Do check Ahmedabad Muncipal corporation property tax bill due details online and complete the payment within due date and get rebate as per the discount rate mentioned…

The property tax is an amount that is collected by municipal corporations to get their work done to develop the surrounding, and every government structure in the city which comes under this municipal corporation is all developed with the collection of Ahmedabad Property Tax.

The rate of interest and the annual rate for commercial and residential property is quite higher than in other towns, and the development rate in municipal corporations is always high, the tax rate also goes higher which may check in the property calculator.

If you’re an owner of any property, then it is your responsibility to make the payment without delay and tiny paying also gives you benefit with rebate.

The Ahmedabad house tax can be paid by the owner or occupier of property from using the quick links, and here is the process which lets you know how to get the property tax paid.

Pay Ahmedabad Property Tax Online

- Visit Ahmedabad Municipal Corporation Online Website at https://ahmedabadcity.gov.in/portal/index.jsp and wait to load Amdavad Municipal Corporation web portal

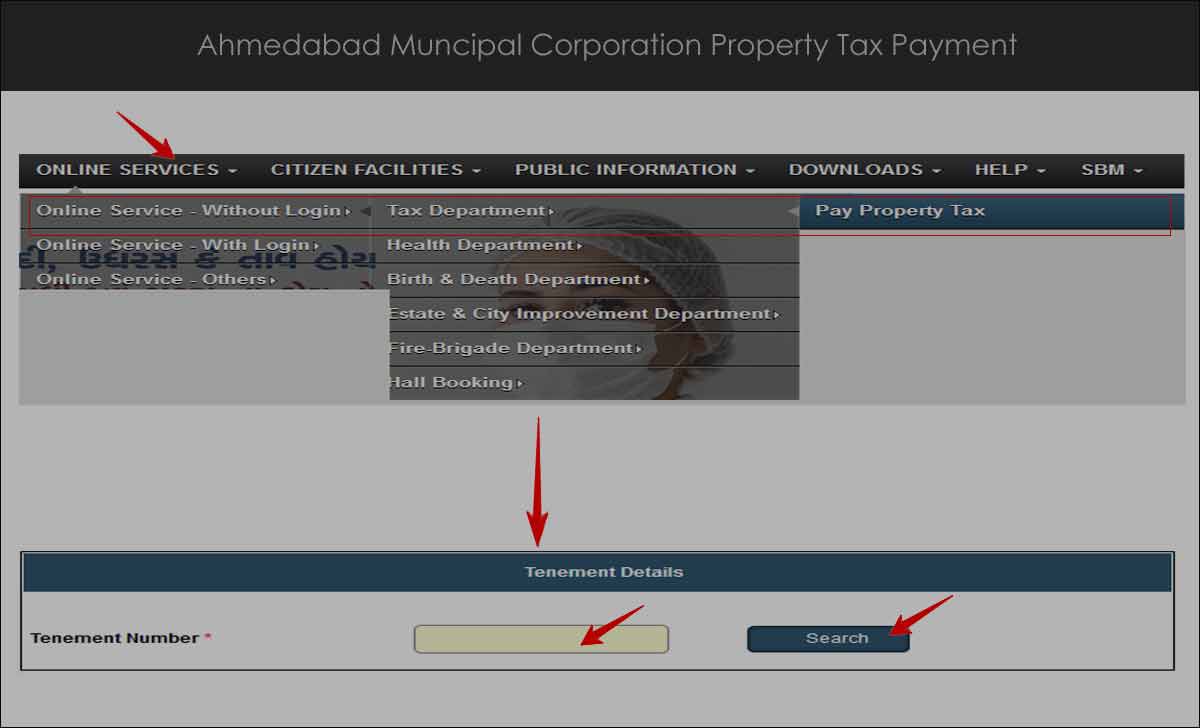

- Go to Online Services > Online Service without Login > Tax Department > Pay Property Tax

- Enter your Tenement Number > click on the Search button

- You can either use the option to Login or Without Login

- Verify details of your property and the Amount to be paid

- Click on the Pay button and Go to the payment gateway method

- Once the amount is paid/submitted, you will receive your Ahmedabad Tax receipt as payment confirmation to your email and mobile number.

Make Ahmedabad Property Tax Offline

The property tax amount for Amdavad Municipal Corporation is accepted from any of the municipal offices. As well the citizens of Ahmedabad can visit any Bank or the government office nearby to pay their payment for Ahmedabad house tax, where the receipt of payment is compulsory to have proof of your tax payment.

- Visit the Office with your Property Tax Number

- Property Name and Address with the number can also be supplied

- Confirm the details before getting your payment done

- Clear your dues before the due date to avoid the penalty

- Get Tax benefits of 5 % if you pay in advance

Can we make partial payment of Ahmedabad Tax?

Yes, there are options to make the payment of Ahmedabad house tax partially, and there is a due date provided for every quarter payment which is to be maintained, else the owner will be levied with penalty charges.

Why is it important to make Ahmedabad Property Tax?

The Ahmedabad Municipal Corporation does works for the development of the surrounding and the amount collected from the tax collection is all spent on municipal works, and thus this is a compulsory amount to be paid by every owner or occupier of the property.

Is the Ahmedabad Property Tax Taken by the State Government?

The Ahmedabad house tax is all about the collection made by municipalities for their local development, and thus the tax rate and the annual rate of interest for residential and commercial property is decided by Ahmedabad Municipal Corporation and there is not much involvement of the government in tax collection.