Resident of Kolkata Muncipal Corporation can pay the annual tax in online through Kolkata Property Tax payment gateway with new discount offer, Check the simple steps allowed for Residential and commercial users…

The citizens of Kolkata levied with a property tax every year (4 quarters) on their properties located in Kolkata Municipal corporation area. The Property Tax for residential and Commercial properties calculated based on their location in the city.

The Property Tax always applicable based on the development of surroundings in Kolkata, as the amount taken as property Tax due from different areas utilized for their development.

Citizens of Kolkata City can use their Kolkata Municipal Corporation Official website to pay their Property Tax Bills. Here is a step wise process that will guide you to pay your Property Tax.

Kolkata Property Tax Online Payment

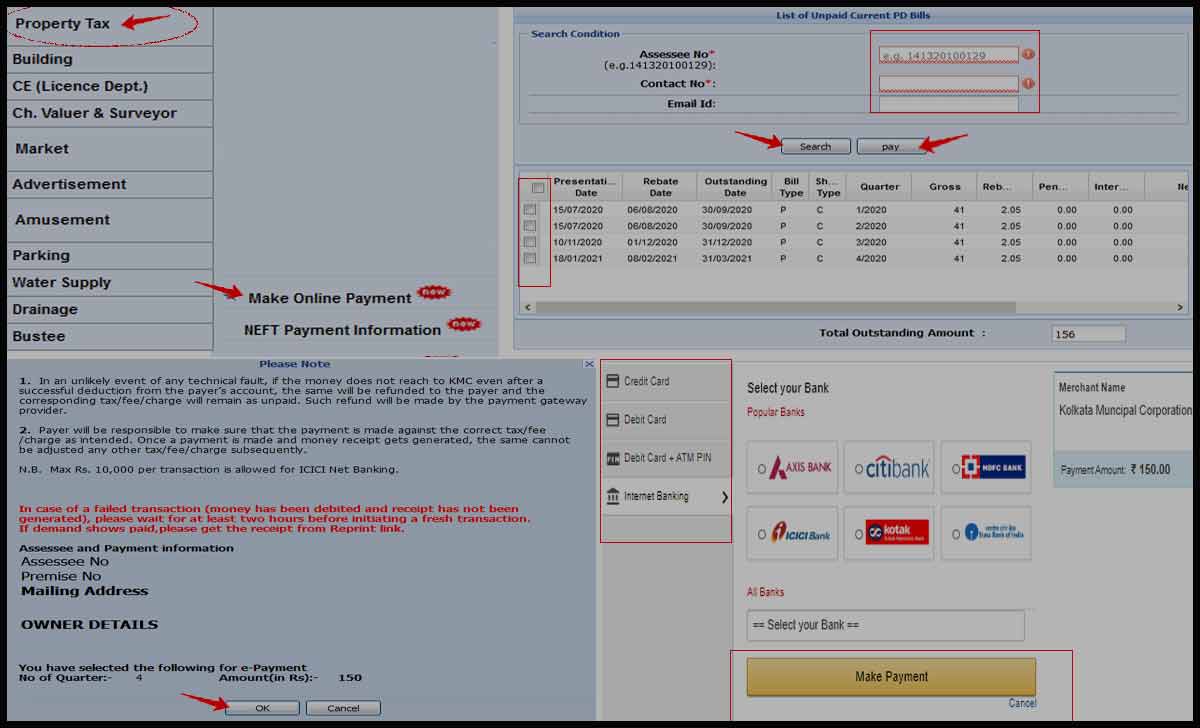

- Open kmcgov.in in your browser

- Hover to Make Online Payment > Property tax > Select Current PD

- A new page “List of Unpaid Current PD bills” loaded with giving you the option of Property Tax

- Enter your 12 digit Assessed Number > Contact number > Email ID

- Click on Search to first display your details on the screen

- Select the Presented Date of Due using radio Button to pay all the bills or Select a single column which you want to pay

- Click the Pay button to directly move to the payment gateway page

- Verify the Details on new Pop Up > Click OK to proceed to make payment

- Select your Payment gateway (Credit Card, Debit Card, Internet Banking) > Click on Make Payment to complete your online payment

- Once the payment done, a Receipt number generated for your successful payment confirmation. This is an official proof of your Kolkata Property Tax payment confirmation.

What is the last date for KMC Property tax payment?

The KMC portal every year provides a final date for their citizens to pay property tax. For the financial year 2020-21 or any other, the last month would be April.

Can we get a discount in Property Tax Payment?

Yes, the municipal corporation does give a benefit for 5% to every owner, and this offer is only applicable for the owners who have paid their commercial or residential property tax before the due day with the full amount for a complete year (four quarters) in advance.

Who decides the Rate of Interest for KMC Property Tax?

The Tax rate of Kolkata for residential and commercial properties decided by the Municipal Commissioner. This is based on development works done in the area along with future projects to lay. By every aspect of Annual Rateable Value, the KMC Property Tax imposed with a different interest rate.

Can we exclude from paying the Property Tax?

No, every owner of Kolkata Municipal corporation does need to make the payment for the property tax, and delay in the payment will lead to imposing interest on their whole amount and further will be strict actions from the municipal officers.

can’t download property tax payment receipt

Please arrange for e receipt of payments for property taxes paid on 01-05-2023 through online payments. At that time, I couldn’t received any receipt from your end. Thanking you,

Properly Tax paid on 05/05/2023 but couldn’t download e-receipt. Please arrange to send e-receipt at the earliest.