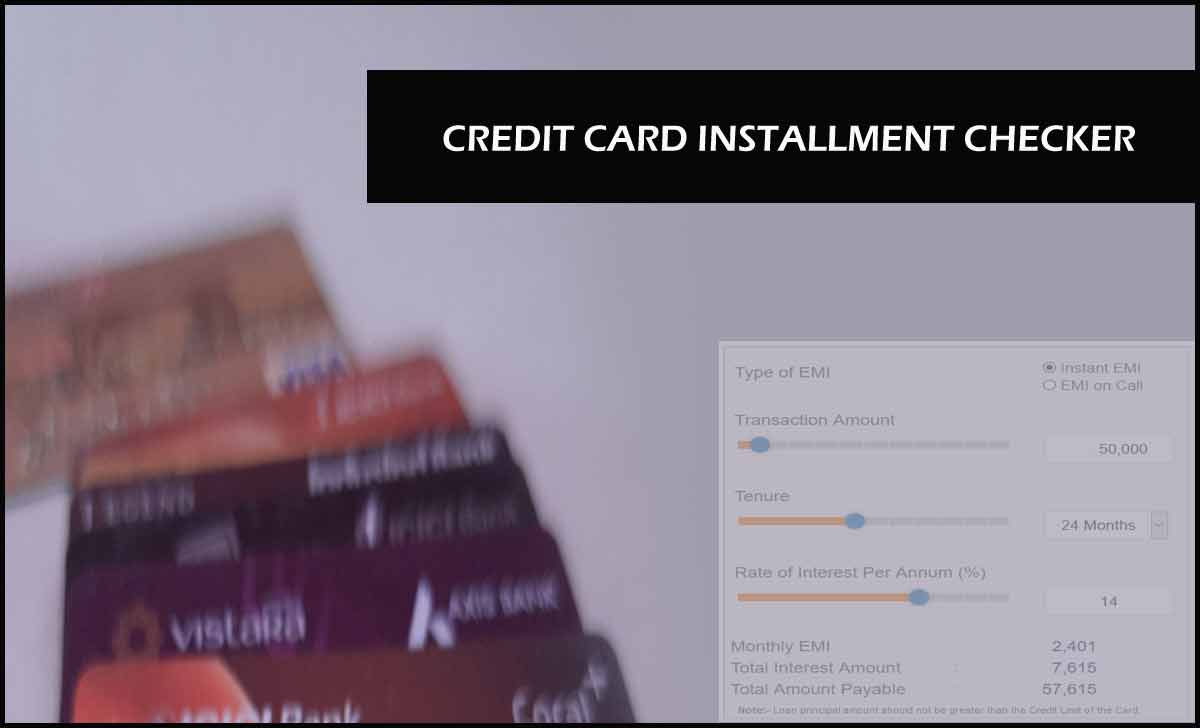

Find equated monthly installment instantly in advance on Credit Card EMI calculator to workout for your repayments with interest and plan accordingly for which amount you have to shop with credit card…

Do you own a credit card, If yes, then you might have taken a loan sometime back or want to take a loan or use your credit card for payments right? but the main question someone like you might come up with is what is going to be the monthly EMI that needs to be paid towards the loan or bill for the credit card.

In fact, this is an important question because credit card users need to take a look at the interest rate and the EMI from different banks and financial institutions first before opting for any loan, and in this article, you will learn more about the credit card EMI calculator from what it does to how you can use it to your benefit to make informed and valuable financial decisions.

Credit Card EMI Calculator

A Credit card EMI calculator is nothing but a simple EMI calculator which is used in order for you to know the EMI i.e, the monthly installments to be paid towards your credit card usage or loan in order for you to strategize the payments accordingly. Another reason why this calculator is to be used is to know the interest rate that is being applied and how much interest amount is going to be compounded over your total credit card bill payment.

Assume that you have three banks that provide different credit card loans for the same principal amount and same tenure but the EMIs are different for each, and then the wise option is to go with the bank which provides you with the least interest rate that will give you the least EMI to be paid per month.

But calculating all these through normal means would be a hard task and can be full of a lot of errors which is why you should always make use of a credit card calculator to not just calculate the interest amount but to know the EMI to be paid every month that allows you to make proper financial decisions.

Why do I need to use a Credit card EMI calculator to Calculate EMI

Yes, a credit card loan is no different from a normal loan which takes into consideration the major factors such as the principal amount, tenure of loan, interest rate upon whose calculation you will get to know the interest rate, but the major thing is that the credit card EMI rates are sometimes lower and sometimes higher which can cause a lot of error when done manually which is why every banking service will suggest you to use a credit card EMI emulator to calculate the emi.

Well, the main reason why you use a credit card EMI calculator is to calculate the EMI that has to be paid off towards the total amount of loan taken over your credit card balance, and this is important as credit card loans will need timely payment and if not paid might incur a fine which later on can decrease your CIBIL score as well.

Credit Card EMI Calculator Formula

There is a lot of misinformation that there are a different formula and method to calculate the interest rate and the EMI for a credit card EMI, but to be precise, a credit card loan and a normal loan EMI formula is no different because in both the scenarios we only consider the three major factors which are listed below.

- P = Principal Amount of the loan or the credit card usage

- R = Interest rate of the credit card or loan

- N = Tenure in months or annum as per your loan selected

- E = EMI to be paid per month

So, taking into account the above factors the EMI including their interest rate amount to be paid for your Credit card loan is given below.

E = P x r x (1+r)^n/((1+r)^n – 1)

This formula simply works on taking the numerical values into account for the given three factors at the end provides you with the EMI amount to be paid per month.

How to Calculate Loan on EMI for Credit Card

Since you already know the EMI amount with the credit card EMI formula from above then the question could be what would be the total amount to be paid at the end of the completion of the loan. In simple terms, when you take a credit card loan and you know the EMI amount then you can also get to know what would be the total loan amount you need to pay which is important.

Total loan amount = Monthly EMI * Tenure in Months

Assume that your monthly EMI is 10000 rupees and the tenure in months is 6 then the total loan amount will be 10000*6 = Rupees 60000. Where Rupees 60000 is the total loan amount.

Do I need to use different credit card emi calculator for different banks?

No, if you want to use an online credit card EMI calculator then you can use anyone from any banking service but the factor is that you need to input the proper interest rate, principal amount, and tenure in months to get the correct emi.

How do I use a credit card emi interest rate calculator?

You will need to input three factors that are the total loan amount, interest rate and the tenure in months through any of the online credit card EMI calculators to get your EMI.

How do I convert a credit card loan into an emi?

In case if you have bought something through your credit card recently, then simply call your customer care service then provide them with the transaction details and ask them to convert the payment into an EMI.

Does No cost EMI affect credit card calculators?

Yes, if you have opted for no cost EMI on any then when using the credit card EMI calculator then you will have to enter 0 in the interest rate place since there is no interest rate.