A Systematic Investment Plan is an investment scheme that offers by mutual fund companies, and SIP calculator does help the investors to invest in small amounts which make invested on weekly, monthly, or quarterly basis.

The SIP does offer disciplined and passive approach for trial investor who does approach investing and creating some wealth in long term. In these calculations, the amount invested in smaller section, the market volatility will not make much impact on your mutual fund transactions.

Systematic Investment Plan calculator does help the individual to calculate the wrath gain expanded return after minimum set maturity met. For proper calculation, of value, one can get an around value of maturity which they can plan for saving or for bigger investments further.

Any sudden changes in the market will give you a rough estimate of loss or how much deducted from your mutual fund investments. 99employee.com will provide all the options and formulae related to the SIP calculator. Go through this and create your healthy wealth on Systematic Investments.

SIP Calculator

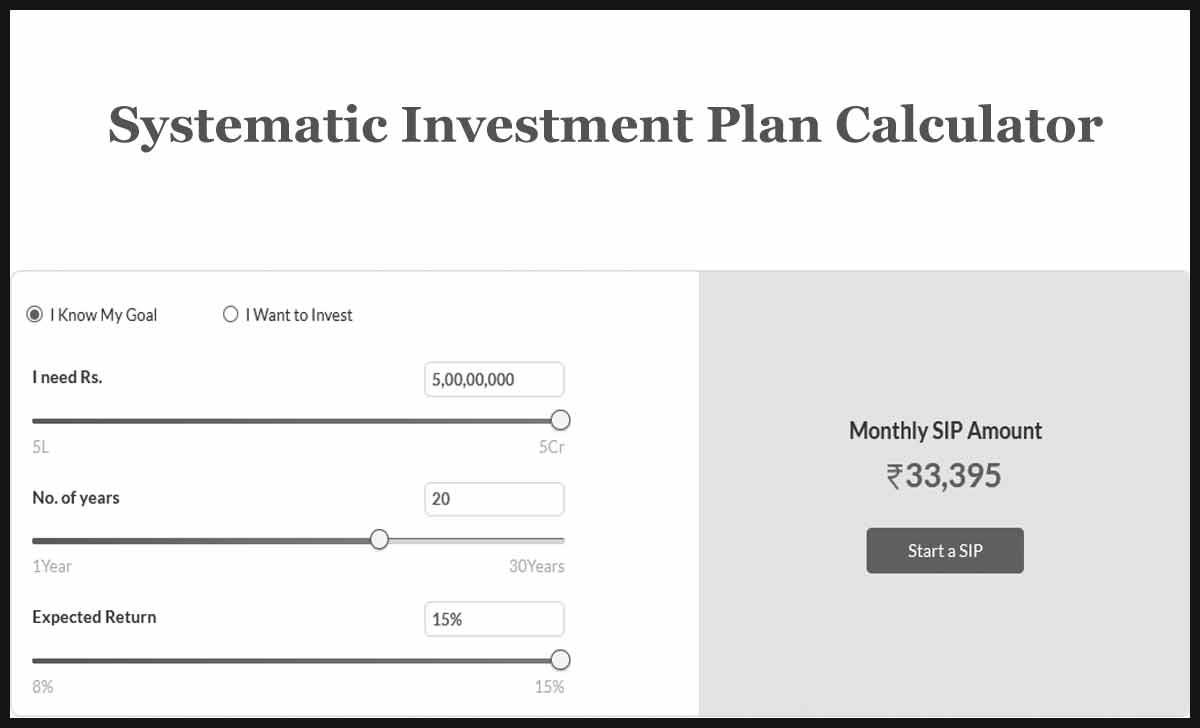

A SIP calculator is a simple tool that allows individuals to get an assumption of returns on mutual fund investments. The SIP investment is a popular investment that does have the option of millennials lately.

The calculator designed to give an estimate on mutual fund investment. This gives a return value calculated based on different values that are derived during the mutual fund investments.

A SIP calculator does not calculate the exit load and expense ratio instead they give the wait gain or expected to earn in the monthly or quarterly or half-yearly investments. In every investment, the average maturity amount is what an individual does expect and thus having a rough figure of that amount will give them a real value of expectations.

Benefits of Systematic Investment Plan

There are some clear benefits of Systematic Investment Plan investment, which may easily read from the below-given points. If interested in SIP, just have a look at the points and ensure to go on the correct investment plan.

- Individual don’t need to stress the timing of market

- Amount invested on monthly basis and the amount adjusted if there is a change in market volatility

- The passive and easy investment does make you more committed to having a guaranteed investment

- Systematic Investment Plan may cancelled anytime

- SIP created or updated anytime with having Rs 1000 as the least value

How does SIP Calculator Help an Investor?

Here are some major points that may helpful for an investor when trying to use Systematic Investment Plan.

- SIP calculator determines a value that you want to invest in

- Brings you an total amount that you have invested

- Shows you an round value of the returns

SIP Calculator Formula

Here is the calculator formula which you can take on and try to get value based on your month or half-year basis. Make use of these formulas rather than going to the online tool.

M = P × ({[1 + i] n – 1} / i) × (1 + i)

The following are the parameters of the formula

- M = it is the amount you receive on maturity

- P = it is the amount you invest at regular intervals

- n = it is the number of payments you have made till date

- i = it is the periodic rate of interest

Make use of these formulae and calculate the Mutual Fund Systematic Investment Plan based on your values on the SIP calculator. The amount entered as per your investment will give you a figure of the exact expected maturity amount. You can also Systematic Withdrawal Plan benefits on SWP calculator at any time.

What is the minimum amount in a Systematic Investment Plan?

As per the guidance of mutual funds, the minimum amount may invest is Rs 500. There is no limit in the maximum value. Individuals can decide to change these values anytime and make them an investment for that month. If an individual fails to fill the investment for a month, will mark their account as inactive and will activate once the entire left amount submitted.

What is the tenure of Systematic Investment Plan?

The maximum investment term of the Systematic Investment Plan is unlimited. It is mostly decide by the age of the individual, and the minimum maturity period is 3 years. This can’t lowered in any case and individuals will get benefits under mutual fund’s scheme if there is any demise. You may find the fixed investment goal at any time.

Can Systematic Investment Plan Amount Change?

Yes, the amount that individuals invest in the Systematic Investment Plan scheme changed anytime. The amount should minimum of 1000 and the maximum based on their capacity of the individual income. The same decreased at any particular without any prior information if the individual does not have enough amount in their hand.