Complete PAN Aadhaar link online as per the new process in income tax login, Do check why PAN Aadhaar link is mandatory and What to do if the name differs in Aadhaar and PAN Card and not linking through income tax login, also check can we proceed to submit tax returns without Aadhaar?…

Aadhaar Card already known as unique identity card to every Indian citizen. This card holds every detail about an individual. Biometric of Fingers, Eye along with Facial and residential details added to unique identity card.

By the support of Supreme Court, Government of India made it mandatory to Link PAN and Aadhar Card. The PAN has a history of holding all transaction details used as an Income Tax proof for individuals.

PAN Aadhaar Link

The linkage of these two cards is going to make a big difference in the Indian Economy, where Aadhaar does e Verify an individual detail in the Income Tax Login page, and thus they need not upload any KYC documents in extra as well.

It is believed that Link of PAN number and Aadhar Card Number to Income Tax department will directly hold a clear record of an individual involved in, and also there are many benefits for adding PAN and Aadhar card number, as they do affect an individual life in below given ways.

This card is being used by an Indian Citizen differently in different areas of concern and holds full information, and thus, linking these two data cards will add a plus point for the Income Tax department to track the transaction and expenditure of an Individual, and the Income tax report generated by the department does ask each individual to use their PAN number as password.

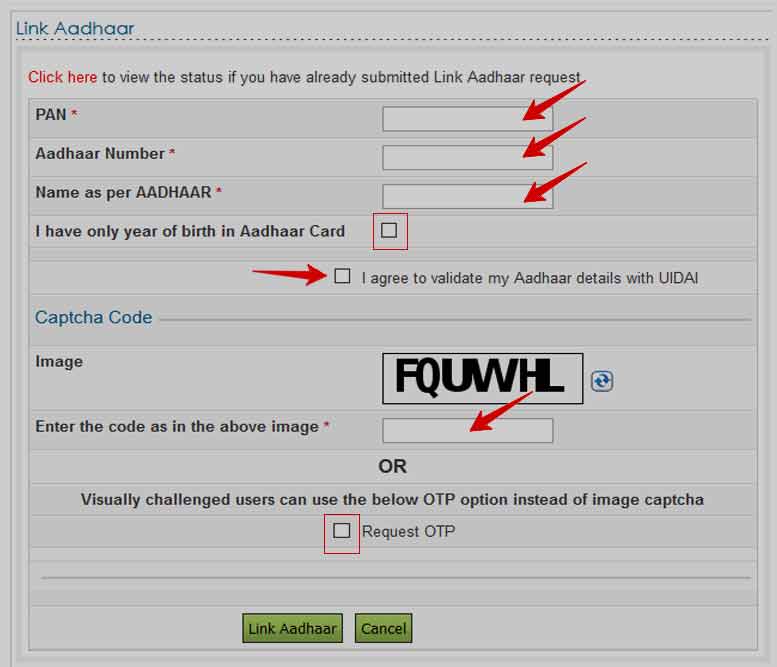

How to Link PAN with Aadhaar

- Visit the Income Tax Department eFiling official website at https://www.incometax.gov.in/iec/foportal/

- Go to Quick Links, click on Link Aadhar to open the Aadhar page, or open the direct link at https://eportal.incometax.gov.in/iec/foservices/#/pre-login/bl-link-aadhaar

- Enter your PAN Number > Aadhar Number

- Click the Link Aadhaar button to validate available at bottom of the page

- The details will fetched as provided with your Aadhaar and send you an OTP to your Aadhaar Linked Mobile Number

- Enter OTP received from UIDAI and Click Submit

- Immediately Income Tax login will verify the details with the Aadhaar server and linked if matched with the Aadhaar Number.

Why to Link PAN to Income Tax Login

PAN number is a unique number which is granted to individuals who have crossed 18+ years of age, and below are the details why PAN card is used in day to day life and thus why it is important for Income tax Login

- Any transaction to be made in Bank over 50 thousand needs a PAN card

- Bank or Respective firm issuing a large amount ask for PAN number before credit

- Applying for any kind of Loan does require PAN to find history

- Buying Car or heavy goods require PAN number as mandatory

Thus, any transaction which is large in amount in terms of Goods or Cash requires a PAN card number, which benefits the Income Tax Department to record the history of individual transactions and mark them in respective Slab of Income Tax.

Why to Link Aadhaar Card to Income Tax Login

Here we bring some basic usage of Aadhar Card numbers and how it affects the Income Tax department to their usage.

- Creating a New Bank account must require Aadhaar Card Number

- Most Government Organizations use Aadhaar Card as Address proof

- Applying for Government Proof as Voter ID, Passport and etc

An individual KYC documents linked with Aadhaar Card number in all forms. This number helps in finding an individual personal and professional details easily.

Taxpayer must aware of having their details fills correctly and should verify their existing PAN & Aadhaar Number. This is must and the process of Taxpayer may verify their account under government’s rules. The process to Link Aadhar number follows by PAN number written below in steps.

That’s it, You have now successfully link your Aadhaar Number and PAN with your Income Tax Official Account. This will make easy your process to access the Claims and Refund in the future by assessing officer.

What if PAN not Linked with Income Tax?

The Income Tax Department does scan the total report of individuals from the period using their PAN number only. Thus, any individual having a PAN card should apply for Income Tax and get their ITR for that financial year collected. PAN is the first basic proof account of Income Tax Department.

What If my Name is wrong in Aadhar Card Number?

There is no need to worry, if you must link your Aadhar Card with Income Tax and does contain Wrong name. You can visit nearest Aadhar Seeva Kendra and submit a form for change of name by verifying your biometric information. Aadhar Number Linkage is important and thus an individual once name change has done, can re-initiate the process to Link Aadhaar card with Income Tax Department.

Can I proceed to fill Income Tax without using an Aadhar Number?

No, this is against the rules allow by Reserve Bank of India. Thus, every Indian citizen who is eligible to file income tax should login to Income E-filing website and provide their PAN and Aadhar number as a mandatory KYC document.

Can I use only one ID Card to link for Income Tax?

No, you won’t allow and the filling process will not allow it as well. Because these two ID details are important for the process. Aadhaar will provide the identification proof whereas PAN will provide the banking transaction history.