GSTIN Integration with ICEGATE | How to Link GST with ICEGATE Online | Why to link GSTIN with ICEGATE…

If you are a business owner or a transport owner then you might be using ICEGATE regularly and this is because this platform is an online portal for custom clearance.

The Government Department for customs clearance of Goods has initiated this portal through which you can pay your goods bills online for clearance from the customs office. In this way you can get the bill and pay it online as well which makes the offline process obsolete.

All small, medium or large businesses along with transport business have GST now and it has now become a mandatory process to link your GST with ICEGate because it will account all the costs from customs payment and add to your GST payments directly.

| Service | Integrate GSTIN with ICEGATE |

| Available through | Online Mode |

| Who can Integrate | Existing users of ICEGATE ID |

| Why to integrate | To reflect all payments under GST |

Through this you will be enabled to keep track of all custom payments online and are directly linked to GST. If you have not yet linked your GST, then you can follow this article that will help explain you about the process and steps to complete it.

Why to Link GST with ICEGate

If you would want to know why it is so important to link your GST number with your ICEGate account. Then it is because all the payments made will reflect in your GST account and in case if there are any return over the finances they would reflect in your account and you can use this while applying for your Income tax returns.

On the other hand, some of the changes that would take place is you will get a unique number for filing SB and BE along with IGSTIN to be provided.

How to link GST with ICEGate

You can easily complete your linking of GST with ICEGate directly from online only by following the instructions mentioned below.

- First open the ICEGate official website from here icegate.gov.in

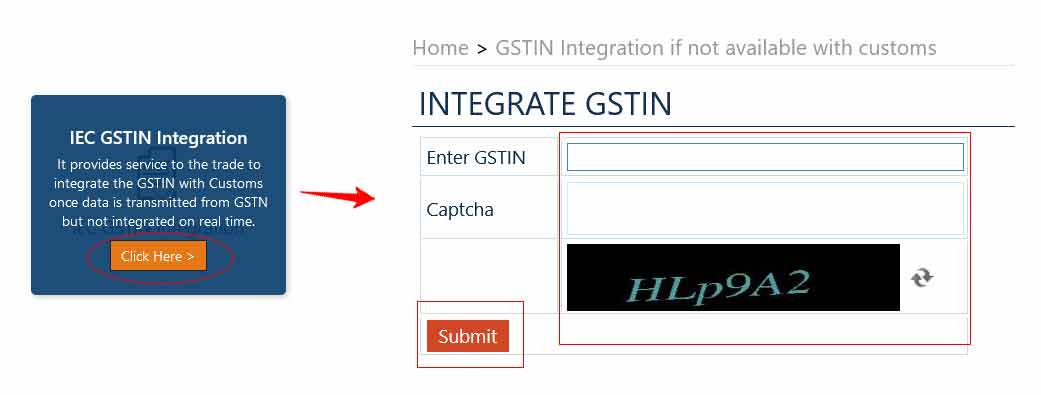

- Scroll below where you can find ICE GSTIN Integration and click on it

- Enter your GSTIN number the ICEGate GSTIN Integration page icegate.gov.in/UserReg/integrateGSTIN,

- Provide captcha code, then click on submit button

- Enter ICEGate ID

- Receive an OTP on your registered mobile number

- Enter the OTP

- Click Submit, and you will now have linked GST with ICEGate

How to get ICEGate username and password?

For a new user you can go to this link icegate.gov.in/UserReg/userAction? and then enter your ICEGate ID and email ID, then click on check availability option to see if the ID is available. Then simply register with the id and you can set your password next.

How to make ICEGate payment?

ICEGate portal allows you to make customs payment using their online e-payment portal from this link epayment.icegate.gov.in/epayment/locationAction.action. Here you have to provide your ICE details to make your payment.

What is ICEGate helpdesk email?

If you need help from ICEGate then you can always reach out to their ICEGate helpdesk from icegate.gov.in/help.html. They will be available to help you from 10 AM IST to 6 PM IST.

What are the documents required for ICEGate registration?

If you want to complete your ICEGate complete registration from start to integration. You will require your GSTIN number, PAN number, Aadhaar card and mobile number.

What to do if forgotten ICEGate ID?

If you have forgotten your ICEGate ID then you will have to reach out to ICEGate helpdesk to help you find your ID. Through this portal only you can only try to retrieve forgotten password.