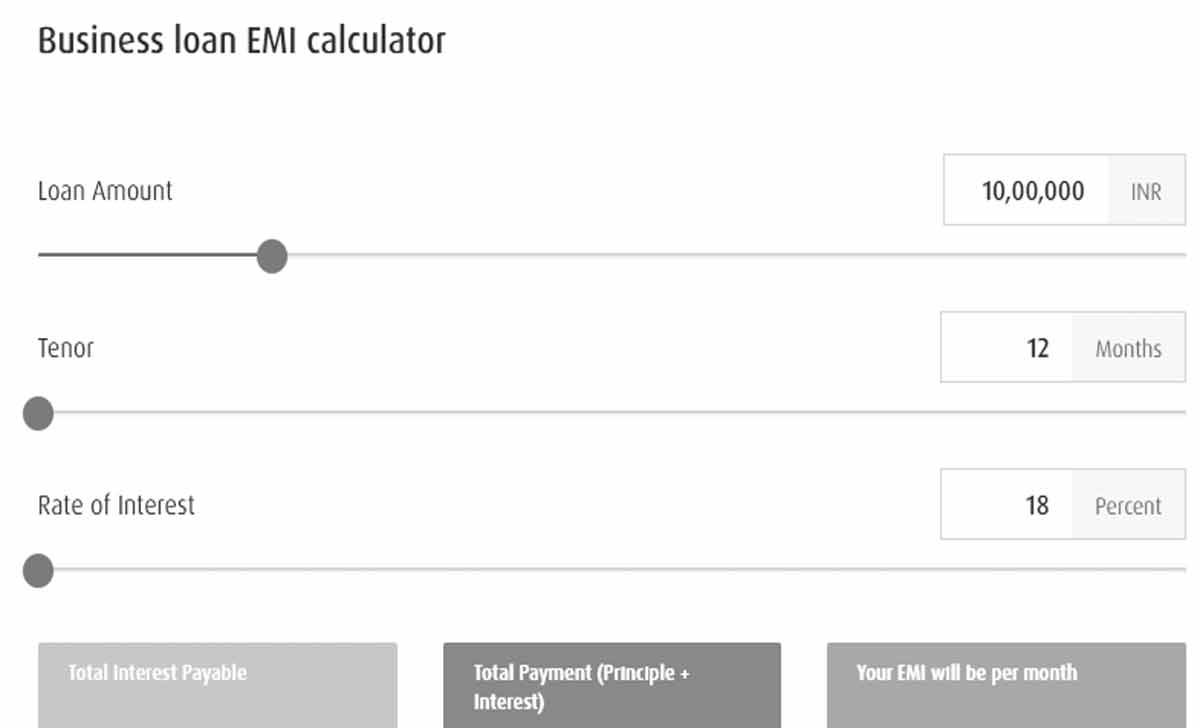

Login to the Business Loan EMI calculator app and calculate your business loan monthly installment online. Check the interest, repayment amount in the EMI calculator and decide how much business loan have to avail on your assets for business expansion…

Business Loan comes under higher value money loans, as any business that is going to set up does need a large amount of money. If you’re going to set up a business and you do struggle for money, then you can reach any Bank or Financial institute with your assets and business plan.

As per your requirements and business purpose, the Business Loan will be sanctioned. It is to be made clear that the Business Loan EMI will be higher, as the amount you take as the loan will be in good numbers.

Usually, the process of approving the business loans will be longer and even the documentation always takes much time rather than getting for sanction. Thus individuals need to ensure that he is ready enough when going to have a Business Loan.

Business Loan EMI Calculator

The amount which is set to pay on monthly basis for your Business Loan will be termed as Business Loan EMI. This amount will be a fixed amount that you need to repay every month as per your communication with the bank, and the same will check in EMI calculator.

In most conditions, the EMI does status once your full business has been set up and clear when the loan amount sanction.

An individual who is going to take a loan must ensure that will pay the Business Loan EMI on time. As irregular payment or delay in payment will take the bank to have strict action on your business. Therefore this will verify to check EMI in prior cases, to ensure your financial status meets the amount even if your business is slow.

What is the Business Loan Rate of Interest?

Business Loan is far different from the normal loans to avail by the individual. The rate of interest for business may higher than 20 percent. As the amount of loan is higher and at the EMI will not start till the acceptance start date communicated.

The rate of interest will be different from private banks to other financial institutes. Thus an individual needs to check their approval status and as well other documents while going to get a Business Loan EMI. Having checking the EMI for the loan amount and selecting the lowest interest provider will be the best choice.

Business Loan EMI Formula

There are numerous websites for banks that allow you to get the Business Loan EMI for your provided inputs. If you wish to get the EMI through formula, here the formulae to use and get amount for exact calculation.

E = P x r x (1+r)n / (1+r) n-1

Here E refers to monthly EMI amount. P refers as Principal amount. R refers as Rate of Interest and N refers as number of repayment months.

Having set up a business will always eat your financial setup and will regularly hold all savings into the business. Thus it is quite a requirement to check a few points before you your Business Loan taken. The Business Loan EMI calculator does give you the below points which will help you manage your financial transaction.

What you need and Does on Business Loan EMI calculator

Get free form Tedious Calculation: Having a Business Loan EMI calculator will solve your calculation issue, as it gives a fixed amount based on your inputs. Thus these can save and treats as monthly repayment amounts.

Fixing your Financial Status: As you need to always pay a huge amount monthly for your Business Loan, the EMI calculator will try to let you know the amount. Based on these you can check if you’re ok with Business Loan EMI or you need to go for a higher or even lower principal amount as a loan.

How to Lower your Business Loan EMI?

The Business Loan EMI is a fixed amount and it is always better to have a good amount as repayment which will adjust even if your business doesn’t do well. By using the Business Loan EMI calculator you need to check the calculation to find how much principal amount to avail along with choosing a proper bank with trend and rate of interest.

- If the rate of interest is high, then Business Loan EMI will become higher and may lower, if you choose minimum months to repay the loan even if interest is high.

- In the opposite case if your rate of interest is higher and choose a longer period. Your EMI may become lowered by the interest amount that you repay to the bank will be more.

- As well if you choose to have a large EMI amount, then you need to reduce your tenure. Then try to get a lower rate of interest

What if I miss Business Loan EMI?

The Business Loan EMI is mandatory to be paid on the fixed date by the bank. Any delay in paying the EMI will be levied and penalty as applied on your principal amount as per banker’s regulation. If you have not paid your Business Loan EMI for more than 3 months and if it has crossed 6 months, the business which has been setup will be taken by the bank.

Can I get eligibility checked through a Business Loan EMI calculator?

The Business Loan EMI calculator does only allow you to know how much amount to be paid monthly. To get eligibility for your loan, you need to provide all your documents to the bank and wait for their response after verifying your documents.

Does the Business Loan EMI date change month wise?

The Business Loan EMI amount will be fixed, and it will be the same until your entire tenure has been done. Even the bank has a single date for deduction or paying the loan EMI, which will be the same for every customer irrespective of their amount taken as loan.