Calculate your home loan or personal loan on SBI EMI Calculator to check equated monthly installment over the financial transactions…

State Bank of India is the largest bank in India spreads across all states. The bank does provide various loans to the customer as per their need and through having a good check through over their financial transaction.

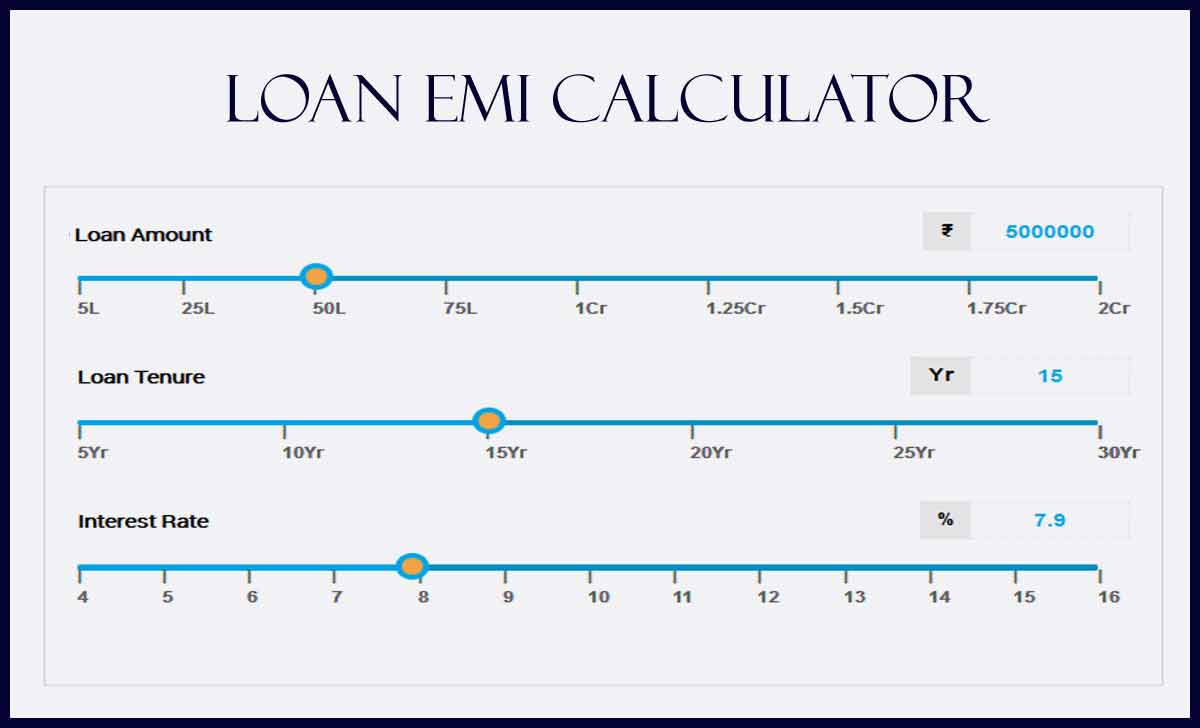

An SBI EMI calculator may use while you’re going to check the monthly amount that has to pay for any kind of loan that you’re going to avail from the bank. It is quite necessary to check your eligibility before going to avail a home loan or personal. After that, it is easy to check your affordability in EMI Calculator, which you can assure of paying installment.

A loan same time becomes important. As it fulfills an individual’s short time goals by giving them enough time to get that back to the bank.

Kinds of SBI EMI Calculator

State Bank of India being a national bank does also have its branches in the other countries. There are different loans provided by SBI which has to avail by customers who have accounts as Salaried, Individual or Business.

SBI Personal Loan EMI Calculator: This calculator may use when you’re trying to check your EMI for a personal loan. The interest rate and the tenure of the loan will determine the EMI which must pay for the principal amount taken.

Business Loan: If you’re an individual and do have a good business, then SBI does provide a business loan as per your eligibility for a little higher interest rate. Thus EMI and total interest may check with the Business Loan in this SBI EMI calculator.

Car Loan SBI EMI calculator: A Car Loan may sanction any individual who is seeking to get a car from any dealer connecting them to SBI. This is an easier process if you wish to have a car and can slowly get their money.

SBI Home Loan EMI Calculator: The Rate of Interest for a home loan will be gradually below 9 percent from SBI. This is why almost everyone tries to get SBI Home Loan, and in such cases using SBI EMI calculator, as the trust will be higher. The EMI amount will be quite less for the huge amount that you have taken.

SBI EMI Rate of Interest and Tenure

The rate of interest and tenure are major parameters that let you decide how much EMI you’re going to pay. For the same principal amount, if the rate of interest is higher the EMI will increase. Where the same will be vice-versa. In the same manner, if tenure is bigger the EMI will go down. But in turn, you pay a large amount as an interest amount.

If your seeking to pay less interest amount for your loan, then you need to check low tenure with even having the lowest interest rate. The combination of these parameters may match correctly and then can you consider a good repaying track.

If you want to pay less EMI for a longer period, then your inter amount might be higher. If your monthly financial status may not disturb as EMI amount is low.

How to Check your Affordability in SBI Loan

The SBI EMI calculator may use for calculation of home loan, personal loan, or any from State Bank of India. This way an individual or business firm which is on their way to take a loan from SBI will get an estimate of the monthly amount to repay.

Based on the principal loan amount that is sanctioned for your name, the EMI will calculate oddly. Also, you can even check that by filling. By this way, you can ensure how much principal amount you must apply. Also, you can find if that falls under your financial budget of monthly repaying.

- Confirm the monthly amount for loan repayment

- Plan for EMI amount and manage your financial status

- Does allow you to change the principal amount if you feel EMI is higher

Thus by using an SBI EMI calculator for your respective home loan or personal loan, you can get EMI amount. It is a match which you can actually plan for how easily you can for a loan and how much amount you need to adjust on a monthly basis.

SBI EMI calculator Formula

As per the standards of SBI EMI calculator for home loan and personal loan, the formula stands the same. If you’re looking for an online tool, then you can find different SBI EMI calculators for different loans. – Check loan EMI at homeloans.sbi/calculators

EMI= [PXRX(1+R)^N]/[(1+R)^N-1]

Here the EMI is the amount that you need to pay back to the bank. P is the principal amount senses as a loan amount. R is the rate of interest which depends on your loan category. N is the number of months.

Why is my SBI Loan Application rejected?

The state bank of India being a large bank does look for proper documentation for sanction of loan. So even if your Cybil goes wrong or if any of the documents are met according to their regulation the SBI Loan application will be rejected and individuals need to correct them in a proper way to get a loan by producing supporting documents.

Does SBI loan have any age limit consideration?

The Age limit for applying for any kind of loan is from 21 years to 65 years. An individual need to be under the age category to process their application or else their application will not be considered. There will be no exception at the age category for any loan and thus individuals need to wait to get under these age slabs.

Can we Cancel loan once it is sanctioned?

Yes, the loan can be cancelled if it is in a stage of sanction. The loan cannot be cancelled if it has been delivered to your account and individuals need to wait for minimum 6 months to get the same for closer. As well individuals need to get in contact with a Bank or Financial institute for loan cancellation and can work for close based on their regulations.