Pay your house tax bill online with AP property tax online payment gateway and get discount if any applicable for house tax details in AP residential & commercial property located in the state…

Andhra Pradesh State Government collects Property Tax from citizens every 6months or Yearly from their citizens owning property (Land, House or any such equivalent), and the AP property tax payment fee is calculated based on Annual Rental Value and Tax Rate fixed by the corporation of property.

The percentage of the house tax details in AP will change based on the location of urban bodies which will be calculated to measure the area of land or property, and thus a clear calculation of Property Tax for that month can be found on the official website or from the receipt received while payment.

AP Property Tax Online Payment

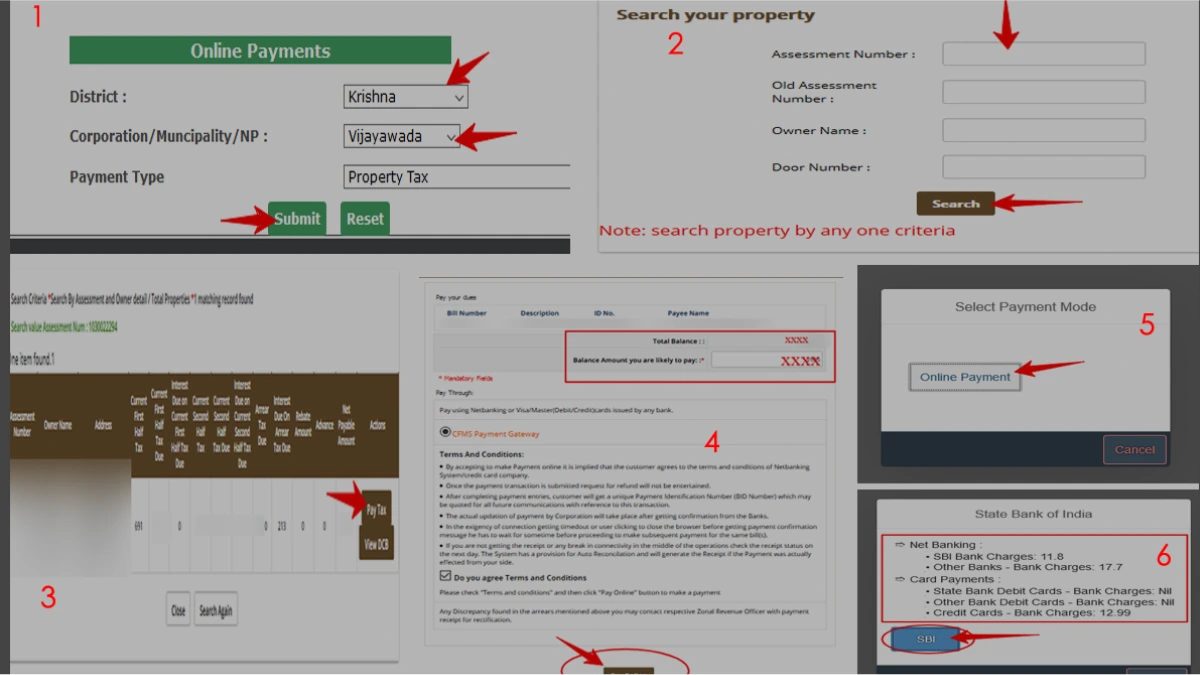

The below is the step by step online new process for AP property tax online payment through a web portal, so without wasting time let’s watch the house tax details in AP and bill payment process

- Open cdma.ap.gov.in web portal on your browser

- Hover to Online Payments

- Click on Property Tax

- Drill down and Select District, Corporation / Muncipality / Np and Payment Type

- Click Submit

- Enter your 10 digit Assessment Number and Click Search

- Click on Pay Tax at right side

- Enter the amount to pay in the column provided (Balance amount you are likely to pay)

- Select CFMS Payment Gateway

- Scroll down and Accept the Terms Conditions

- Click Pay Online

- Click Online Payment

- Find the Charges for various modes (Net Banking, Debit / Credit Card)

- Click SBI

- Select your payment source from different options and complete your payment with your secured credentials.

The same AP property tax online payment process is applicable for all corporations and municipality like Tanuku, Nellore, Tirupati and other along with village panchayat house tax in AP state.

The property tax bill is different for Agriculture or Industrial tax mentioned, and there are multiple online payment platforms launched to pay Andhra Pradesh property tax department to clear current dues, Let’s check as below

| Si.No | Payment Platform |

|---|---|

| 1 | cdma.ap.gov.in |

| 2 | UB Counter |

| 3 | Meeseva Counter |

| 4 | AP Online |

| 5 | Puraseva App |

How to change my Name in House Tax details in AP Property Bill online?

If you found to change your name based on the current generated Property Tax payment slip, then you need to visit the nearest municipal / corporation office with your receipt, Sale deed having correct name on property, No Objection Certificate and an Application form, and this will be taken by the department through AP Online and will be proceeded in 15 working days.

Is AP Village Panchayat house tax online payment process is same or different

AP Panchayat house tax online payment process is same as mentioned above through the portal cdma.ap.gov.in as per the charges applicable for Village Panchayat of the state.

Does AP House Tax Collected on Empty Land?

Yes, as per the rules and regulation if any land is owned by anyone without being under the agriculture category in Andhra Pradesh, the property tax will be calculated with less percent value and one can get detailed information from their local municipality with the current AP Property Tax payment and a receipt may issued for successful payment.

What is the last date to pay property tax in AP?

In Andhra Pradesh, property tax payments are typically due on a half-yearly basis. The two payment cycles usually end on April 30 (for the first half-year) and October 31 (for the second half-year). However, these deadlines may vary slightly depending on municipal guidelines or extensions announced by local authorities to avoid penalties for late payment on AP property tax.

how to get online property tax payment receipt

how to get online property tax paid receipt

I have paid property tax amount has been deducted but it reflecting the pending in portal even after 2days

I have paid property tax online payment through State Bank of India dt.APRIL 5th,2021. @ Rs 4733/- is deducted from the account. But, the payment receipt was not generated from the online payment. Hence, I request you to send me the above-said pay receipt to the above email.

Thank you

Did your problem got solved, if so how?

Because I am facing the same kind of issue today?

I have today paid my house Property tax (Andhra Pradesh) through SBI Debit card, an amount of Rs.1,514/- online through CDMA A P portal, My account with bank was debited but receipt was not generated. In the website, it is showing as the amount is due for payment. The amount paid by me was not updated. Pl checkup at your end request you to resolve the issue.

I have paid the property tax of my house in Guntakal municipality, Anantapur district for my house assessment no. 1003020738 through SBI debit card on 8/4/2021 and received a message from SBI giving details of the payment that payment tx# 109823083180 for Rs2957.60 by SBIDrCARD X9579 at UTIS2I05 on 08Apr21 at 19:15:50. But receipt was not generated. Again I made the payment through some other account by net banking and cleared the payment. Kindly check up as I have made two parents one through debit card and the other through net banking. The extra amount paid may kindly be credited back to my account. A line in reply will be much appreciated.

Did your problem got solved, if so how because today I faced the same problem

I have paid property tax of 585 through payumoney on 1st March 2021. Receipt was not generated and still showing in dues. Whom we need to contact

I have been trying to pay property tax and water bill on line for the last 2 weeks. Until pay on line it goea smoothly. when it comes to actual paying it gives 2 options. Payu and sbi. i agreed all terms . After that it says “RFC error” . I am an NRI .I need help with this

Sir, I am also facing same problem with Tanuku municipal property tax payment online since years . I am also a NRI property holder at Tanuku.noresponse eventhough ihave given mails to cdma Director and cmo also. I suspect some deficiencies in technical services of online, Which they cannot disclose But the tax payer penalized , for not paying in time. God only knows inthis digitalised world we are not able to pay tax online, surprised. We have to pay personally only by requesting some relatives at local only, which they are telling indirectly. Thankyou Bestwishes

how to pay Village house tax online (A.P. rural)

I paid Rs. 2552 towards house tax online using SBI net banking. Bank generated Payment References are 50053821112021I & GALNYMRZ4. My property ID no is 1021019654. Amount is debited to my bank account but no receipt is generated. My tax account is still showing I owe money.

Please verify and correct. Thanks.

Hi Raghu,

For me also got the same issue, Could you please tell me how you rectify this issue

Hi please enquire about it at your nearer ward sachivalayam with the payment details

Paid property tax but not get the tax receipt

how to pay house ?️ tax

Have paid AP property tax ( 3 BR property at Tirupati, Chittoor district) twice online but receipt not generated. Money deducted from bank.

To

Greater Visakhapatnam Muncipal Corporation

Dear Sir,

I have paid property tax amounting to Rs.3785-00 on line on 22-4-2022 against my Assessment No.1086xxx28. But Tax Receipt is not generated till now. The GVMC web page is showing tax dues as Rs.3785-00. My payment was NOT UPDATED. Please send me the receipt to my email address : rrjayanthi1962 @ gmail.com.

Regards,

Raja Rajeswari Jayanthi

My payment has been debited but transaction has been failed, how i will get my money back, What should I do know?