The National Pension System is a scheme from Government of India to bring financial stability to every employee on Retirement. NPS Calculator brings the complete details about monthly pension for post retirement, lumpsum amount eligibility for withdrawn, and the Interest earned on NPS account.

In the past the NPS referred to as the National Pension Scheme which is now more firmly refer to as the National Pension System.

The employees who enroll themselves with the National Pension Scheme may given the whole amount once they reach their retirement age. There are certain conditions when the employee can ask for the earlier withdrawal of their savings with respect to valid reasons.

There are numerous benefits of this scheme as the entire process is through the Government of India which makes it more secure. The motto of bringing the life of an employee stable after their retirement has brought the National Pension System scheme in view.

What is NPS Calculator

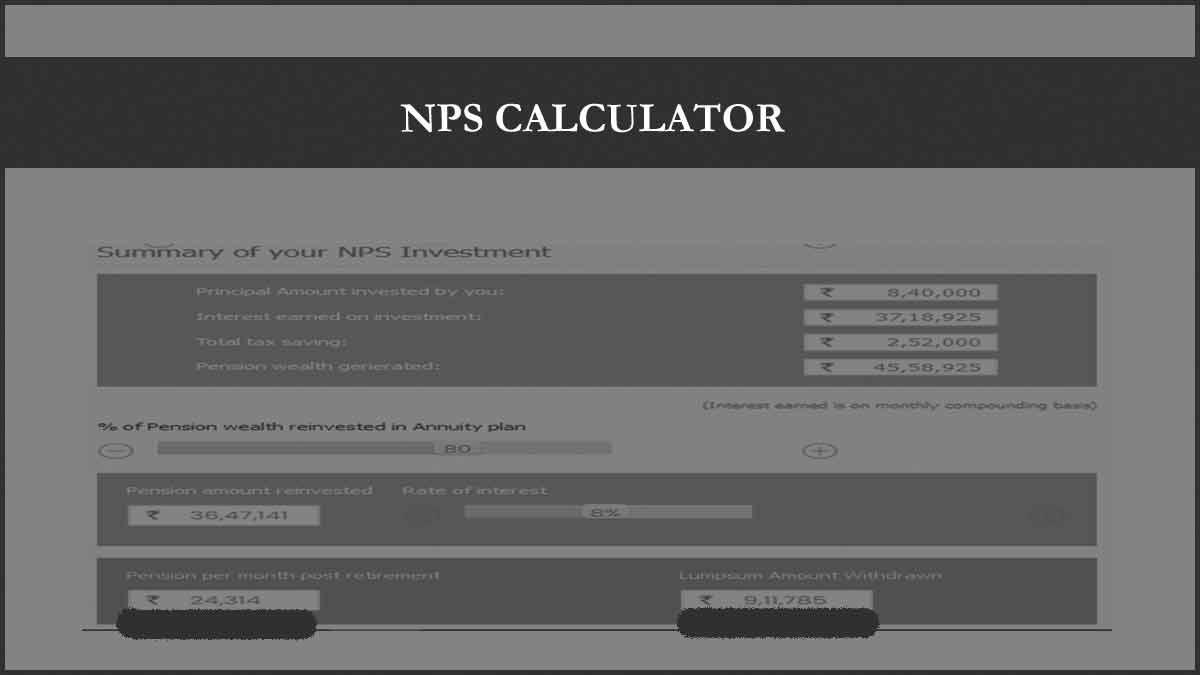

The amount of National Pension System accumulated in your account does differ with every employee. There is an NPS calculator available online, which allows you to calculate the total amount adds in your account.

These calculators will take the values of your investment and bring the lump amount total with the applied rate of interest by the Government. Using this Calculator will help you plan for your retirement and as well get prepare for investing the huge amount.

National Pension System Calculator Working

If you’re very new with the National Pension System, then have a look at the below points that describe how an NPS calculator assists you. We brought some detailed information about the NPS calculator and its way of working.

The National Pension System calculator brings you a figure of the amount that an individual is going to hold one their date of retirement.

- NPS is very important to consider the total corpus

- No individual can withdraw their entire NPS amount until their retirement period

- NPS will automate the calculation of 40% which invested in annuities and 60 percent which are subject to taxation.

- NPS calculator will exactly take your values and gives accurate output sum

- Get to know about the taxation regime on your entire pension funds

NPS Calculator Formula

Here is a detailed guide to calculate the National Pension System manually. We have brought the actual formula used by the online NPS calculator tools. Make sure you fill in every detail as asked to find the exact value of your NPS.

- Formula for National Pension System: A= P(1+r/n) * nt

- Here A is the actual NPS amount accumulate

- P is the Principal Sum to invest in NPS

- R is the rate of interest

- N is the number of times interest compound for calculation

- T is the total tenure complete till date

How to Use National Pension System Calculator

Have you got your NPS calculation values, then you just follow the below given steps and know your entire amount gained through the NPS scheme.

- Enter the amount and values in the formula by calculating form start to till date

- Enter your present age

- Find the exact rate of interest applied by the government

- Just use the basic steps and calculate them through the formula to get the exact sum of the total amount accumulate as per your current age.

Advantages of National Pension System

There are various advantages with the National Pension System calculator that does benefit the beneficiary of the scheme. Have a look at these points below stated about the NPS calculator.

- Get exact value of your Savings at the time of retirement

- Know exact figure value as per current date

- Get list of contribution during every month

- Know the interest rate applied to increase your value

You may check more details at npstrust.org.in/content/pension-calculator

Can I withdraw my National Pension System amount earlier?

The employees who enroll with the National Pension System scheme asked to withdraw the entire amount at the time of treatment. Under certain conditions, they can visit the NPS office or online website to apply for the NPS amount. NPS will allow only to withdraw 40 percent of the amount from their total amount as per the conditions applied.

Does the National Pension System interest change every year?

The interest applied on the National Pension System amount decided by Government of India. The interest rate will vary accordingly and may update in your National Pension System Account.

Does pension maturity change based on the Tier cities?

The National Pension System scheme is through the government of India and it is all similar all over the country. Thus to clear the misconception the pension scheme has a unique interest rate and calculation without any description about the tier 1 or tier 2 cities. Every employee can use the National Pension System calculator online which doesn’t have any entry or selection of tier cities.

Can I increase my share in the National Pension System?

The amount of contribution in National Pension System calculated based on the Basic salary. Thus the employee can increase their share in the National Pension System which should not exceed their basic salary amount and must be not less than the initial amount invested in NPS.

How will I get the National Pension System Amount after maturity?

The maturity amount after the retirement age may directly credited to the employee linked bank account. The amount credited within 90 days of the retreatment day. It is all by verifying the detailed documents provided. If the amount is high, NPS office will thoroughly check the documents before crediting the amount.