ICEGATE GST Refund Status now available | Find how to check IGST refund status on ICEGATE | Export Ledger or Refund…

ICEGate is an online portal provides by the Central board of excise and customs for business owners to pay their custom taxes online easily. Though this website offers more than just epayment of customs, this is the main purpose it serves.

If you have been using ICEGate to make different customs payments then you might already know that you also receive a refund in your IGST account only if you have linked your IGST to ICEGate.

In case if this is done, you can see refunds receive in your account every time you make a customs payment through online. In this article we will help you to find out how you can use this portal to check for your GST refund status on ICEGATE.

What is IGST Refund?

Everyone who involves in export of goods understands that they have to pay a certain customs amount as tax. Upon paying this tax you will also see an amount reflects in your IGST account as part of taxes paid.

As you keep on paying taxes while your link GST with ICEGATE, then you will receive a certain amount of refund from IGST. It is simply a reflection of effective payments which made throughout the customs process. Though the refunds might not be huge and will be maximum of 2% to 5% of the total amount.

How to track IGST Refund Status on ICEGate

You can follow the steps below that can help you understand how you can track your IGST refund status on ICEGate.

- Open ICEGate official website from here icegate.gov.in and then login into your account

- Click on services

- Refunds

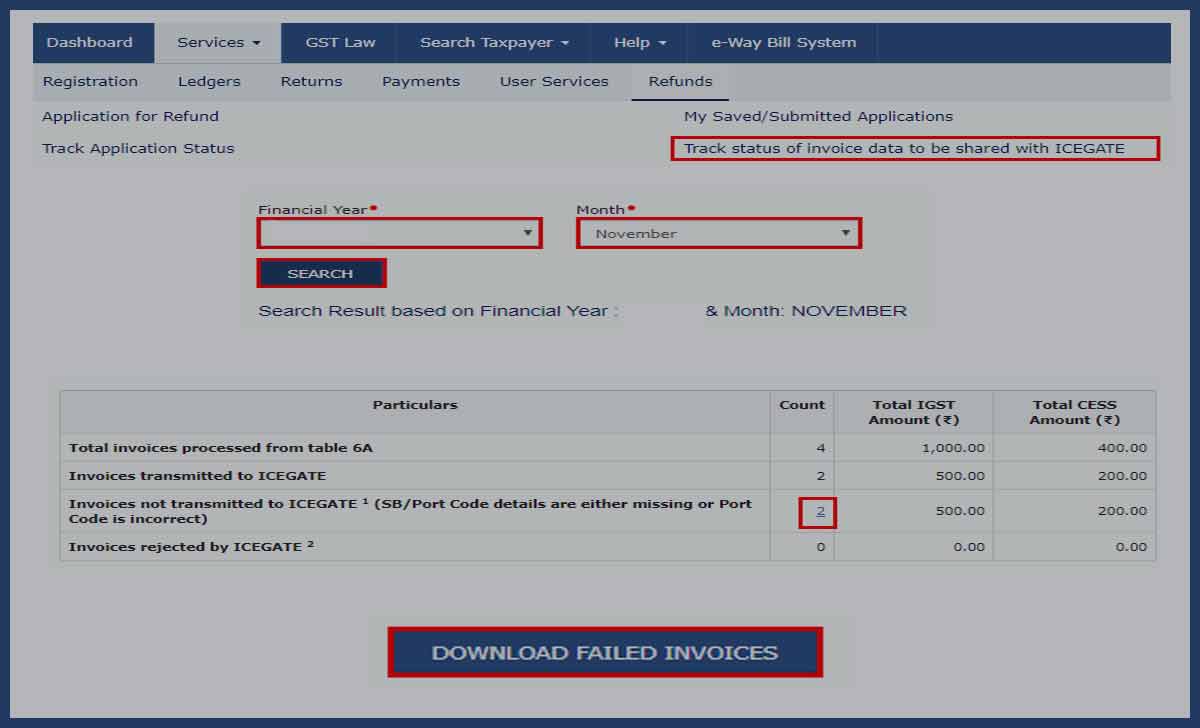

- Click on Track status of invoice data to share with ICEGate

- Then under Invoices not transmitted, click on count option and click on download failed invoices

- These are the invoices which are not yet approves for refund due to some error.

- Now you have downloads the failed invoices along with their invoice numbers. You can use this all to file for a refund again.

Export Ledger of Refund

If you want to view the refund on the ledgers, then you can go through the steps below

- Login to ICEGate account at icegate.gov.in/iceLogin/loginAction

- Click on services option

- Click on Refund and Track option

- Click on View Export Ledger

- Download transaction CSV application or form

- Refund Ledger transactions completed sucessfully

How do I check IGST refund status on ICEGate?

You can go to your ICEGate account and then click on services. Select refund and under this click on Track status. The said option which will show you the refund status once you export the refund ledger.

How do I get my IGST refund?

In case if you want to download the IGST refund then you can go to your account. Under this Refund > track application status and you can enter our account number to get a refund.

How do I download a refund from IGST portal?

Go to your account > services > refunds >click on track status. Go to the refund search page and click on view export ledger to download refunds.

Invoice transmitted to ICEGate but refund not received, What to do?

In case if your refund failed, then it will not receive by you, and that is why you can see this issue as invoice transmitted to ICEGate but refund not received.

IGST refund not received?

If your invoice marked as invoice transmitted to ICEGate but refund not received, then it means it has failed as refund.

How to check the IGST refund amount?

You can view the refunds from the view export ledger option from the refund search page.