due amount may display

Also read>>> telangana EC Telangana

With the above simplified process, you can search GHMC property tax details online at anytime

Do I get a Telangana Property Tax Receipt?

Telangana state government does provide a receipt of Bill for property tax for every property holder in the month of April and November. The Receipts will consist of all due amount details along with other information of a property that require to pay property tax.

Also read>>> Dharani portal

Is there any deadline for paying Telangana property tax?

The citizens of property tax asked to make the due payment of their property tax within stipulated time mentioned in receipt. In case of delay of payment, the property holder will get 2% extra as a penalty charge which will add with their current dues.

Is Telangana property tax same for all?

The Telangana property tax is different for residential, commercial and agricultural property. It’s also segregated based on rural, urban or developed areas. The calculation of property tax made based on all this information and may sent to every individual property owner.