Do check the simple steps to complete your Vadodara professional tax payment online using different online payment methods, Also find the process to check the status…

The city of Vadodara on the plans of Gujarat has seen tremendous growth in terms of Municipal development which has helped the city, citizens, and out of all making the payment for their professional tax has become due to online infrastructure being developed readily with the world growing.

In the following article, we walk you through the simple methods which can help you make the Vadodara professional tax payment easily online. Previously, making the tax payment in Vodadara has been a rigorous process that involves revolving around the tax office, filling abrupt long papers but now with the Vadodara Municipal official website coming into effect making the payment seems like a play of hands.

Now it becomes easy after getting into online and moreover, you do not need to create an account or any type of registration for this process which makes it seem more convenient to use as well.

As we already said about the process of Vadodara Property tax online payment, and if you have taxes that are unpaid or pending professional taxes, then you can follow the below instructions which are quick and simple that can help you understand the Vadodara Municipal tax payment.

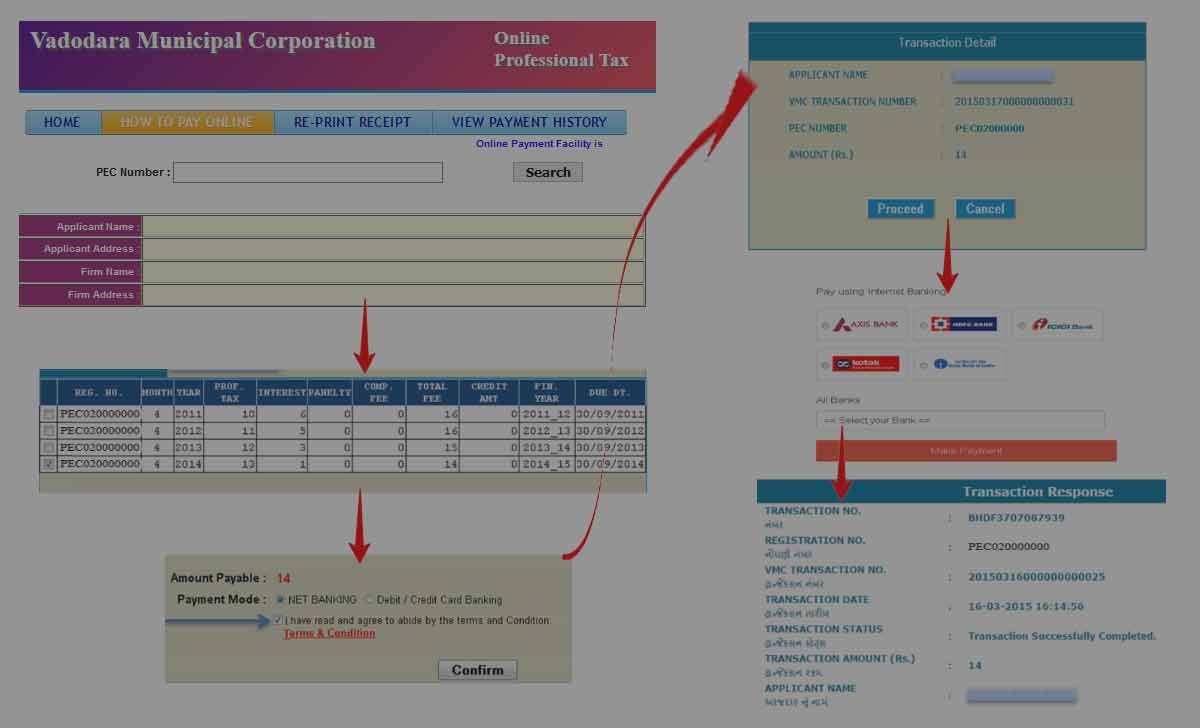

Vadodara Professional Tax Online Payment Process

- Open Vadodara online professional tax payment page directly at https://vmc.gov.in/profonline/DemandProfTax.aspx

- Enter the PEC Number first > click on the search button beside

- Once done it will show you all the information related to your tax payment invoices along with the due dates

- Under the Reg Number, find all the invoices for the tax payment information with PEC number that is due along with the year, month and the invoice month due as well

- Click on the checkbox of the PEC numbers required to do the payment, and if once done, you will see that the Amount Payable section shows the amount to be paid

- Under the Payment Mode, you need to click on the payment option from Net Banking & Debit/Credit Card Banking

- Select one of the payment methods

- Select the terms and conditions and then click on the continue button

- Click on the Proceed button once you confirm the applicant name, transaction number, amount, and PEC number

- Finally, make the payment through your selected payment option and your transaction response will be shown along with the transaction number as proof of payment

Can I check if my VMC Professional tax payment via online has been completed?

Sometimes the VMC Tax payment process shows uncompleted after making the online payment for this you can check your payment history after 24 – 48 hours from this page https://vmc.gov.in/profonline/PaymentDetail.aspx by entering your PEC details that will show you all the payment information and whether it has been completed or not under the status section as well.

How can I get the VMC tax payment receipt after online payment?

It is necessary to have an offline version of the receipt to showcase as proof of making payment of tax which you can get from this page https://vmc.gov.in/profonline/CheckStatus.aspx by entering your VMC transaction number along with PEC Number. Simply click on the “Check Status” button and it will show you a transaction status that will showcase your receipt and payment status that you can download and print as receipt.

How to pay professional tax payment through PER number