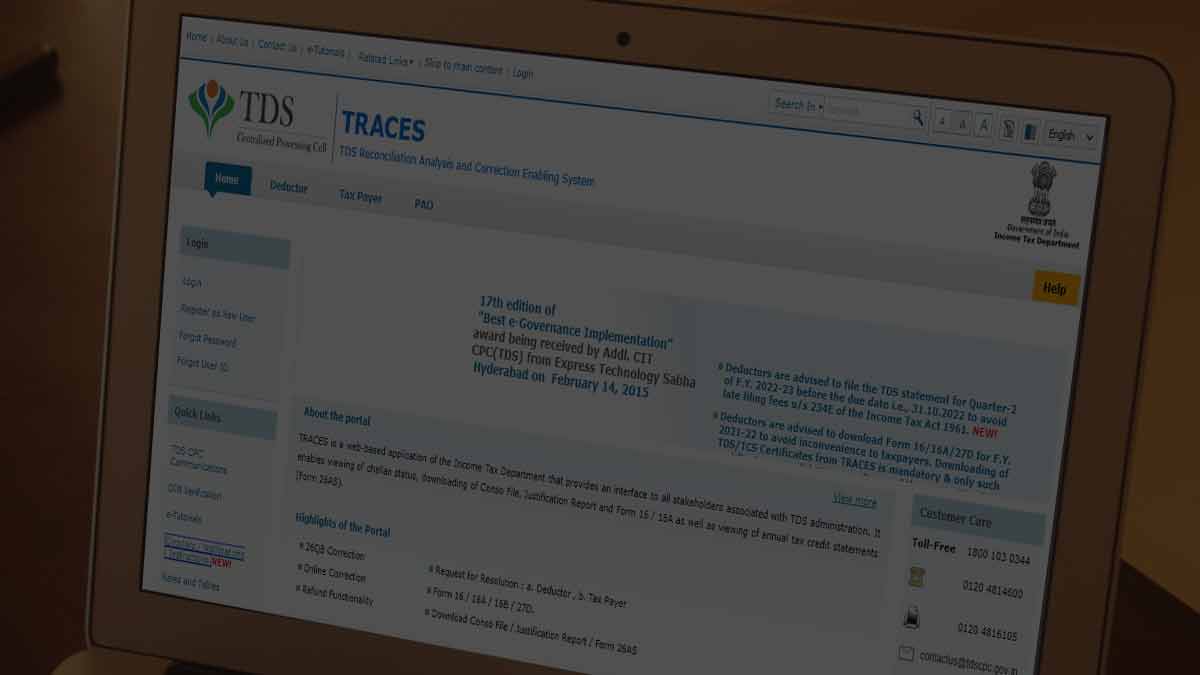

Income Tax Department of India launched TRACES platform which may used by deductors and tax payers/ PAO in order to apply for TDS submissions, updates, corrections and any changes required so that the TDS/TCS may used during eFiling of Income Tax returns.

The goal behind launching this platform was to provide Indian citizens with a single platform and portal where they can reconcile their bills paid, update their TDS and get approval on them to be used for Tax refunds.

In this article, we will help you understand a little more in depth about the TRACES platform and how it can be effectively used for Income tax returns for filing for refunds. Then look at the account registration, login, user id & password retrieval guides as well.

What is TRACES Portal & TDS

TRACES full form is TDS Reconciliation Analysis and Correction Enabling System and Indian citizens have to first register on this platform in order to view the taxes deducted on their income.

In order to register for the platform they will have to enter details such as PAN, email id and mobile number to get their account created and activated as well.

This platform is for both salaried and non salaried individuals to find out their deductions on income by different forms such as 26AS, 26Q, 16, 16A and more.

Through these forms you will have to update your KYC and then the portal will provide you with the updated TDS details that you can use and then file for refunds while e-Filing your Income tax returns.

In order to complete your TRACES registration you will have to follow it in two parts such as registration and then the account activation to confirm the account.

TRACES Account Registration & Activation Process

TRACES is available for registration to deductors, tax payers, PAO and even NRI foreign individuals who are paying taxes in India. Across all there are 10 steps to create and confirm your account.

- Open contents.tdscpc.gov.in on your browser

- Click on Register as New User

- Select Type of Registration

- Enter the TAN of Deductor, verification code from the image and click on Proceed button

- Complete the KYC process by entering the required details for Token Number/ Provisional Receipt Number (PRN), Challan Identification Number (CIN) and PAN Amounts

- Click on Proceed button

- Authenticate your account with code, organize your details for the account next

- Enter your user account details like user id, email id, password and confirm password and click on confirm button at the bottom of the page to complete your account registration

- On the next page confirmation will popup that your registration request has been submitted successfully and you can move to the activation process

- Open your Email or Registered mobile number to check activation link

- Click on the activation link from your email enter the activation code from SMS and Email Id

- Click Confirm for activation of TRACES account

TRACES Login

The login process for TRACES for either deductor, tax payer or PAO is pretty simple as shown below.

- Go to the TRACES official portal and then click on the login button

- On the login page select either to login as Deductor or Tax Payer/ PAO

- Then enter the user id, password and required details such as TAN for Deductor and PAN for Tax Payer and AIN for PAO

- Then simply click on Login button and you will be now logged into your TRACES account

TRACES User ID and Password

It is common for anyone to forget either their user id or password and sometimes both as well. So, you can always follow the instructions to retrieve TRACES user id and password.

Retrieve TRACES User ID

- Go the TRACES official portal and then click on login button

- Next click on Forgot user id (Deductor) link and complete the KYC on the next page

- After that enter the OTP received from the registered mobile number you gave

- Enter your PAN and required amounts to confirm. Your user id and email will be populated on the next page

- Finally enter the password and confirm password to retrieve your TRACES user id

Retrieve TRACES Password

- Click on Forgot password? Link from the TRACES Portal login page

- It will redirect you to KYC completion page and once that is completed click on proceed

- Enter the OTP received on registered mobile number you have provided

- click on proceed

- Next reset your password by entering a new password and confirm password for TRACES

TRACES Customer Support

In order to ensure support is provided to all the customers who are either deductors, tax payers and PAO, the TRACES platform has provided various customer numbers with their working hours.

TRACES might not be a simple portal for everyone to use. Sometimes you might have difficulties with something or else you might either want to file a complaint or provide a suggestion as well.

Queries related to how the platform works and how each form can be submitted or guidance on the submission to approval process can be provided once they contact customer care along with help on Income tax e-Filing and more details on TAN & PAN as well.

| Service | Helpdesk Number |

| General Queries | 1800 180 1961 (or) 1961 |

| e-Filing | 1800 103 0025 (or) 1800 419 0025 +91-80-46122000 +91-80-61464700 |

| TAN & PAN | +91-20-27218080 (or) +91-20-25658300 |

TRACES Portal Important Forms

TRACES portal is essentially for TDS reconciliation and analysis. This helps both salaried and nonsalaried individuals with different form submissions and approvals which can be used for Income tax returns.

So, we have listed out all the forms you can find from the portal which can be useful to you.

| Form Name |

| Form 16B |

| Challan ITNS 281 |

| Form 12B |

| Form 12BA |

| Form 13 |

| Form 15CA |

| Form 15CB |

| Form 15D |

| Form 49B |

| Form 15G |

| Form 15H |

| Form 16 (Part A) |

| Form 16 (Part B) |

| Form 16A |

| Form 24G |

| Form 24Q |

| Form 26Q |

| Form 27A |

| Form 27C |

| Form 27D |

| Form 27EQ |

| Form 27Q |

Hopefully, you will be able to save a lot with the TDS forms that you submit for approvals and then use it for e-filing your Income tax returns.