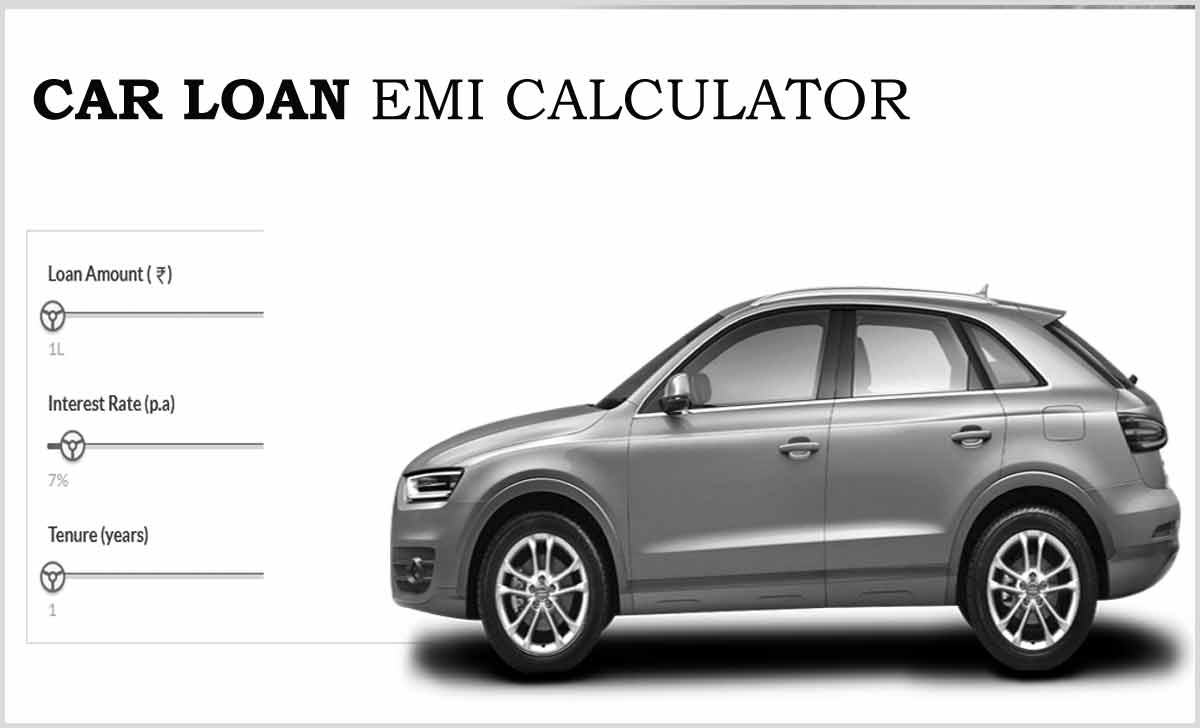

Car Loan calculator is the best option to check and decide the installment you to plan earlier before going loan. Car Loan EMI calculator gives you, what’s the interest you have to pay for entire period of loan…

In recent days having an Car Loan on your name is much easier. If you have got a good eligible credit score. Banks and Financial institutions have made it easier to get a loan based on your financial transactions.

There are numerous banking services that provide your Car Loan. But before going to avail them you must be aware of the EMI options. Individuals can get the Car Loan EMI calculator, to get the exact amount that needs to pay to the banks.

An EMI Calculator for Car Loan calculates based on your principal amount given to you as loan along with an interest amount calculates based on new rate of interest.

Car Loan Calculator

As per the latest update of Banks, an average of 10% rate of interest applies on the Car Loan amount. Thus individuals need to confirm the rate of interest from Banks before going to get the EMI amount.

Apart from this, at the time of disbursement, a minimum amount as service charge and GST percentage on your total loan amount may apply. Thus principal amount may deposit by deducting the processing fees Service charge and GST charge as per their respective percentage.

If you choose less tenure for Car Loan repayment, then you will surely have a benefit of paying less interest. Thus it is necessary to calculate the best way to find the EMI amount along with the fixed rate of interest to manage your repayment.

There is a proper bank transaction is required based on which the bank will decide as a Car Loan amount. As well if you have a good bank history, they do provide a low rate of interest which in turn gives you a low EMI amount and as well you get to pay less interest amount.

How to Calculate Car Loan EMI

The equated Monthly Investment of your Car Loan may calculates by using the formula shown below. Do fill in your details as required and get your Car Loan EMI.

E = P x R x (1+R)^n / {(1+R)^n – 1}

- E stands as Equated Monthly Investment that has to pay every month

- P stands as the principal amount given to your loan

- R stands as the rate of interest fixed during your loan disbursement

- N stands for tenure in months which is the total number of months to repay

Fixed Rate and Floating Rate of Interest in Car Loan

Banks do provide the Car Loan at two different rates of interest which are fixed and floating. Thus you must be aware of fixed-rate and floating rate of interest when going to avail your Car Loan.

Fixed Rate of Interest in Car Loan: If you have got a Car Loan with a fixed rate of interest, then your EMI value also same till your loan tenure completes. There will not be any change in the EMI amount at any cause.

Floating rate of interest in Car Loan: If a Car Loan is provided with floating rate of interest then the EMI which has to pay to bank will change due to change in the rate of interest. If increases the Car Loan EMI does increase and as well it will go down if your rate of interest also comes down.

Advantages of Car Loan EMI Calculator

There are numerous benefits of having an Car Loan EMI calculator. Here are some which you can view and get to know how an EMI calculator can help in Car Loan.

- EMI calculator for Car Loan helps you determine the exact processing fee and interest paid against the principal amount taken

- Let you know the EMI amount, which will allow you manage your budget as car Emi is always light high

- Using an Car Loan EMI calculator, you get accurate value of your loan.

- You can know how much down payment has to pay.

- May compare with different rate of interest provided by different banks and decide which is best for your Car Loan

You may check the exact calculation data at this leading bank page

What is a Car Loan Repayment Table?

The EMI amount of Car Loan is divided into two different parts which is a principal amount and the next is interest amount. As the banks apply a fixed interest on your Car Loan taken. At the initial stage of Car Loan EMI payment, the maximum interest is taken at an early stage and a lesser principal amount. Using these table, one can know how much amount is being and how much exact principal amount is left.

Who can get Car Loan?

There are some fixed bands by Banks and one who falls under these categories can avail the Car Loan. Individuals who are self-employed, salaried, partnership or having fixed income can avail the Car Loan. A loan provides to an individual or firm based on your financial transaction and proper bank statement, which brings a trust that banks can get the EMI amount monthly.

How can a Car Loan EMI be repaid to the Bank?

There are few connection methods which will let the individual banks account to link with their respective Car Loan account. Thus using the post-date cheques, ECS mandate or standing instruction and Bank account may link with a Car Loan account. Thus at the exact date of EMI the amount may deducts from the bank account.

Do banks throw penalties for late Car Loan EMI payment?

Every bank has a fixed date for payment of Car Loan EMI amount against the loan amount taken. Thus if these dates missed, a bonus charge may apply and adds to your EMI amount. It is by continuing the missing of EMI date that will bring your name in blacklist that does reduce your cibil score. As well if the payment is delayed for more than 3 to 6 months, the car taken by Car Loan will be retrieved by Banks.