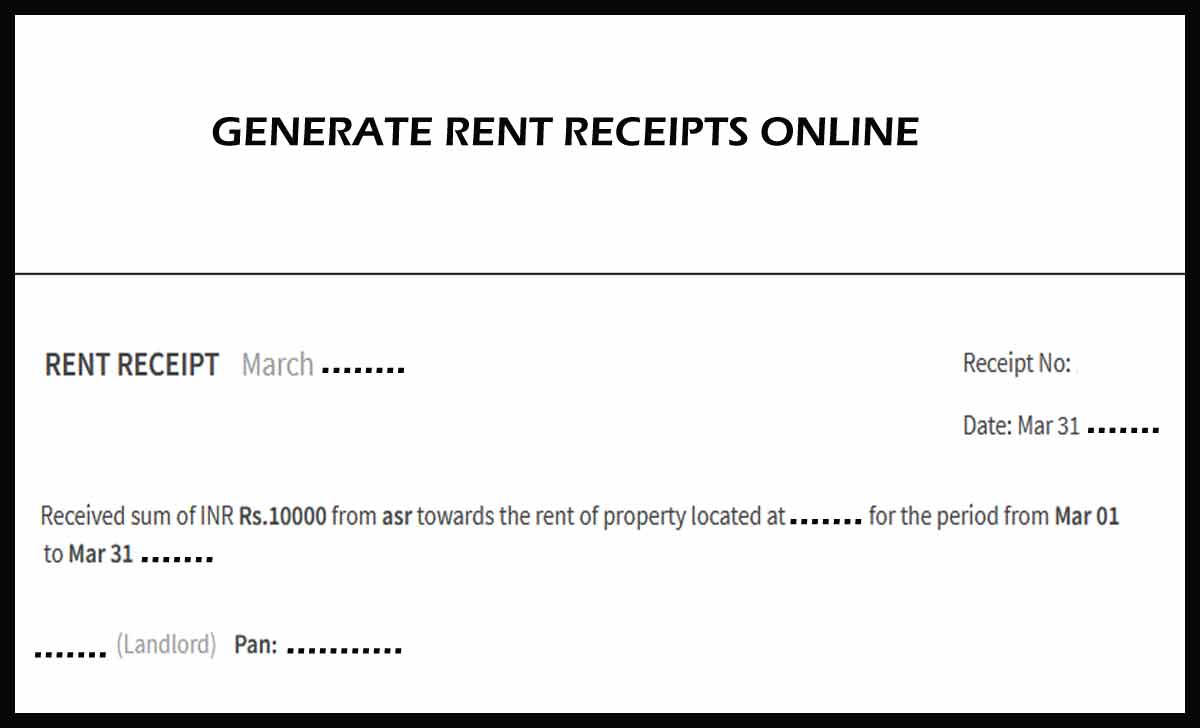

You can generate rent receipt online in Pdf to submit to the employer to claim income tax for the current financial year, Check the rent receipt format and download pdf…

Income tax declaration is pretty important for any person working in this modern world. The company HR will surely ask you to provide recent receipts that may used further to provide income tax declaration. Also, to create the house rent allowance form which may used during the tax return filing process.

And when the times of Income tax returns filling comes, every employee would turn around and wonder why it is important to generate recent receipts. Also, how could someone get them in the first place. So, in today’s article 99employee.com will be sharing with you more information about the recent receipts. Also, how to get it, and why they are important as well.

What is a Rent Receipt

A rent receipt is simple form either provide by your landlord or the service through which you have either rented or leased your place of stay. This recent receipt will have all the accommodates that the place has along with the money spent on each item list through an invoice format submit each month.

This is the proof that you have been staying at the respective place by showcasing your rent receipt invoice generated that has all the required information with invoice payment date and payment amount as well.

The Recent receipt becomes helpful when the employees like you want to get the tax exemption and tax returns on the HRA amount, and you will need to submit these receipts to your HR in the company to receive the HRA form after they confirm the receipts submitted for proof.

In the end, you will able to use these while submitting your tax returns filing, but before you do so, the most essential aspect to get the rent receipts from your landlord, and according to the Income Tax department you will have to get your landlord to sign and complete the Receipt of House Rent form along with PAN card details, amount spent for each month separately that has to submit to the HR of your company.

What is HRA & How is it linked to Rent?

If you are working in a government or private company then you might have come across a section in your salary slip call as HRA which is House Rent Allowance. This is a form of allowance provide to employees from their employers to help them find a place to rent or lease to live in which may checked in HRA calculator.

The reason this is necessary is that most of the time the HRA is at least 12% – 20% of the basic salary includes which is taxable in most cases. It means the government can tax the HRA allowance, but in order for you exempted from the taxes on the HRA, you need to provide your employer with the rent receipts so that they can provide you with HRA form that you will be able to apply as supporting documents while verifying and completing your tax filing process.

In Simple words, in order for you to receive tax exemption or tax returns on the HRA allowance that the government has taxed you on. You should get your landlord or service provider to give you rent receipts which you will provide to your employer upon verification they will give your HRA form that may used for the tax filing process.

Do we need to generate rent receipts on paper or soft copy?

The Receipt of House Rent declaration form by the Income Tax department that has to fill by your landlord manually first and then you can scan the copy to convert it into a digital soft copy that can share between your HR of the company and then use the same digital soft copy while submitting returns in Income tax login.

How can I get my Nestaway & NoBroker rent receipts to download?

We have taken the example of popular house rent and leasing services such as Nestaway and NoBroker which used by most of the working class now, and if you are using such digital platforms then you can go to your account through which under the payments section you can download the payment history as proof of your rent receipts.

At the same time, you can also download the declaration from your landlord on the rent or lease form that can be provided as a supporting document.

How can I get the rent receipts in PDF format?

Through any of the online portals where you have got your place rent or lease you can look into your account > payments & invoices through which you can click on the download the PDF for all the months you have rented or leased the place. But in case if you leased or rented the place through face to face talks, then get a written communication and get sign by your landlord for validation which you can later converts into PDF format.

How can I get my recent receipts from the landlord?

You will have to ask your landlord to provide your rent receipts through Receipt of House Rent form. This may provide by the Income tax department that may found online.

Do I need the landlord PAN card number and information for rent receipt & HRA?

Yes, In case if the rent per annum with the landlord crosses over Rupees 1 Lakh then you can get an exemption on HRA from your employer. In that case, you will have to first provide your employer with your landlord’s PAN card details. If a PAN card is not available, then you need to get written confirmation and validation from your landlord.