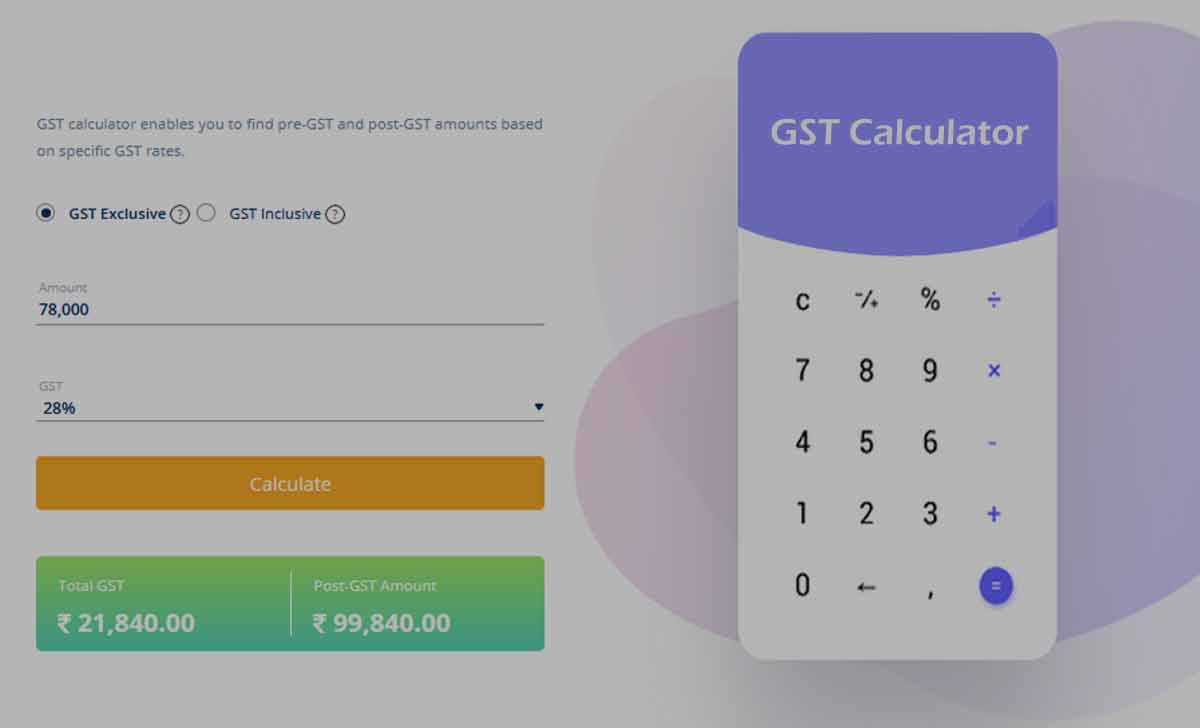

You can calculate Goods and Service tax online with GST Calculator Get the results for GST exclusive and GST inclusive prices at different GST % rates…

Goods and Service Tax is an indirect tax that levied on the supply of goods and services, which is shortly referred to as GST, and in India, since 1st July 2017 GST has been brought as a single taxation system that has replaced numerous indirect taxes.

The Central Government of India has passed these GST acts under their 2017 budget session and is also approved in parliament on 29th March 2017, and this is a comprehensive tax levied on sales, manufacture, confirmation of goods by various entities.

There are different sections of GST which are divided as per State and central government, and thus any bill you get on your purchase will have these GST included without having any other taxes levied, and there are multiple calculators available online which can be used to calculate GST, or you can use the GST formula shown in these article at 99employee.com page.

Types of GST

There are four different GSTs that are levied in India on the purchase of goods and services by an individual or by a manufacturer, and this GST will be implemented on your final price based on your purchase and type of good from their origin, and thus many products might have both state and central GST applied.

- State GST which is collected by the state government and referred to as SGST

- Central GST is collected by the Central government and is referred to as CGST

- Integrated GST is collected by the central government for an interstate transaction and other imports and referred to as IGST

- Union territory GST is collected by Union Territory governments and referred to as UTGST

How is GST Calculated

The comprehensive tax levied on goods and services does a formula that any taxpayer can check, and this GST calculator gets aware of how much tax is being levied on their purchase of goods, and the GST calculation segregates different slabs that start from 5 %, 12%, 18%, and 28%.

GST Calculation: Here is the direct formula that is levied on every goods or service that is bought, and if the net price is Rs 1000 and the GST rate is 18 percent, then GST will be = 1000 +( 1000*(18/100))= 1000+180=1,180.

GST Formula

- GST Amount = original Cost – (original Cost * (100/(100+ percent for GST)

- Net Price = Original cost – GST Amount

What is Inclusive Amount in GST?

GST Inclusive amount refers to the value of poverty after including the GST price, and this amount will be a total of product price along with the goods price, in this view, the tax is not charged differently from the customer.

What is the Exclusive Amount in GST?

The exclusive amount in GST is the amount that is calculated after removing the GST amount from the total amount of the product, and this amount to the actual amount of product.

Can I ask to remove GST from my product?

No, as per the government of India rules the GST is mandatory and will be levied on everyone when on their purchase. The GST will be levied as per the slab rate of the product and thus it will be included in the total price.