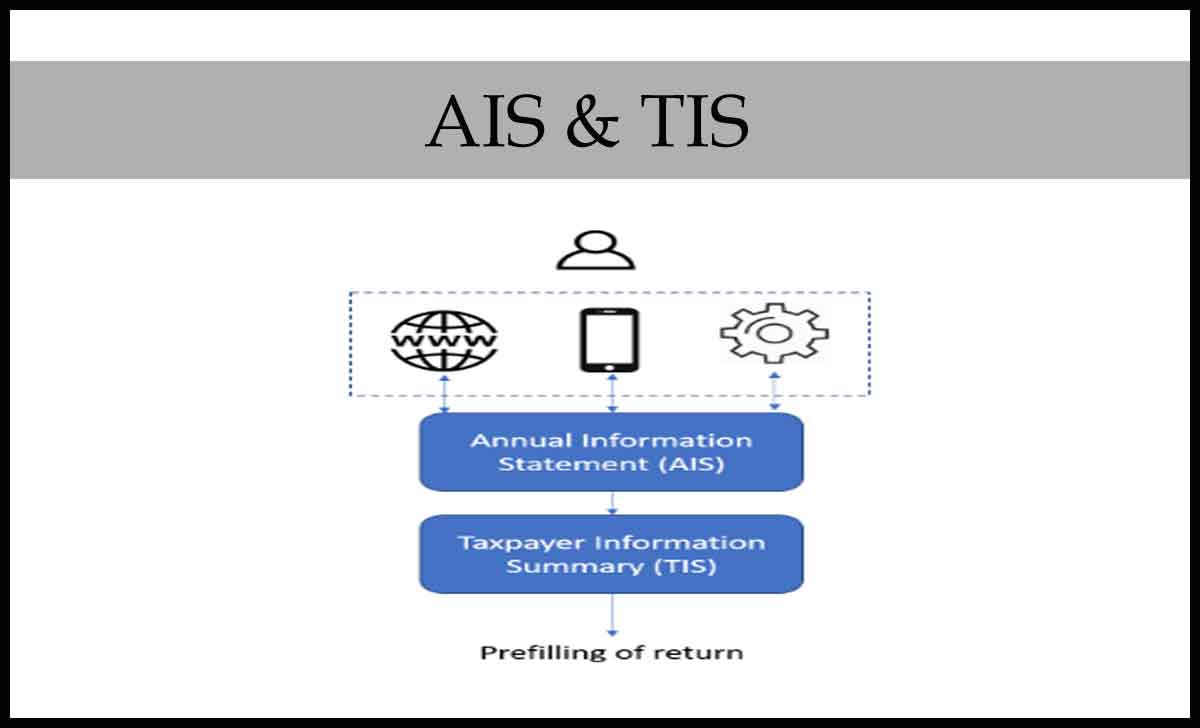

Tax payers can download Income Tax AIS (Annual Information Statement) or TaxPayer Information Summary(TIS) online…

Income Tax Department has announced roll-out of a new statement – AIS (Annual Information Statement) with detailed information and TaxPayer Information Summary(TIS) options. This will give you all details (well almost all) about your financial transactions during the previous financial year and present Assessment year. But this information is purely available on Income Tax Login account only.

What is AIS (Annual Information Statement)

In one sentence we can say that, AIS is a comprehensive statement of information for a tax payer with reported and modified value under each section.

You know earlier Income Tax used to give statement 26AS, but AIS is a much detailed one – with many more details included as follows during the financial transactions of the previous year.

- Stocks

- Insurance

- Credit Cards

- Purchase of property

- Mutual Funds transactions

- Salary or Business income

- Dividends

- Interest on SB A/c and Deposits.

The above list is just indicative. It is your overall financial profile and will get fine tune to include more categories.

What is TIS (Taxpayer Information Summary)

Taxpayer Information Summary (TIS) is a category showing a summary of all transaction during the financial year. The statement shows processed value under each information category (e.g. Salaries, Stock Market, Interest, Dividend etc.). TIS information allows to download Taxpayer Information Summary in PDF/ JSON format

How to Download Income Tax AIS (Annual Information Statement)

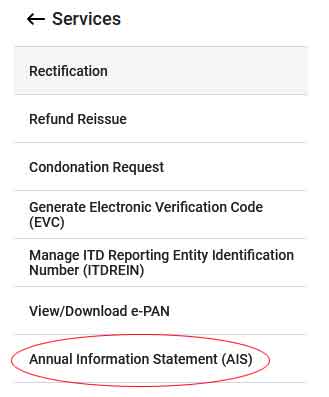

Income Tax payer now allow to download their Annual Information Statement of previous financial year at any time online with Income eportal login, Find the process as below

- Open Income India eportal at eportal.incometax.gov.in and login to your account

- Go to Services and Annual Information Statement (AIS)

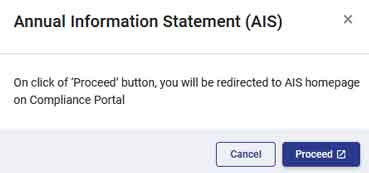

- Allow Pop Up if asked

- Click on AIS and find TIS and AIS

- Click Download in Pdf format which is password protected

- Open TIS or AIS with password and the password is ur PAN Number (in CAPITAL) + Date of Birth (DDMMYYYY)

What is TIS and AIS

Both are the same. TIS is a summary and AIS is the detailed statement. You can download both. When you download you get a pdf statement (There is jpeg option also, but let’s stick to PDF now).

Will 26AS be stopped?

Now you can get both 26AS and also AIS. Both put together, Income Tax department knows all your financial transactions, And it’s good as now you will find it very easy to know and submit details for your Income Tax returns.

What we can do if AIS information of Income Tax shows incorrect?

If the taxpayer finds any information shows incorrect, then he/she must submit online feedback form with the details, which may shown separately in AIS after feedback. If denied the authority will contact for confirmation.

What to do if the information shown differently in AIS and filed returns?

Tax Payer must have to submit revised return to reflect the correct information on modification.