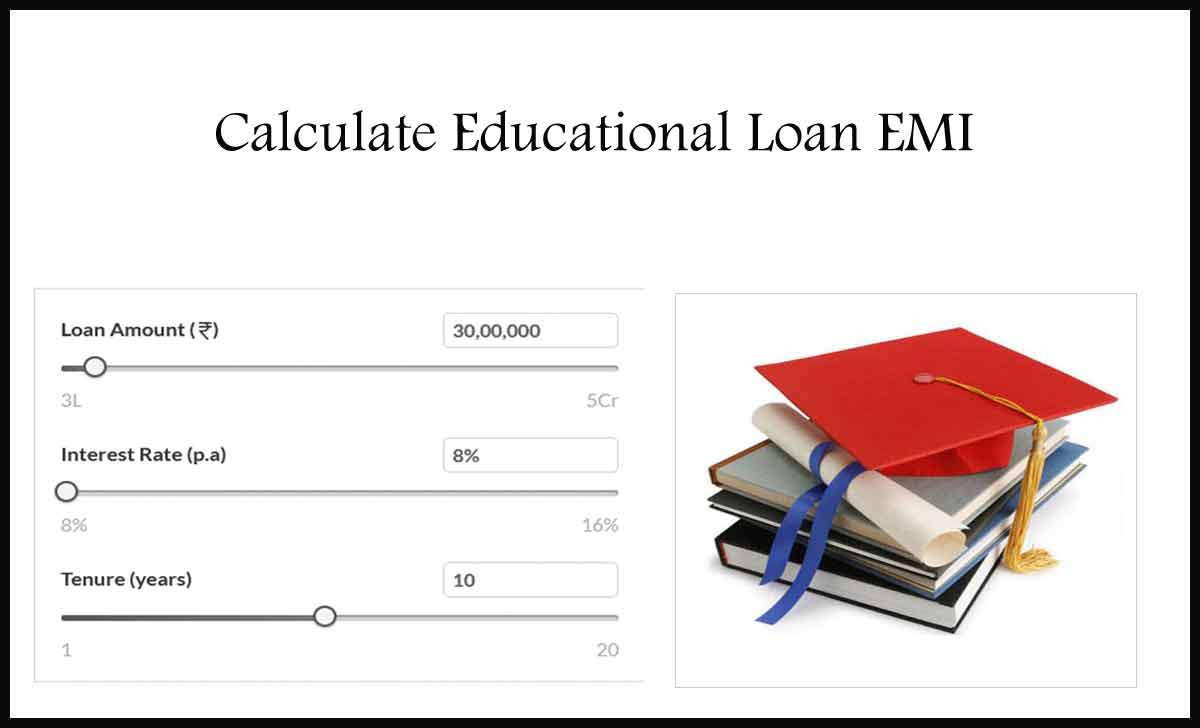

Enter principal amount in Education loan calculator to check repayment amount with interest, Decide payment pattern as per Education loan EMI calculator to increase repayment if affordable later…

Education is the most important criterion of parents in modern days, and as every parent wants their children to study and reach out to high points in their life, and in such conditions, there are many situations where education institutes ask for high prices as per the education and parents seek the best choice of Education Loan for the future.

There are banks and financial institutes that provide education loans to students based on their education marks and by considering the value of money they want, which you want to check the repayment in earlier with Education loan EMI calculator.

Having a child studying in a good institute will get you an offer for a loan that is being asked for their graduation or post-graduation or even for higher studies in other countries, So here we provide an EMI calculator info to check the exact monthly installment for your education loan.

What is Education Loan

An education loan is a kind of loan that is offered for only educational purposes for students of any age, and there are certain conditions that must be agreed upon, based on which the Education Loan will be approved and will help you pursue the education.

The best part of the Education Loan is you should not pay the EMI now, as it is asked to check the repayment amount in the Education loan EMI calculator for monthly fixed EMI which you have to pay once you pass your graduation or said education.

Banks do provide a flexible plan, as they seek to wait for education to get completed and once a statute is on getting a job, they can move forward to get the loan repaid.

Points to Remember in Education Loan

If you’re going to avail of an Education Loan, then there are some important points that you must remember, as this is one such loan whose repayment time will be after a good period but the rate of interest and its amount to be repaid will be higher.

Processing Fee: The processing fee will be higher in private banks and will be obviously lower in nationalized banks, and thus it is quite necessary to connect with nationalized banks for your loan as their processing fee will also be lower.

Prepayment Process: Prepayment of the Education Loan is a must be considered, as however your loan EMI will start once your education has been completed, and in this way, you can opt to repay a marginal amount of loan before EMI starts or even you can try to repay the principal before your actual EMI starts, and these will ensure you have a lesser interest amount for repayment.

Benefits of Education Loan

Education Loan as said is best for any students who want to study more and won’t get stuck due to financial issues, and thus here are some benefits that one will get through the Education Loan.

- Get your desired education completed as per your plan

- No waiting for managing financial issue, as banks pays for our education

- No repayment of loan during studies, just repay once you have completed said education

- Get it approved in quick, just by providing your good score results in studies

- Marginal rate of interest with deliberately comforting plans for education

- Abroad study loan which cover your studies in abroad along with your expenditure

Education Loan EMI Formula

The Education Loan EMI calculation formula is detailed here, where you need to provide the said nuts in the formula and then know how much you need to repay once your education period has bent one.

E = P x r x (1+r)n / (1+r) n-1

Here He is the EMI to be repaid once education time is completed

- P is the amount that is given toward your education loan

- N is the number of months

- R is the rate of interest applied in our Education Loan

What does affect Education Loan EMI

The factors such as tenure and interest rate as discussed below will do affect your Education Loan EMI.

Tenure: As usual the Education Loan EMI will have a longer period and it obviously makes you pay the fixed EMI for the entire period, and if you do prefer a lower tenure then you will, however, have an Education Loan EMI lower.

Interest Rate: The interest rate depends on the bank you selected higher the interest rate the Education Loan repayment EMI will be higher. Thus checking the good interest rate will be similar which will not let your interest rate go high.

Prepayment: It is good if you try to repay the margin of the principal before your Education Loan EMI has been started, and these will automatically decrease your tenure however your EMI will be fixed which was selected during the sanction of Education Loan.

Higher EMI: If you have fixed an EMI and then you can even pay an extra amount whenever your tenure has come, and these will get added to your principal amount and will decrease your tenure in months which will be always a good benefit.

Purpose of Education Loan EMI Calculator

The calculator for Education Loan is used to know how much amount will be deducted monthly once you have taken a loan, and in these managers, you need to have the details of your loan taken along with the interest rate applied by the bank and the tenure selected.

Based on these you will get an Education Loan EMI and thus it will help you know if you’re confident enough to pay these amounts.

As well you can get a look at the EMI amount and anytime you can try changing the bank for lower EMI or changing the loan amount as per your future convenience.

Does the Education Loan EMI look for a Student Grade?

Yes, the Education Loan provided by the bank will firmly check the Grade of students from their start of studies, and they need to have a good grade with having passed every examination, and only with a good track in education, the Education Loan Will be processed for sanitation and then the EMI option will come.

Can I cancel the Education Loan in Between?

As per the bank regulation, if the Bank agrees you can repay the full principal amount by paying the service charges. There are multiple options that need to be checked before you get for repaying your loans.