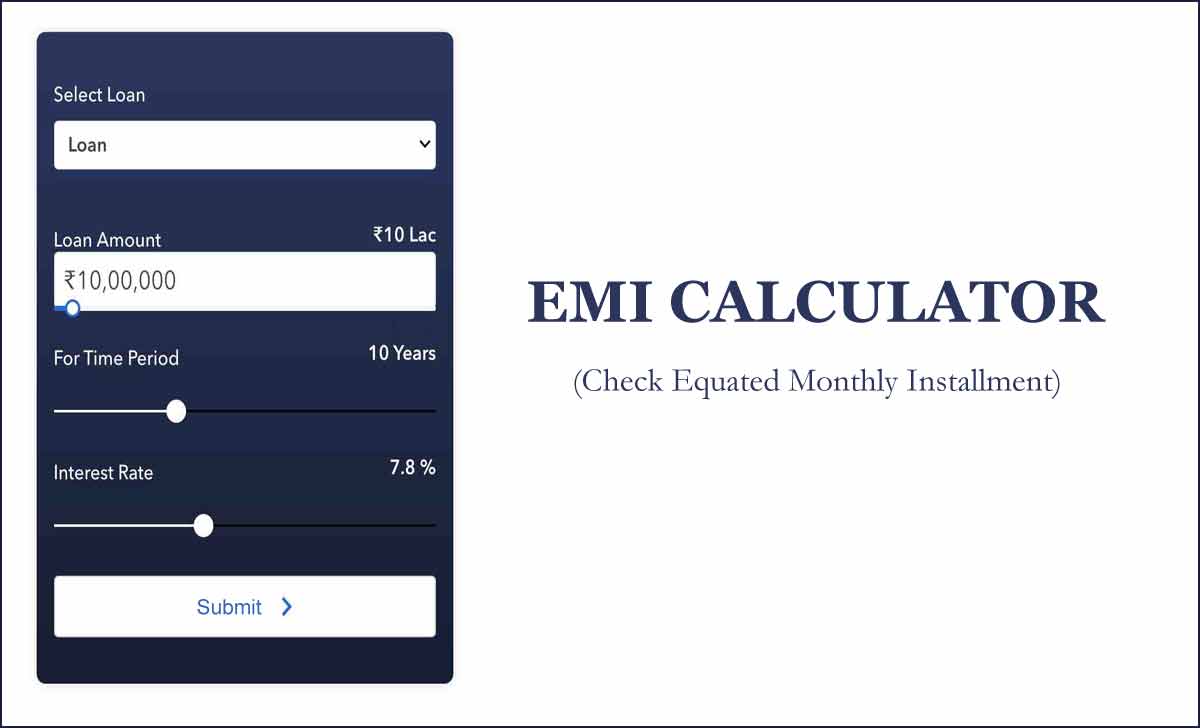

Calculate your loan interest and monthly installment on the new EMI calculator and get accurate results online as per your applicable rate of interest to decide to opt for an affordable loan…

In present-day life, the banking sector plays a major role, as they provide support to every individual during their nearby times, and every bank or financial institute is entitled to provide a Loan which might be for a car, home, education, or person with a defined rate of interest.

Thus EMI Calculator is derived to let an individual know on a specific principal loan amount how much interest is being applied and how much will be the amount paid towards interest.

Thus the exact EMI value will be shown using these EMI Calculators, which will help an individual or firm to decide if it is all fine or they can wait for any other better opportunity.

What is EMI

EMI is celebrated as an equated monthly installment which is an amount that is payable towards a loan taken from any bank or financial institute, and this is a monthly payment that needs to be paid by the individual until their respective loan has been covered.

This amount is a combination of your principal amount along with the respective interest if applied by the bank. The entire tenure of the loan will be shown to the respective individual at the time of loan taking so that it would be clear to them about how many months they should repay their loan.

In the EMI concept, the amount of interest will be higher in earlier stages and will have a very small portion of the principal amount, and as the bank provides a large loan at your emergency time and in a quick span, the interest will be first major collected and then EMI amount will have a varying principal along with the interest amount.

The monthly EMI will fix in your tenure, only your respective structure will change which is all about to check by the banks.

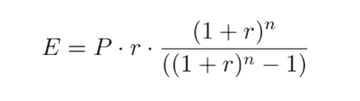

EMI Formula

The formula to calculate the EMI is the same for every category which might be Home Loan, Personal Loan, or Car Loan. Use the formulae provided here and calculate your EMI for your reps via loan and verify the same from the bank-provided amount.

Below is description of Parameters

- E = Referred to as Equated Monthly Instalment

- P = Principal Loan Amount

- R = Rate of interest to calcualte on monthly basis

- N = Loan Term in number of months

How to Use EMI Calculator

EMI Calculator can be used in an easier way if you’re aware of its important components. Get to know the below-listed details and you will get your EMI Calculated with exact results on the Home Loan calculator for home loan and other for Car Loan, Education Loan, or Personal Loan instantly.

- Principal Loan Amount sanctioned

- Rate of Interest per month or year

- Loan Term in Year or Months

Once you have these three values you can use any of the EMI Calculators available online or use the above formulae to calculate your EMI amount. It is to be checked that you use either month or years in values not both in combination and in these, you can also calculate the same principal amount that is paid or the rate of interest amount that is paid using your derived EMI Amount.

Floating EMI Calculator

99employee.com will provide some of the basic information of these, so please check. In many loans, which is provided by the financial institutes, the EMI’s rate of interest will be floating only. This EMI calculation may done by using two different scenarios to get the exact value. The two scenarios defines as deflationary scenarios and inflationary scenarios. All this which makes you clear if the rate of interest changes timely.

The loan amount and Loan tenure are two different opposite components that have to use to calculate the EMI. It is as if the loan is to have a floating rate of interest. Once these two values serve one must use two different rates of interest and calculate the EMI. This way they will get a rough figure of how much has to pay monthly.

Inflationary Scenario: in these scenarios, if you assume that you have a rate of interest increase from 1 percent to 3, it is not possible to continue to pay the same EMI with an increase of 2 percent in the rate of interest, and this will make an increase in your monthly EMI amount, and so, having such caution will let you be aware of future changes in your EMI amount if the loan taken is in the floating rate of interest.

Deflationary Scenario: In a case, if the rate of interest decreased from 3 to 1 percent, and this is not possible to pay red use EMI. As it is already set when you ask for your loan with the respective bank.

In these cases, the bank automatically increases your loan tenure, but EMI amount will stay the same until the total amount taken back.

What is zero percent interest on EMI calculation?

There are some private banking institutes that provide zero percent interest on the purchase of goods or even on taking personal loans within the agreed time limit. Any of such loans will loan required to pay the principal loan amount which is the product price and they should not pay any interest for their entire EMI tenure.

Can I change the EMI Value in the Bank after taking Loan?

The EMI Calculator does give a fixed amount which will be based on your tenure of loan taken. Thus the amount cannot be decreased but it can be instead increased which will be added to your principal amount at every year’s revision of loans. The extra added monthly basis in the loan will be added to the principal at the end of the financial year and will interim reduce your tenure period.

Does EMI Calculator have changes in calculation?

Every EMI Calculator that is found online is all the same, as they combine to calculate the amount, and based on your different rate of interest the type of loan does change. Thus individuals must be aware of how much loan they are being given for loan and make sure it is in proper slab without giving you an excess value.