Superannuation is retirement pension scheme of funds will contribute by both employee and employer. Retirement Age limits, benefits and withdraw, pension of funds attached with strings of terms and conditions.

What is Superannuation

Superannuation is a guaranteed retirement funds for which some percentage of Gross Salary will auto deduct to certain funds during their employment period. Employer will also have to contribute for this employee retirement funds. These are superannuation fund or super funds/retirement funds.

Employee will not have full authority to withdraw these funds as and when needed. These secure funds when employee retire from their services and have no income on monthly basis. These Superannuation funds will provide as lumpsum amount to employee at time retirement or monthly salary.

Types of Superannuation

The Superannuation Benefits are segregated based on the type of plan which might be fully barred by the employer or through employee contribution.

Defined Benefit Plan: In Superannuation benefits, they already planned and fixed during the joining of employees or during their term of employment. These include the number of years of service, age of employee, salary and other components. These are fully on employer and upon retirement only the employees who are eligible may given the benefit.

Defined Contribution Plan: This plan defined as Superannuation benefit which the benefit plan not predefined and as well not fixed. The fixed contribution made either by employee or employer doesn’t include the total sum of the amount at retirement. This type of Superannuation benefit is only with employees, as they don’t know how much they receive but a fixed contribution is compulsory.

Superannuation Working

In an organization the employer contributes to a Superannuation benefit on behalf of their employee as an individual or through a Superannuation policy. The funds under Superannuation policy managed by their own trust or through any benefited insurance policy. There are multiple insurance policies which offer better plans for Superannuation funds accumulation.

In general, the employer does contribute a fixed percentage from employee basic salary under the Superannuation part every month from their salary. In a similar manner, there are certain schemes which allow employee share as well which added with the employer contribution. These at last make a huge lump sum amount during the time of retirement.

Superannuation Options

The annuity options are available for employees which must be only from the below list.

- Superannuation only payable for life

- Payable for 5 years or 10 years or 15 years as agreed

- Payable with a return of capital

- Payable towards joint account with nominee

Superannuation Taxation

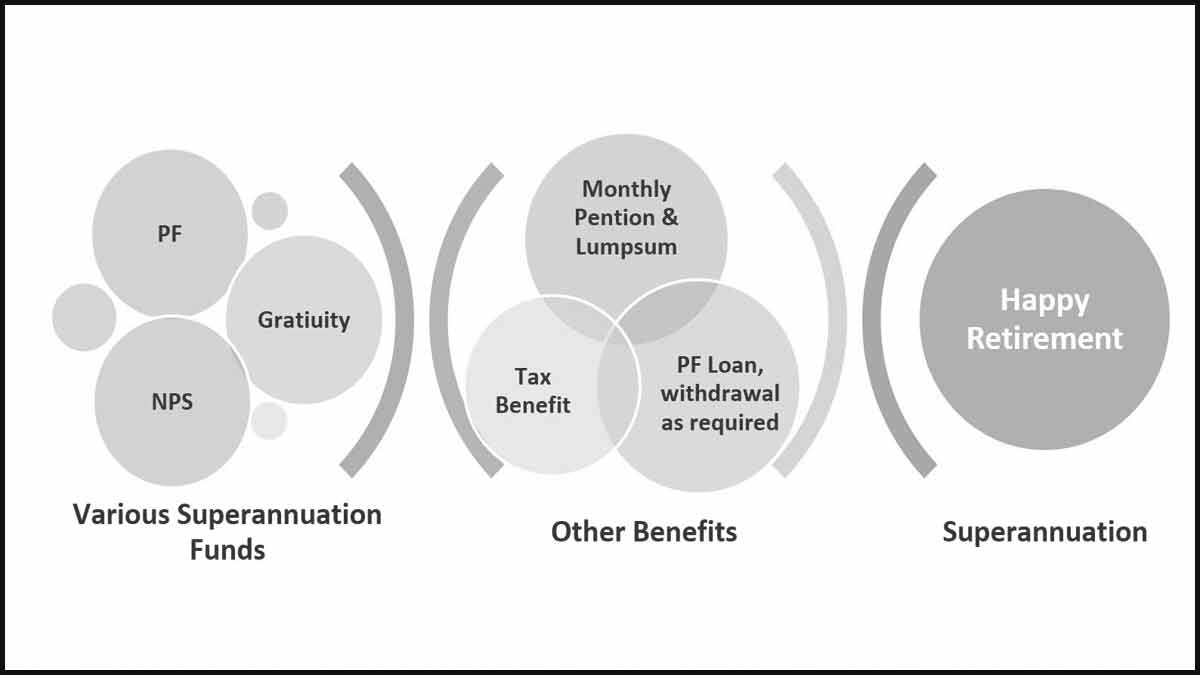

Superannuation benefits are a part of other income tax benefits which include in retirement benefits. The fund of retirement restricted to a limit and thus is free from taxation. These amounts will be total tax free and will not have any cutting later on.

For employer, the retirement funds may approved by the income tax department and does if approved will be exempt

For employee the approved retirement fund deduction under Sec 80C with an limit of 1, 50,000

Ifemployee withdraws any amount during their time of job change, then it will be taxable under ‘Income from other sources’

On death of employee, the retirement fund will fully tax free

Interest gained on Retirement fund will be tax free

How Superannuation is Important for Employee

These days Retirement planning is one of the main goal towards successful planning and happy retirement.

At time of retirement, at age of 60 years we will not have proper income. This could be because of various reasons like ill health, increased responsibilities, or live-in peace for rest of life. All of us need money for all our expenditure with increased rate of inflation. Superannuation is a guaranteed fund or income during the retirement time as pension.

What are Various Retirement Funds & Operations

Provident fund is one of the superannuation funds may deducted from the salary with some percentage, this % of deduction will vary from government to private organizations. There are some mandatory finds and some of the funds needs choice per employee choice. As discussed above Employee provident fund, Gratuity are the privilege for any employee during their services to employer.

Other non-mandatory retirement funds may ignored by employees like NPS (national pension scheme) etc.

When can We withdraw the EPF or PF from Superannuation Fund?

As we discussed above it is these funds will come with its strings. In general, at time of retirement employee may receive 1/3rd of the PF fund and remaining amount converted as monthly salary/income. During the employment time, there may have few times employee is entitled to withdraw this amount.

- On health requirements

- Property/home investment

- Pandemic situation (In 2020 Indian Government allotted for Covid Fund)

- Another general benefit is PF loan, employee will get loan benefit on this PF fund and this will be pay back to employee PF Funds.

Age Limit for Retirement

In most of the counties like USA, UK, Australia, South Korea etc along with India a certain around same age limit for retirement is 60 years. This is slightly varying from 58 years to 60 year for government employee. Employee will be retiring at the age of 60 will receive all the funds. The revised age limit for superannuation is from 60 to 62 year in India will be effective form 1st Aug 2021 for some of the employee segment.

Do We Get any Tax Benefits on PF or superannuation funds?

Yes, superannuation provides income tax benefit not only for employee, but also for employer.

- This may covered as part of 80C section up to Rs 1,50,000

- Withdraw at time of job changing

- Transfer the PF funds from one account to another if case we have job change

- 1/3rd amount given to employee from the PF funds will be 100% tax exempted

Hence it is important for all of use as it is primary planning and more importantly to declare the nominees.

Does Superannuation amount break if employees resign?

There is a scheme which allows you to move the Superannuation fund to the next employer directly. In case of gratuity the Superannuation fund if attain the eligibility criteria may handed over but not transferred to another employer.

Will the Superannuation Fund modified by the employer?

There are certain formulas which defined for the Superannuation funds under their particular scheme. Every employer does follow the same formula for Superannuation funds and none have authority to modify the fund if an employee is eligible.

How much amount may contribute for superannuation?

Maximum up to 15% of employee basic salary may contributed towards EPF (employee provident fund). And usually, same amount may deducted from employee salary as employee contribution towards this fund. There is another flexibility that employee might also contribute additional amount money as part of investment or savings.

Does Superannuation get interest on its funds accumulation?

Yes, the fund accumulates under the Superannuation scheme, may add with extra interest applicable. The interests may add to fund every financial year by making the principal amount higher.

Is Superannuation in India and Australia same?

May be Yes, fundamental benefits and program will remain same. But the type of mandatory funds and withdraw terms and conditions will vary depends up the geographical area and the labor policies in accordance with it.

Is taking PF loan is beneficial over other loans?

All of has false thought process that PF loans are more beneficial. But when we are taking any loans like personal or agricultural loans the interest rate his high unlike to PF loans. The catch here, we are losing the benefit of 14% interest on that PF. Hence, it is always good to payback the PF loans as quick as possible or prefer the agricultural loans as it is low interest if you have a farmlands.