IceGate ePayment allows for multiple challan payments | Pay Customs challan online at CBIC IceGate e payment portal | Pay challan at epayment.icegate.gov.in…

ICEGATE ePayment is an online portal for easy payment of customs challan. Taxpayers who associates with the Goods movement must have to get their challans and paid with ICEGATE before their goods imported or exported from consignment.

The custom duty charges laid based on the product size and goods brands, which are mandatory to pay at the custom gate. Thus CBIC ePayment gives a direct portal to make this without and list all your challans at one place.

Just simply login with the IEC code and you can find all your channels listed in one page. As well the design of ICEGATE ePayment will help you pay for all challans in one click by using your bank payment gateway.

ICEGATE ePayment for Import and Export custom Duty

The custom office will examine the goods that applied based on their type and the brand. And 5 to 40 percent of custom charge applied on the Goods based on their brand value.

How to link GST number with ICEGATE

As per the regulations it is mandatory to pay the custom duty, as this is the service tax which applied on Goods for their movement from one country to another.

The determination of Value of Imported Goods rule 2007 implemented at Indian Boundaries, based on which the entire value of custom charge applied.

As well, each goods which imported from any other country, will have to pay their export custom duty based on their country’s charges. Only upon paying the import custom duty charges and export custom duty charges, Goods may cleared for movement.

As the taxpayer needs to clear their chains for their Goods, they must proceed to pay them as early as possible. Here is the process to get challan ePayment online within quick steps.

ICEGATE ePayment

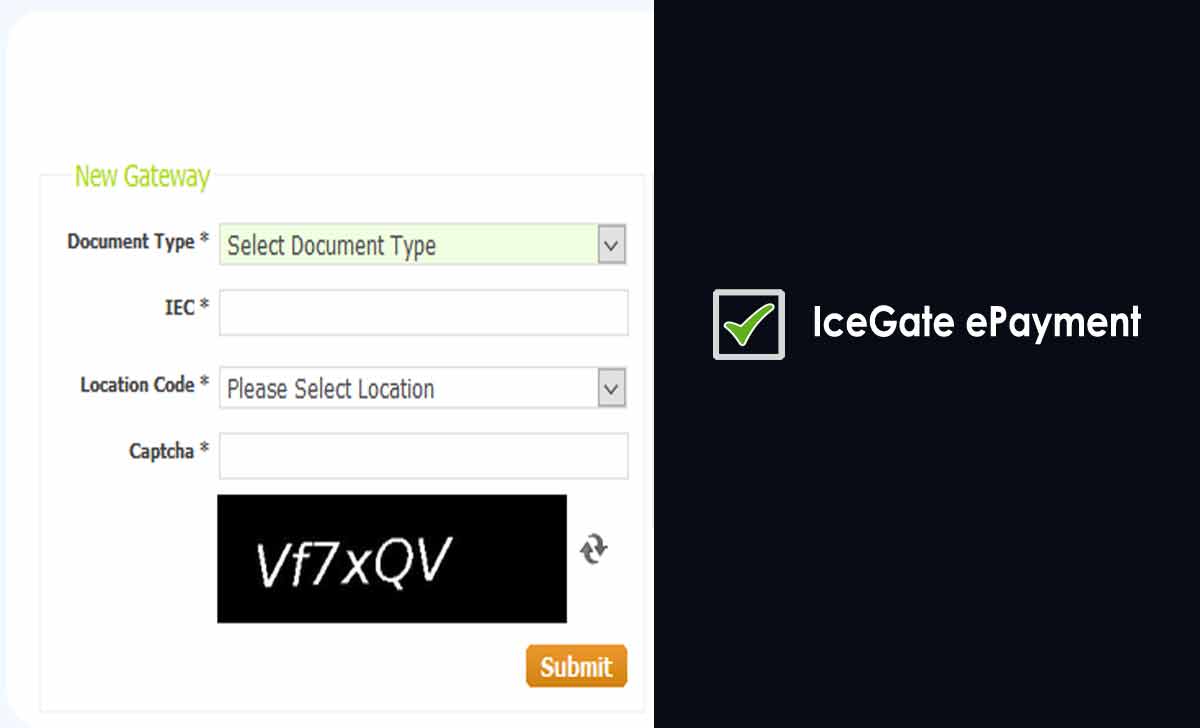

- Visit ePayment portal at epayment.icegate.gov.in/epayment/locationAction.action

- Now select Document Type

- Enter your IEC code below

- Select your Location

- Click on Submit button to proceed further

- Tap on Bank list to check if your bank is in New e-Payment Gateway

- Else you must have to go to older ePayment page

- You can view unpaid challan in list, mark them as to pay

- Click on Ok and then confirm button to check entire selected entries

- Select Bank and then move to e-Payment gateway of bank

That’s it, Once your payment processed, you will get a transaction status page with a successful message. If the transaction failed, then you need to follow the below given steps to clear your challan dues.

Reasons for ICEGATE ePayment Transaction Failure

There are multiple reasons due to which the transaction might fail in ICEGATE ePayment portal. Here is the common problem which one can view during their payment of challans.

- Payment paid form user, but the ICEGATE e Payment portal haven’t got confirmation from bank

- If the payment from user side was not successfully due to wrong entry of credentials

- Payment failure due to low balance in account used to pay the ICEGATE ePayment Challans

- Connection failure during the payment processing

How to Pay ICEGATE ePayment for Failed Transaction

Here we will let you know how to clear your dues of challan through ICEGATE e Payment. Make sure you follow these steps when you have a failed transaction only.

- Go the online portal from your browser at epayment.icegate.gov.in/epayment

- Use your IEC code and location code to enter the page

- Now click on Income Transaction from menu to view all

- click on verify ink to complete transaction left

- If the transaction is failure, then it will move to unpaid challan list

- Else your challans will pass to ICES as payment successful

That’s it! You can view the unpaid challans again and if you see any in the list, then you need to use the same process again and make the payment form your listed bank to clear your ICEGATE challans.

How to check ICEGATE IGST Refund Status

How to Check ICEGATE ePayment Transaction

The page designed for customers who want to clear their challans for Goods for easy movement. Thus here are the steps to follow to get the transaction summary for their reference.

- Login to epayment.icegate.gov.in/epayment/locationAction.action

- Select document type

- Enter IEC and select location, provide captcha, Click Submit

- Now click on Transaction summary to view last 60 days summary

- Click on ‘Today Transaction’ to view challans paid today to IEC

- Or use start date or end date to get details of other to pay challan

- Once listed, click on view button to get your e-receipt for transaction

- The pop-up windows will show your selected transaction to print

- That’s it, As per your printer settings you can select the print page and get the ereceipt for your successful transaction through CBIC ePayment.

Points to Remember while making ICEGATE ePayment

- It is a mandatory part of your shipment, thus one must do it very slowly to get exact results. Here are some points which must remember while completing using ePayment.

- Select only the challan which are due within short time to make payment easy

- In bank payment gateway, Don’t click back and wait until transaction complete

- Check the status of payment after 10 minutes and don’t rush to pay again

- Make sure to collect e-Receipt for your transaction and reference

- Pass the internet banking credentials only after payment amount displays

- Use old ePayment portal if your bank not listed in new Portal

How many challans can pay through online form ICEGATE ePayment?

Of all, one can pay a total of 25 challans associated with their IEC code in a single click. By listing all the unpaid challans , taxpayers can select the25 from the list and make the payment by the bank processing. The confirmation for each challan will be available for your reference with giving you a valid e-Receipt.

Can we generate CBIC epayment transaction?

The succesful ICEGATE e payment portal will allow to check the new transctions. But the old portal not allows to check the same.

What is the timing of ICEGATE ePayment?

ICEGATE ePayment portal is available between morning 9 AM to evening 8 PM to receive the challan payment. taxpayers can only use them between Monday to Saturday and as well the site will not respond if there is a government holiday as per Indian holidays. Thus taxpayers must complete transactions on time to process the goods smoothly.

Is it mandatory to pay Custom Duty Charges?

As per the Goods regulations of India, it is mandatory to pay the charges applied on goods by the custom office. The custom duty is the total charge on goods for imported or exported to the state from any other county. Without paying custom duty your goods will not eligible pass or enter the country.

What to do if my ICEGATE ePayment fails?

There are numerous reasons due to which a payment can fail and have given the details of it in the above article. This is to inform that you have to wait for atleast 1 or 2 hour after a transaction failure. As if any connection issue the transaction will get update and your challans will pass to ICE.

Where does ICEGATE e Payment Challan created?

The taxpayer needs to create their challan through GST portal from the option of services. Here the option to track challan status is also available to provide an up to date status of the challan created.

Is import duty different from export duty?

If a product imported to the country then an import charge may apply on it. If the same goods exports to any other country then the export duty may issued. Thus each good will have to get the import and export duty paid at both countries for their free moment.

Can goods be clear without paying custom charges?

No, there is no limitation of Goods to pass the custom office without paying their custom charges. If the duty charges not paid, the goods may seize at the custom office and will only move out after paying the custom duty charges along with the extra penalty as per applicability.

Can I get my good form action from the Custom Office?

There is a limit for each goods to kept in a custom office and after that limited period, they will move to the auction center. Once in the auction, there may be multiple parties who will involve to get the Goods at the lesser rate than market value.