EPF Account portability now available with KYC linked UAN, Find the new process involved for transfer of EPF amount from one account to other online…

Employee Provident Fund Office has got some new links added to their portal, that allows the members to transfer their old EPF account to the new one in quick steps, and the entire process is going to be online and thus the individual will not have to struggle to get their EPF account merged in quick time.

This is going to save a lot of time and as well, will help you to attain an easy way to combine that allows you to collate your money at one password account with a UAN number.

The rule of One Member One EPF Account will be attained with the transfer process and will help you have a unique account with EPF for your entire working period. Having the same account of EPF will help the employee to get extra benefits and services offered by the Government of India for employees.

EPF Transfer Eligibility

There are some eligibility requirements that must be met with the individual, when they are trying to transfer their EPF account to another number.

- UAN activation must be completed on EPFO Portal

- The Employer must verify the employee bank details and IFSC code

- Aadhaar is mandatory to get the EPF Account transferred as EPFO KYC

- One Member can transfer one account ID as per the EPFO

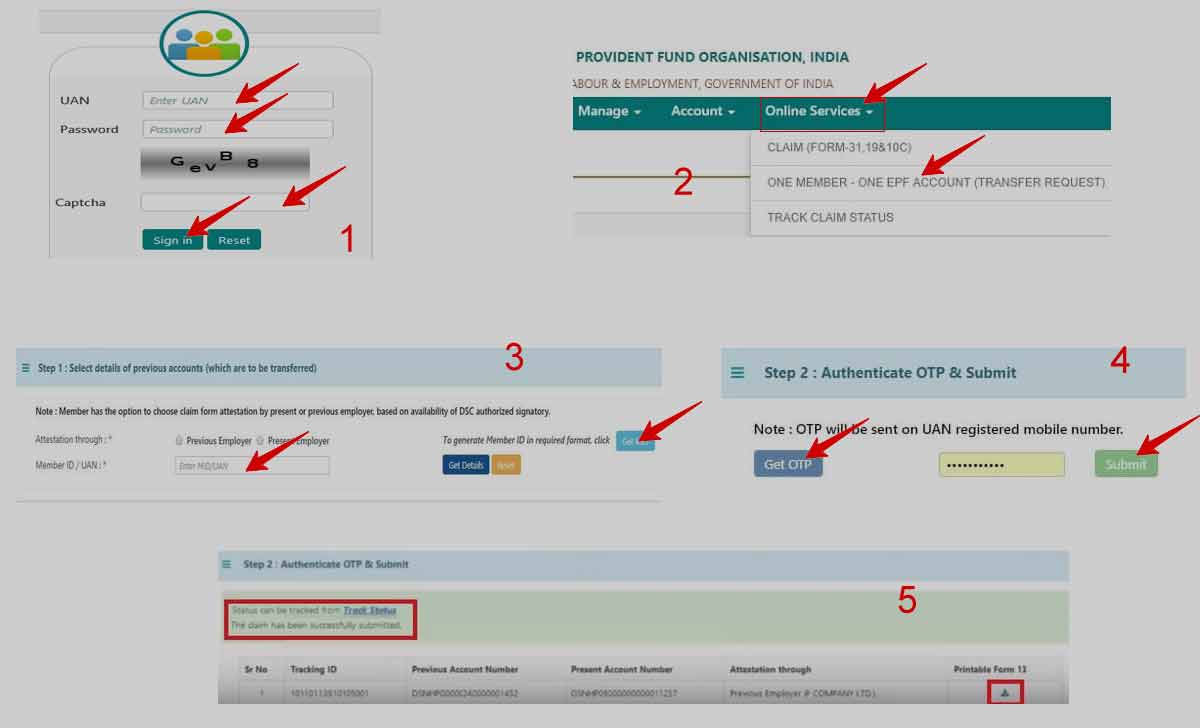

The process to get the EPF Account Transfer through one to another in quick steps is shown below, and the process is quite easier, and one needs to request for one member ID only.

EPF Account Transfer Process Online

- Visit the EPF Official website epfindia.gov.in

- Click on Services > Employees

- Go to Services > Click One Employee One EPF Account to open https://unifiedportal-mem.epfindia.gov.in/memberinterface/

- Enter your UAN number > Password > Captcha Code

- Click on Online Service > select the Transfer Request (One Member One EPF Account

- Select the Previous Employer > Enter UAN Number > Get Details

- Attestation of the previous employer must be attached for the transfer process

- Provide Your UAN number > Generate MID by selecting Get MID

- Click Receive OTP > Enter the OTP received for validation

- Click on Submit

- Note down the tracking ID generated and displayed, which will help you to check the updated status

- The request goes to the employer which needs to approve the request digitally

- That’s it, The EPF amount transfer request will be with the employer and once they have approved your transfer request will go to EPF Regional Office of the first, after their approval, all the amounts will be transferred to the new account as mentioned

EPFO Account Transfer Documents

There are some important documents that are required to be completed before transfer as EPFO KYC, even if you’re trying to get the EPF account transfer through online mode.

- EPF Transfer Form 13

- PAN Card, Aadhaar Card

- UAN number of both accounts

- Employer Details of Current company

- Establishment Number and Account Number

- Bank Details

- New PF and Old PF account details

Reason to Transfer EPF Account

There are multiple reasons for an employee to have an individual EPF account if they have not made it in a single setup, where the below-listed points will be applicable and will benefit an employee in every aspect.

- TDS will be charged for any account which has below 5 Years of term

- Combining the EPF account will make your account tax free if that make 5 years above period

- EPFO does give compound interest on savings, which two account collaboration make it a large amount

- Having an EPF account for 10 years will make you eligible to become a pensioner

- If EPF is closed every time they change jobs, benefits to then will be levied.

Is Aadhar Mandatory to Link with EPFO Account?

Yes, the Aadhaar does hold all your basic information and it has been made mandatory to be linked with the EPFO Account, and an individual must first get their Aadhaar Linked, and else their account will be kept on hold and will not be eligible for any services to choose.

Thank you for advise but here left one thing. That if a older pf holder have not uan no that how a pf holder apply for withdraw money. please mail me the way for withdraw money.

My mob no – 88953xxxxx.

Thank you.

Mera pf withdrawal keise kare

One employe one epf

Sir/Mam

How get my old UAN link with my mobile number and merse with my current UAN number