Now you may check your LIC premium in an online calculator, Find how the insurance premium is calculated for any policy and how the online calculator helps to calculate insurance premium before policy subscription to plan your budget, Check the sampling method…

LIC Premium Calculator

As the name suggests, this LIC premium calculator online introduced by LIC India helps its customer to calculate the amount of premium to be paid against any particular Life insurance policy on any type of endowment, child, pension, money back, term plan, whole life plan or health plan. Where LIC premium calculator not only calculates about premium but also calculates the amount that you will get after the LIC maturity.

The calculation of Life Insurance premium and maturity seems easy for some who are good at mathematics and can do wonders with a calculator in hand, but not all the people are that much efficient. Moreover, the availability of LIC online premium calculator helps one to make the premium calculations in a matter of seconds.

How Online LIC Premium Calculator Helps

Online Premium Calculator helps in to make the decision quickly, sometimes with the help of this LIC premium calculator, the prospective insurance policyholder just wants to take an idea of what would be the overall of costing of the plan and whether it will suit the budgetary needs or not, where here, the LIC calculator without any registration to LIC Login portal comes as a savior, and it helps to get an idea very easily without much effort and time wasted.

Calculate Insurance Premium using LIC Online Calculator

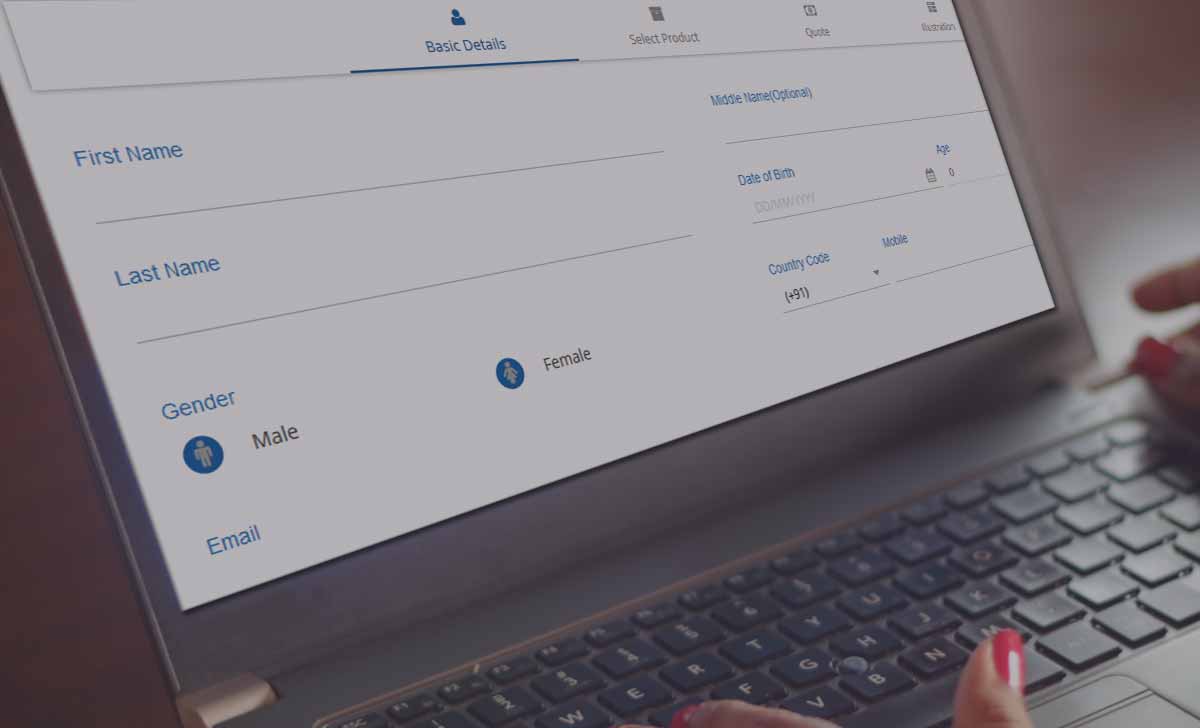

- Open you browser and login to ebiz.licindia.in/D2CPM/#qni/basicinfo

- Enter your basic details

- First, Last Name, Date of Birth, Gender, Mobile Number, Email

- Click Next

- Select Quick Quote or Compare Quotes

- Click on Policy required (Select square box)

- Click Coverage

- Enter Policy Term by drag down (Changed as per the insurance policy selected)

- Enter Sum Assured & Policy Term

- Click Quote

- Then you will get Total Premium with Tax for Yearly, Half Yearly, Quarterly & Monthly

LIC Premium Calculator to Calculate Insurance Premium

When it comes to taking an insurance policy everyone wants to take an informed decision only, To add to the ease of its customers, LIC has developed embedded premium calculators for different policies, where these different online premium calculators of LIC calculates the premium of the insurance policies much faster than expected, and there are different premium calculators for different policies and you have to select the correct policy to calculate its associated insurance premium

What are the Premiums of LIC?

Premiums of Life Insurance Corporation are the one time or recurring payment made which are essential for keeping a life insurance policy alive or in force, and the insurance policy only provides all the benefits to its borrower, only if, he/she makes the payment of the premiums on time and pays the appropriate amount of premium for the whole tenure of the policy, and however, the frequency of the premium payment can be decided by the policyholder at the time of opting for the insurance policy from LIC India.

The Insurance policy stands void if one stops to make the payment of the premium amount, So it is necessary to keep a track record of the premiums and pay them regularly, the most common premium frequencies offered and opted by the customers are monthly, quarterly, halfyearly or yearly.

How the premium of any insurance policy calculated?

Well, the insurance premium of any policy depends on a variety of factor, but the foremost factor on which the premium of the Life Insurance policy depends is the type of policy chosen, and the amount of premium varies with the type of policies taken.

The pure term policies require one to pay the lesser premium, while the endowment or small term policies require you to pay more premium.

The premium of the insurance policy depends on many other factors also such as age, smoking habits, the tenure of the plan, total sum assured etc, and a healthy individual of 30 years of age has to pay a lesser premium for the same tenure of the policy than a 50 years individual.

If you are a non-smoker, you will need to pay the lesser premium as compared to that of the smokers for some policies for normal and term insurance, So there are a variety of factors on which the calculation of premium depends for a policy, A premium calculator is usually designed keeping in mind all such factors affecting a policy, So there are different premium calculators for varied policies of Life Insurance Corporation of India.

What is LIC Premium Calculator?

Actually, the LIC premium calculator is a tool provided in online to calculate the approximate amount of insurance premium to be paid for the policy chosen by you or for the policy you are interested in, and while calculating the premium of any policy we have to keep in mind certain technicalities involved such as age, the tenure of the policy, total sum assured, premium frequency etc.

These technicalities are different for different types of insurance policies offered by LIC India, and the calculators are developed after keeping in mind all these technicalities, To make the work of LIC officers easy, it is made available to all the official insurers for all the types of LIC product they sell and also for agents and for customers in online portal at licindia.in or at ebiz.licindia.in.

But before starting the calculation of premium for a policy, you need to give some information beforehand, so that it can calculate the correct amount of the premium to be paid monthly, quarterly, half-yearly or annually, and the various types of information that you may need to enter are:

- Name of the plan

- Age of the Applicant

- Total tenure of the plan

- Any rider which you have taken

- Total Sum assured

- The frequency of the premium to be paid

If you are in clear in your mind about what you need to calculate, it just takes lesser than a minute to fill in all the information, If you have entered the information and preferences correctly you will get a rough estimate of the premium to be paid for the frequency of premium you have chosen and the figures shown by the calculator are just an approximation, the final premium to be paid is decided by the insurer depending on your background information, health information etc.

Are the premium calculators available for the general public?

The best thing about the LIC premium calculators is that these calculators are available online for all to use, and the use of these calculators is completely free, also there are no hidden charges as well, anyone can easily get an idea about the amount of LIC premium to be paid for an insurance policy one is planning to purchase.

If the LIC premium amount seems to be impossible to be paid, one can adjust the parameters related to the policy to get the policy premium under the range of affordable premium and there are different policies to choose from, while using the premium calculator, just make sure that you choose the right policy without any confusion from the drop-down list.

One wrong selection can bring an entirely different result, so in order to use these calculators, you just need to visit the official site of Life Insurance Corporation of India and search for the LIC premium calculators, and after opening the premium calculator, just fill in the required data like the plan, the age of the policyholder, the term of policy you seek and the total sum assured expected, then immediately the calculator display the LIC premium with final calculation for all the payment options.

LIC Premium Calculation Sample

Here, I am giving you an example of how the premium calculator works, Suppose, you have chosen the New Endowment Policy in the LIC calculator, then now the calculator will ask you for some details, here, I am giving the details only for the purpose of explanation.

- Age of the insured: 38 years

- The term of the plan: 20 years

- Sum Assured: 10 lakhs

- Rider: Yes

Now, after giving in all the details, the LIC premium calculator may indicate the result in the following form:

- Monthly premium: Rs. 4,200

- Quarterly premium: Rs. 12,500

- Half-yearly premium: Rs. 25,000

- Yearly premium: Rs. 49,500

The above-stated figures are just for example and are not true, and the LIC premium calculator shows the result of premium calculated in the way shown above, we think it is clear that yearly premium costs are lesser than the quarterly, monthly or half-yearly premium.

The use of the LIC Premium Calculator is highly recommended if one wants to calculate the premium to be paid for the insurance policy of one’s choice, so why waste the time on different calculators at home, when you have an online LIC Premium calculator.