Claim income tax refund and check the status of IT refund and find in which mode will get the refund of advance tax paid and what to do if refund amount reversed to Income tax department…

Well you might have heard about the Income tax department of India which governs all across India and deals with every tax rebate that goes on, If you are a salaried person then you would be really tiding up your sleeves this time of the year to look up for the refund status on your income tax.

Well your work the whole year getting a varied salary and then during the last quarter you can apply for refund on your income tax which the government deducts from your account as advance tax.

Basically, consider your salary and through this the government monthly takes a constant sum of money from your account which is considered as the tax, and during the last quarter and mostly during before July 31st of the Assessment year, everyone who have paid taxes are notified to apply for refund on the taxes, Let’s have a look in detail

Income Tax Refund

Eligibility

So even before you are about to get a refund from the IT department of the Indian government, You would have to be eligible to apply for the refund in the first place, and many Indians have to understand whether they can get a refund through this process, and It might sound a little hard to be eligible but the IT department who at last decides if the tax you have paid are more than the other taxes and liabilities you have.

The Income tax department of Indian will deduct money from your account, and this is called Income tax which is from period of April to March of the said financial year.

Now, during the month before July 31st, you will have to upload the other taxes and liabilities on you to the Income tax department, i.e. Income Tax Returns (IT returns), then the income tax department will go through the tax refund you have applied through the eFiling site

During completion, the IT department will release if you are eligible for a refund or not which is assessed on the tax that they have deducted and other taxes that you have currently paid and paying, and if the other self-taxes and liabilities are more than the tax deducted by IT department you will be eligible for the refund.

Requirements for Income Tax Refund

These requirements are must to be with one who is ready to claim his Income Tax Refund, there are two way of refunds which is used by official e-filling website to make transfer the money, and the Taxpayers will have access to view their refund status which will be sent by Assessing Officer to Refund Banker.

- Direct Transfer : Taxpayer banking account details must be correct to make a direct transfer of Refund to Bank. Account Number, IFSC code or MICR code and Account Name.

- Check Transfer : Account Number, Full Address of Taxpayer

Full Address of Taxpayer in details with Landmark and Postal Address should be mandatory in both the cases of refund, and It is must to submit all required documents to make an easy refund process.

The Income Tax login website has made proceed to view the refund Status very easily, and If you haven’t got much information about the Income Tax Refund, then have a look at below given detailed steps.

Income Tax Refund Status – How to Check

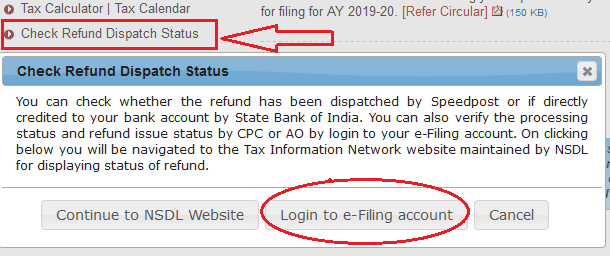

1. Open your browser and go to incometaxindiaefiling.gov.in

2. Click on Check Refund Dispatch Status (Available at left side tab)

3. Click on Login to e-filing account

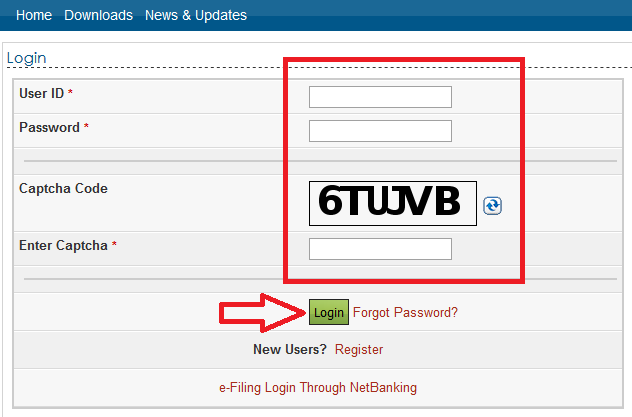

4. Present Income Tax User ID and Password (If not created, first register the details)

5. Enter the Captcha once filling all mandatory details correctly (If getting an error, just click refresh to generate new code)

6. Click Login > Go to My Account > Find Refund / Demand Status (You will get the exact status of the IT refund)

Taxpayer can view the year of assessment and status of Refund along with reason if there is any obligation in refund process.

Taxpayer must have all required credentials correct to login and view the status process, and the Status of refund will be displayed in official site after 10 days of refund has been initiated by the Banker, and the mode of payment can be selected by Taxpayer which are Direct and Check, which are secure and protected.

Note: Any miss of documents while applying for refund, will cancel the Refund by Assessing officer and reason for cancellation can see at Status page by Taxpayer, and It is must that Taxpayer analyse their whole year investment and excess limit by a known Chartered Account and seek their guidance while applying for Refund.

IT Refund Adjustment, Interest, Refund Reissue

Higher Refund Amount : So, let’s assume you are eligible for the Income tax refund and you might sometimes receive an amount which is higher than the one which you’ve requested during your refund, and this is basically the interest that the income tax department will be paying and most of the times this interest rate is applicable when you are being paid 10% or more of the tax you have paid previously.

Income Tax Refund ReIssue

Some people might not receive their IT refunds even after they have applied for tax refund with valid papers, and In this case you do not have to worry and just go to official website to apply for Refund reissue request which will help you in this case.

Income Tax Adjustment

In rare cases where you have outstanding tax from previous year then the tax department will appeal with an opportunity for you to respond within a limit of 30 days to explain the tax due, and you can choose to let the department deduct the outstanding due and then send you the income tax refund for the current year.

Thank you for reading this article about the Income Tax Refund and let us know if you have any questions which we would be responding on.