Check the new process to apply Loan in online against Life Insurance policy of LIC India for immediate approval, and what are the required to submit towards sanction of the loan and what is the present interest rates for LIC online and offline loans…

LIC Loan Online

LIC India has recently launched loan facility for the people who have an eligible LIC policy, and the service can be availed by the customers who have registered for the premiere services on LIC web portal.

If anyone who is not registered can apply for the loan online by first registering for LIC premiere services, so let’s have a look at the process of a loan application online at the LIC portal as per the step by step process given below

Apply LIC Loan Online

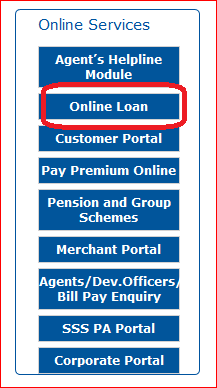

1. Open LIC India Portal at licindia.in

2. Click Online Loan

- Once the user clicks there, he will be redirected to the LIC login page of the portal, and on the login page the user needs to provide below mentioned details

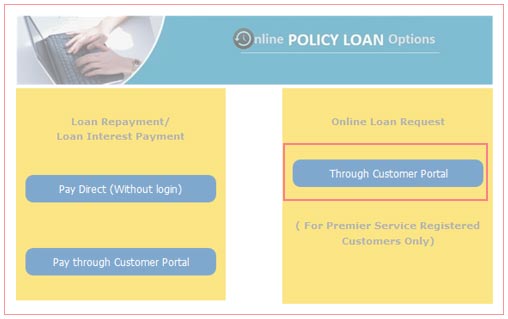

3. Click Through Customer Portal

4. Enter your Login credentials

- Registered user ID/Email ID/Mobile number of the policyholder

- Password created by the user for the LIC portal login

- Date of birth of the policy holder as per the details mentioned

5. Click Premiere services

- This is the third option on the menu, and once the user hovers his mouse over that, a series of options will open, in the new options

6. Click Online loan request

- Once a person clicks on these options, a new page will open which will have all the terms and conditions listed in order to apply for the LIC loan online.

7. Select I Agree Checkbox

8. Click on Proceed

- Once the person agrees and click on the proceed button, a new page will open for customer validation, then the customer would be sent an OTP on the registered mobile number

9. Present the OTP received on your registered mobile

10. Click on Submit

- This will help in the validation of the online loan account of the LIC policyholder, and the customer of LIC India will be redirected to a new page.

11. Select the Life Insurance Policy number which you wish to take the online loan against, from the drop down list shown

12. Select the option of Full Loan Disbursement or Partial Amount

- After this the screen will show the eligible loan amount for which the person can take the loan against the LIC policy of their choice

13. Click on Next

If there is already a loan taken on your account, then it will show all the details such as loan is taken, interest on that, the amount paid, amount remaining, and due date on the same screen online.

14. Submit Confirmation > Click Submit

- After providing all the details and clicking in submit button, the user will be redirected to next page in online web portal for sanction, and this will have all the information selected by the user such as

- Net amount of loan selected by the user

- Bank account details registered with LIC

- Name and address of the LIC branch.

- If the user wants to go back and change any of the details for online application, the user of LIC portal can do this at this point, else if all the details are correct the user can click on the “Yes” button and proceed.

15. Note down the service number which will be generated in LIC web portal at below with a service number, having 3 buttons

- Service request

- Policy loan application

- NEFT mandate form

Download the respective form, and the filled-in LIC online loan form along with signatures needs to be submitted at the nearest concerned LIC branch, where the request form is valid for four working days, and in case the user fails to submit the online loan application during the said period, the loan application will be canceled by LIC and he/she would have repeat the whole process.

Key benefits and drawbacks of the LIC Loan Online Complete process

- The LIC online loan process still has certain physical steps for which the person needs to personally visit the LIC office to submit the documents.

- The person can self check the loan eligibility for self without being dependent on any LIC agent.

- The interest charged on the Life Insurance policy of LIC India is only 9.5% which is one of the lower interest rate for loan among other financial institutions.

- LIC India Loan amount eligible is on the surrender value of the policy and no pre-approval is required for the same.

- EMI payment, interest payment is in line with the policy premium payment.

- One can pay the principal amount any time and his convenience, thus one can also pay the principal amount through the online mode, and Risk cover under the policy will continue as it is without any change, and the loan benefit provided is a wonderful facility by LIC especially with the convenience and the easy process that one has to go through in order to avail the loan.

Sir mujha lic per online loan apply ka leya kis app ko dawnload karo

I want to 20 lac loan which document provide their I job in Indian Army

how to apply loan through online