NPS subscribers will have the option to update their FATCA (Foreign Account Tax Compliance Act) details through the self-certification online with the initiative by National Securities Depository Limited.

Here is the steps which you can follow and get to process the self-certification. As per the guideline there are online and offline processes that may used by individuals as per their eligible conditions.

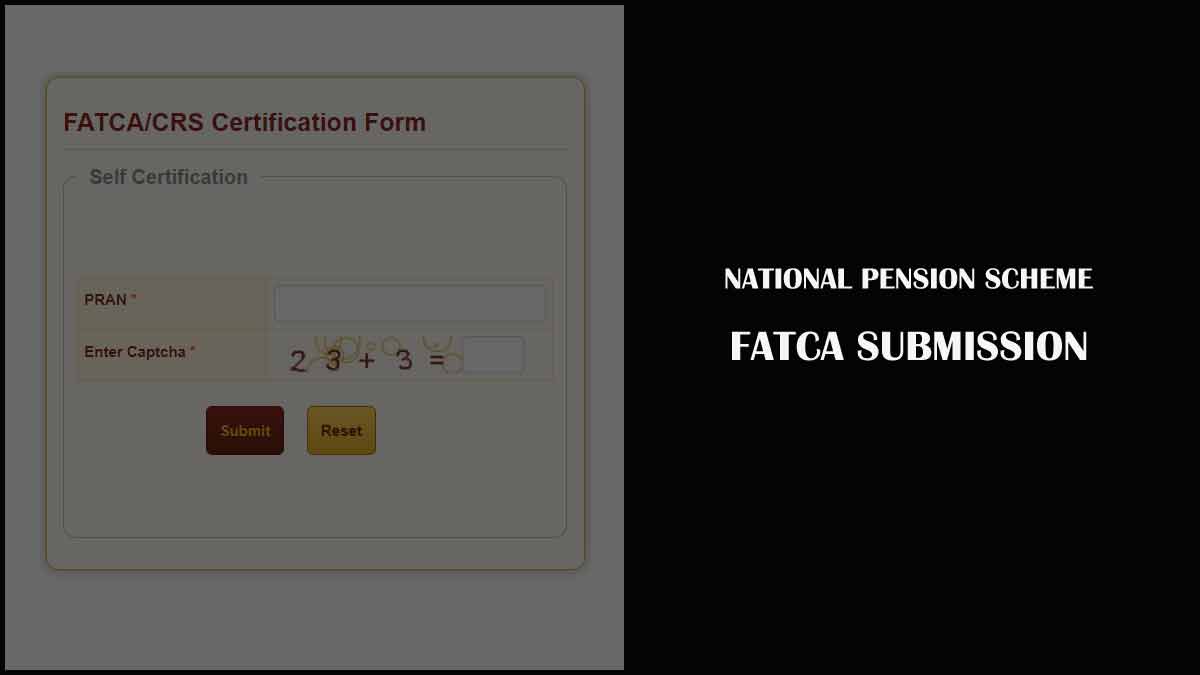

NPS FATCA Details Online Submission

- Go to the official website of National Pension Scheme using cra-nsdl.com

- Click on FATCA Self Certification form menu option provided

- Select Transaction and then Click on FATCA Declaration Form

- Fill the required details and then click on submit button

- Tick Declaration & authorization by all customers after reading it

- Click on Confirm button and then wait for OTP received

- Enter OTP received and then click on submit button

- That’s it, Once the authentication with one time password processed, NPS FATCA Self Certification may successful and the acknowledgment for completion of self-certification issued.

How to Fill NPS FATCA Self Declaration form Physically

Let us look at the details of FATCA declaration form which downloaded from the official website of NPS. Here is a clear description of information that required to submit in form.

Basic Information: Here an individual has to fill in their Name, PAN Card number and Date of Birth. These all are the basic information that are available in an NSDL account during registration.

Part 1: Here the details of Country of Birth, Citizenship, Residence, whether individuals has to submit the information require to fill.

Part 2: If the county mentioned is India, the individual can directly move to the next part and sign the NPS FATCA details form. If not India, the individual has to fill in a Tax Identification Number or any similar number issued by that country.

Part 3: Declaration Part has to fill by every individual and has to sign the declaration. It is confirmation as you agreed with the details provided and all information provided by you is correct.

Part 4: Self Certification: This part filled by individual who doesn’t not belong to India and Tax number not available. If an individual does not have a TIN number and does belong to US, has to fill the part. The details may fill and the respective identity proof has to submit which may issued by Government agency.

What happens if you don’t Self Certify FATCA?

If an individual opens their National Pension Scheme account after 01.07.2014, then as per the guidelines of NSDL, it requires to self-certify. Else the account blocked and the pension account may no more useful.

When to Submit NPS FATCA Self Certification?

Any individual who born outside India, and linked with India by parents or guardian require to submit FATCA declaration form. The physical form has to submit to the nodal officer or the RKA by the central government. In the case of the National Pension scheme, they can submit a declaration form physically.

How to Check FATCA Compliant Status?

Individuals who submit their FATCA self-certification by submitting the declaration form, they can check the status of their FATCA declaration. The complaint status checked by visiting NPS official website and using your PRAN number to check the complaint status.